What is Bitcoin Halving and How Does it Work?

Bitcoin halving is a significant event in the world of cryptocurrencies, with far-reaching implications for the value of Bitcoin, the mining process, and the entire ecosystem. In this introduction, we will provide an overview of what Bitcoin halving is, how it works, and why it is essential for the long-term success of Bitcoin and the broader cryptocurrency market. What is Bitcoin Halving and How Does it Work

By understanding the fundamental principles behind Bitcoin halving, you can better appreciate its impact on the digital currency landscape and make more informed decisions about your investments and participation in the world of cryptocurrencies.

What Is Bitcoin Halving?

Bitcoin halving is an event that occurs approximately every four years, where the reward for mining Bitcoin transactions is cut in half. This process reduces the rate at which new coins are created and thus lowers the available amount of Bitcoin in circulation. Bitcoin mining pool, which are groups of miners who come together to mine Bitcoin and share the rewards among themselves, play an integral part in the Bitcoin network.

During a Bitcoin halving, the impact on mining pools can be significant, as the rewards for mining are reduced, potentially affecting the profitability of mining operations. As a result, only the most efficient miners and mining pools are likely to survive and continue operating after a halving event.

Overall, Bitcoin halving helps to maintain the scarcity of the cryptocurrency and control inflation, ensuring the long-term stability and success of the digital currency.

How Does Bitcoin Halving Work?

Bitcoin halving is a process where the reward for mining Bitcoin transactions is cut in half. This event takes place approximately every four years or after every 210,000 blocks are mined. The purpose of the halving is to control the rate at which new coins are created and maintain scarcity, which is one of the reasons why Bitcoin is sought after by millions of people.

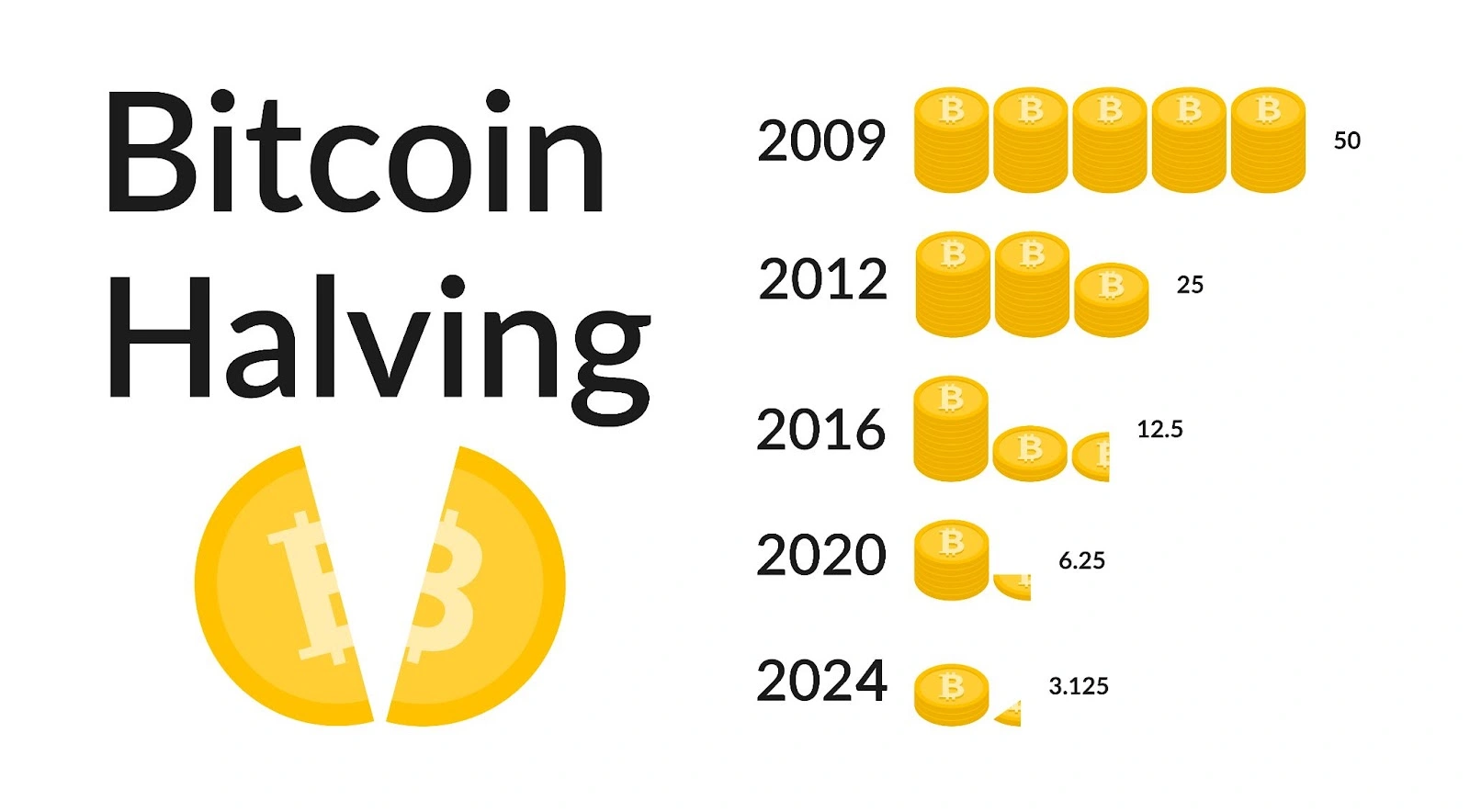

During a Bitcoin halving, the reward for unlocking a block is reduced. For example, the reward was initially 50 BTC per block, but after the first halving, it was reduced to 25 BTC, and so on. This process will continue until all 21 million bitcoins are completely mined.

Bitcoin halving plays a critical role in controlling inflation and ensuring the long-term stability and success of the digital currency.

When Was the First Bitcoin Halving?

The first Bitcoin halving occurred on November 28, 2012. This was the first reward reduction event for Bitcoin miners, who earn newly created coins from blocks they solve. The block reward was reduced from 50 bitcoins to 25 bitcoins per block.

The next Bitcoin halving will occur in 2020 and will reduce the block reward further to 12.5 BTC per block mined on average every 10 minutes.

What are the rules of Bitcoin halving?

The rules of Bitcoin halving can be summarized as follows:

- Bitcoin halving occurs approximately every four years or after every 210,000 blocks are mined.

- The reward for mining Bitcoin transactions is cut in half during a halving event. For example, the initial reward was 50 BTC per block, but after the first halving, it was reduced to 25 BTC and so on.

- The halving process will continue until all 21 million bitcoins are completely mined.

- Bitcoin halving helps maintain scarcity and control inflation, ensuring the long-term stability and success of the digital currency.

What is the impact of halving in Bitcoin?

The impact of halving in Bitcoin can be observed in various aspects, such as:

Reduced block rewards: During a halving event, the reward for mining Bitcoin transactions is cut in half, which affects the profitability of mining operations and the incentives for miners. This reduction in rewards can lead to a decrease in the number of miners, as less efficient miners may choose to stop mining.

Controlled inflation: Halving events help maintain the scarcity of Bitcoin and control inflation by reducing the rate at which new coins are created. This ensures the long-term stability and success of the digital currency.

Potential impact on price: The halving’s impact on block rewards tends to have long-term positive effects on the price of Bitcoin. One common theory is that the reduced supply of new coins, combined with the increased demand for Bitcoin, could lead to a price increase. However, it is essential to note that past performance does not guarantee future results, and market factors can also influence the price.

What happens when Bitcoin stops halving?

When Bitcoin stops halving, it means that all 21 million bitcoins have been mined, and there will be no more block rewards for miners. At this point, miners will rely on transaction fees as their primary source of income. This could lead to an increased emphasis on transaction fees, potentially making them higher to ensure that miners continue to secure the network.

The impact on Bitcoin’s price when halving stops is uncertain. However, bitcoin (BTC) price and charts show that the limited supply could contribute to its value, as scarcity often drives up the price of an asset. Additionally, the market may have already priced in the effects of the final halving, so the impact on the BTC price might not be as significant as previous halving events.

Why does Bitcoin price increase after halving?

The Bitcoin price tends to increase after halving due to the reduction in the supply of new coins and the unchanged demand for Bitcoin. When the mining reward is cut in half, the rate at which new coins are created is lowered, resulting in a decrease in the overall supply of Bitcoin. This, in turn, affects the supply and demand dynamics, leading to an increase in the price of Bitcoin. What is Bitcoin Halving and How Does it Work

Another reason for the price increase is the belief among investors that halving events make Bitcoin scarcer, thereby increasing its value. This perception can lead to increased buying pressure, driving up the price.

Is Bitcoin halving bullish or bearish?

Bitcoin halving can be considered both bullish and bearish, depending on the time frame and market conditions being analyzed.

In the short term, Bitcoin halving can be bearish, as the reduced block rewards may lead to a decrease in the number of miners, particularly those with less efficient mining operations. This could result in temporary market uncertainty and fluctuations in the price of Bitcoin. What is Bitcoin Halving and How Does it Work

However, in the long term, Bitcoin halving is generally considered bullish, as it reduces the rate at which new coins are created, leading to a decrease in the overall supply of Bitcoin. This, in turn, affects the supply and demand dynamics, often boosting the price of Bitcoin. Additionally, the belief among investors that halving events make Bitcoin scarcer can lead to increased buying pressure, driving up the price.

It is important to note that the impact of halving on the market can be influenced by various factors, including market sentiment, global economic conditions, and regulatory developments. Therefore, it is essential to stay up-to-date with market trends and developments to make informed investment decisions.

Conclusion

While the long-term effects of halving on Bitcoin’s price and the mining ecosystem are uncertain, the event highlights the innovative and self-regulating nature of the Bitcoin network. As we approach future halving events and eventually the end of block rewards, it will be interesting to observe the evolving landscape of Bitcoin mining and its impact on the overall cryptocurrency market.