Saudi Arabia Smartphone Sales Increase and Cross Pre-pandemic Levels

Saudi Arabia’s annual smartphone sales grew 49% YoY in 2021 to cross the pre-pandemic level of 2019, according to Counterpoint Research’s Global Monthly Handset Sales Tracker. Saudi Arabia Smartphone Sales

Post-COVID-19 recovery and pent-up demand were the key growth drivers. After a difficult 2020 that saw high COVID-19 rates and a struggling economy, the Saudi Arabia smartphone market benefitted from overall economic growth in 2021, which was driven by high oil exports, rising employment and falling inflation.

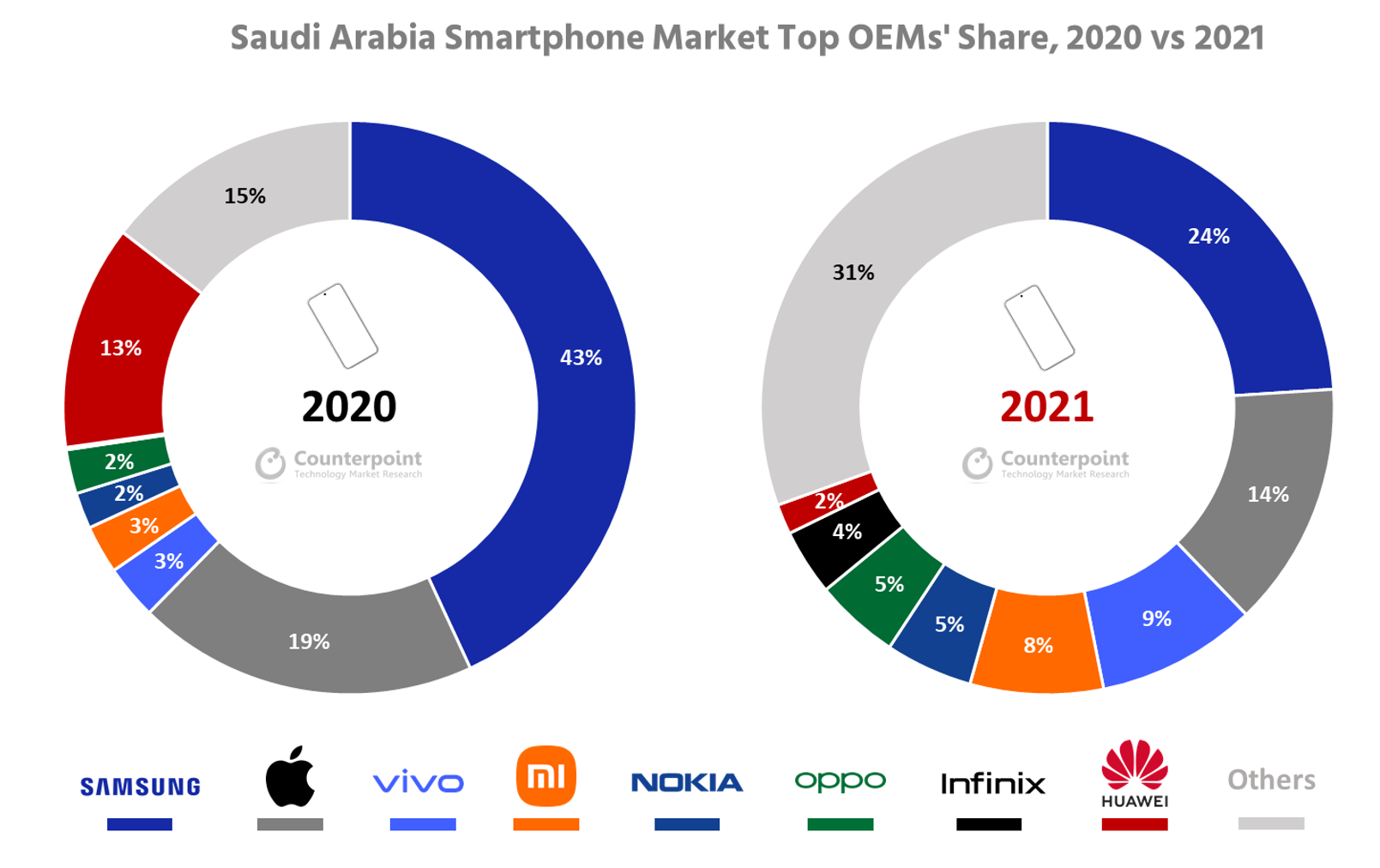

Commenting on the market dynamics, Senior Analyst Yang Wang said, “Saudi Arabia’s smartphone market benefitted from improving consumer demand due to a recovering economy and an increased pace of digitalization, partly induced by the COVID-19 pandemic. Furthermore, the market has gradually adjusted to the statutory 15% VAT increase from June 2020, which had dampened sales in 2020. Huawei’s exit threatened to hit growth in 2021, but Chinese brands like vivo, Infinix and Xiaomi were not only quick to step up, they also grew to increase the share of Chinese brands to 41% in 2021, compared to 29% in 2020.”

Source: Counterpoint Research Handset Model Sales, Jan 2022

Source: Counterpoint Research Handset Model Sales, Jan 2022

Note: Figures may not add up to 100% due to rounding

Samsung led the Saudi Arabia smartphone market in 2021 despite a decline in its share due to supply issues and increasing competition. Apple came in second, with vivo and Xiaomi following next. Xiaomi may have ended ahead of vivo if not for a weak Q4 due to supply woes.

Chinese OEMs like vivo and OPPO ramped up in 2021 and were able to capitalize on Huawei’s exit to grow their market share. Transsion group OEMs also saw modest success in a bid to expand their operations in the Middle East.

With its portfolio targeting the budget segment and new launches during the sales season, Infinix entered the top five rankings for the $200 and below price band in 2021.

Nokia took the fifth spot overall, clocking modest YoY growth after capitalizing on a revamped portfolio, consumer loyalty and improved availability during seasonal sales events.

5G smartphone sales also grew in 2021. Research Associate Ravyansh Yadav said, “While smartphone penetration continues to be a growth driver, 5G smartphone penetration took off in 2021, growing from 7% in 2020 to 35% in 2021. Apple, Samsung and vivo were the 5G smartphone market leaders. 5G penetration reached its highest level ever at 44% in Q4 2021 driven by the launch of the iPhone 13 series. In 2021, one in every three 5G phones sold in Saudi Arabia was an iPhone. With 5G coverage in the country having crossed 70% in 2021 and operators nearing the end of their respective 5G deployment roadmaps, upgradation to 5G smartphones will be an important growth driver for the Saudi smartphone market in 2022 as well.”

While the distribution across price bands remained largely the same as in 2020, sales growth was driven by the $300 and below and $600 and above price segments in 2021. Sales in the $300 and below band grew 55% YoY in 2021 driven by new launches from OEMs and consumer upgrades. Sales in the entry tier also grew driven by the continued transition of consumers to smartphones. Overall, Samsung held the top spot in the price segment.

As incomes rose and inflation stabilized at low levels, sales in the premium segment ($600 and above) grew 44% YoY, with Apple and Samsung grabbing more than 90% of the sales in the price band. Sales in this segment are, however, yet to cross the pre-pandemic level of 2019. With salaries expected to grow again in 2022, the premium segment in Saudi Arabia presents an opportunity for OEMs. Huawei’s exit has further opened an opportunity for the third spot in the premium segment, which other OEMs will battle to capture.

As incomes and employment continue to grow, digital initiatives and e-commerce activity ramp, and 5G connectivity improves, the Saudi Arabia smartphone market is set to record another year of double-digit growth, albeit much lower than in 2021. Market growth will be dependent on supply and economic strains arising from the global semiconductor shortages, an unforeseen COVID event and the currently unstable global political climate.

Notes: The analysis is based on wholesale ASPs; OPPO excludes OnePlus. Saudi Arabia Smartphone Sales