The Year the Telcos Finally Got the Message about Travel eSIMs

It took them long enough — but 2025 is the year traditional mobile operators finally stop pretending eSIMs are a niche. After years of losing revenue to Airalo, Holafly, and a new wave of app-based travel SIM providers, telcos are joining the race themselves.

A new Juniper Research report forecasts that travel eSIM revenues will hit $1.8 billion by the end of 2025, an 85% jump from last year. That’s not just impressive growth — it’s proof that roaming, as we know it, is collapsing.

Travel eSIMs: The Smarter Way to Stay Connected

Travel eSIMs have quietly become one of the biggest disruptors in mobile connectivity. Instead of hunting for SIM cards or queuing at airport kiosks, travellers can now download data in seconds.

An eSIM is built directly into a device through an Embedded Universal Integrated Circuit Card (eUICC) — a tiny chip that can hold multiple operator profiles and be switched remotely. That means instant activation, no plastic, and no risk of losing your card. Because it’s integrated into the phone, it’s also more secure and nearly impossible to damage.

More importantly, a single device can host multiple eSIM profiles — letting travellers jump between networks and plans with a few taps. There’s no hard limit on the number of stored profiles; it’s only constrained by the device’s memory. That flexibility makes eSIMs ideal for those constantly crossing borders.

Apple helped ignite mainstream adoption, but Android manufacturers have now caught up—pushing eSIM capability into mid-range and flagship devices across the board.

As adoption accelerates, so does competition. A growing number of third-party providers are offering white-label eSIM solutions, letting travel, banking, and hospitality brands launch their own digital connectivity products. That means more choice for travellers and wider awareness of eSIM technology overall.

Roaming Is Broken — and Travellers Know It

Anyone who’s ever landed abroad and received a “Welcome to…” text with €9.99/MB rates knows the system is broken. Travel eSIMs flipped that equation — and travellers noticed.

Scan a QR code, pay €5–10, and you’re online instantly — often across multiple countries — without touching your SIM tray. It’s a direct attack on the foundations of roaming economics, which were built on confusion and lack of alternatives.

Now, as more devices go eSIM-only — from Apple’s iPhone 14 and 15 to Google’s Pixel 10 and the upcoming eSIM-only iPhone Air — the excuses are gone. The hardware is ready. The customers are ready. And the operators are, finally, catching up.

Why Operators Are Jumping In

Mobile operators have realised that every traveller who downloads an eSIM from a third-party app is a lost revenue. So, rather than fight it, they’re launching their own “travel eSIM” brands or partnering with enablers like 1GLOBAL, Airhub, or other enterprise-focused platforms.

According to Juniper, this shift isn’t just defensive — it’s strategic. Operators are bundling travel eSIMs into premium subscription tiers or offering “instant connect” add-ons that automatically activate when you land abroad. Think of it as a new roaming layer — but smarter, prepaid, and flexible.

As Molly Gatford, Senior Research Analyst at Juniper Research, explains:

“As third parties increasingly integrate themselves in the telecoms sphere, it will be pivotal in 2026 that operators launch their own travel eSIM services to compete and retain as much revenue as possible from mobile roaming.”

It’s already happening: Vodafone’s Champions Travel eSIM and Orange Travel eSIM are early examples of telcos blending lifestyle perks with connectivity — a sign that the industry is finally taking digital-first travel seriously.

How Operators Plan to Win the Travel eSIM Race

Now that big telecoms are stepping into the travel eSIM space, the challenge isn’t launching — it’s launching right. Agile, app-based competitors have shaped the market, and operators will need more than just brand recognition to compete.

Turning Subscriptions Into Seamless Travel

Bundling international data into higher-tier plans is emerging as one of the strongest plays. Instead of unpredictable roaming charges, premium subscribers could enjoy built-in global data allowances. It turns connectivity abroad into a feature, not a penalty — and transforms one-off roaming fees into recurring revenue.

Some operators are already testing it. Vodafone’s and Orange’s early eSIM bundles show what this future looks like: roaming redefined as an inclusive benefit.

The Welcome Text That Sells

That “Welcome to Spain” SMS? It’s becoming a sales opportunity. Instead of warning users about high roaming costs, operators can send a direct link to activate a local eSIM instantly.

Juniper identifies this as a high-impact tactic for converting silent roamers — those who usually rely on Wi-Fi abroad. If executed well, it could finally monetise a massive untapped segment. If done poorly, travellers will just return to the independent apps that already work.

Using Data as a Strategic Weapon

This is where operators hold a clear advantage. They know who travels, how often, and how much data each user consumes. That insight can power predictive marketing: sending travel eSIM offers just before customers depart or suggesting plan upgrades based on behaviour.

The arrival of RCS (Rich Communication Services) makes this even more powerful. Instead of clunky SMS, subscribers can interact directly through chat — browsing data packs, paying, and activating their eSIM all in one conversation.

Why It Matters

These strategies make sense — but they’ll only succeed if telcos can deliver the same simplicity that made startups like Airalo and Nomad so popular. Operators still carry reputations for complexity and slow UX. If they can overcome that, 2026 could mark the biggest reinvention of roaming in decades. If not, agility will win over scale.

The Competitive Landscape: Speed vs. Trust

Independent players continue to lead in user experience. Airalo sets the benchmark for intuitive design and global reach. Nomad and Saily excel with transparent pricing. GigSky pushes enterprise integrations.

Operators, however, bring what startups don’t: trust, compliance, and subscriber data. In markets like India and Turkey, where regulations are tightening, those advantages matter.

Yet the economics are tightening too. As more providers flood the space, data margins are collapsing. The next wave of competition will come from differentiation — freemium models offering 1GB free for onboarding, data rewards tied to loyalty programmes, or bundles with hotels, airlines, and banks.

The smartest vendors are already there — using algorithms to suggest the perfect data plan based on destination, travel duration, and usage habits. In other words: travel eSIMs that know you as well as your itinerary.

The Bigger Trend: eSIMs as Infrastructure

Travel eSIMs are just the entry point. The same technology is spreading into cars, wearables, and IoT devices — all powered by cloud-managed eSIM infrastructure.

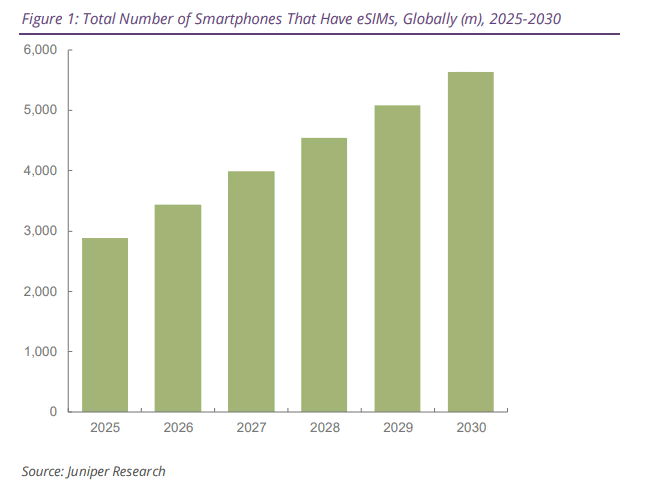

By 2030, Juniper expects over 5.6 billion eSIM-enabled smartphones worldwide, double the 2025 total. Once every major device supports eSIM, the line between “local,” “roaming,” and “travel” connectivity will blur completely. You’ll just connect — anywhere, automatically.

Companies like 1GLOBAL, Airhub, and GlocalMe are already building for that borderless future. Operators who wait risk being left behind entirely.

The Verdict: Adapt or Disappear

If 2024 was the year eSIM startups proved the model, and 2025 was when regulation caught up — 2026 is when operators go all in.

Telecom giants finally understand that traditional roaming revenue isn’t coming back. The real opportunity lies in owning the digital infrastructure behind travel eSIMs — through white-label platforms, cross-industry bundles, and smarter subscription models.

The winners won’t be those selling the most gigabytes, but those delivering the smoothest, most trusted experience for travellers.

Because, in 2026, the SIM slot no longer belongs to the operator.

It belongs to whoever connects you fastest when you land.

- aloSIM

-

eSIM for

Europe

32 countries

-

1 GB – 7 days – €5.00

3 GB – 30 days – €13.00

10 GB – 30 days- €36.00

- iRoamly

-

eSIM for

Europe

39 countries

-

1 GB – 7 day – €6.83

3 GB – 15 days – €10.24

10 GB – 30 days – €18.77

- Maya Mobile

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – –

5 GB – 15 days – €5.99

10 GB – 30 days- €13.99

- UBIGI

-

eSIM for

Europe

29 countries

-

500 MB – 1 day – €2.00

3 GB – 30 days – €8.00

10 GB – 30 days – €19.00

- VOIA

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – €2.69

3 GB – 15 days – €5.05

10 GB – 30 days- €11.70

The Best eSIM Finder brings together 100+ providers in one place, giving you a clear view of everything from data limits and business options to tethering, crypto payments, coverage, travel extras, refund policies, discounts, and reviews—so you don’t just compare plans, you understand which one truly fits your needs. Start exploring today and find the plan that fits you best.