Apple Pay celebrates 10-year milestone & offers new payment features

A decade ago, Apple revolutionized the way we pay with the introduction of Apple Pay. This innovative mobile payment system offered a secure and convenient alternative to traditional wallets, allowing users to tap and pay with their iPhones. apple pay payment features

Ten years later, Apple Pay has become a global phenomenon, with hundreds of millions of users enjoying its ease of use, security, and privacy protections.

A Legacy of Convenience and Security

From the very beginning, Apple Pay prioritized both convenience and security. By leveraging Apple’s cutting-edge hardware and software, Apple Pay eliminated the need to fumble for cash or cards at checkout. A simple tap with your iPhone or Apple Watch securely transmits payment information, keeping your actual card details encrypted and hidden from merchants.

User Satisfaction Speaks Volumes

The success of Apple Pay is not just about technology; it’s about user experience. Statistics reveal that a staggering 90% of users cite the ease of use as a major advantage. Furthermore, security and privacy concerns are effectively addressed, with 88% and 87% of users, respectively, praising Apple Pay’s strengths in these areas (Source: Apple commissioned survey by Morning Consult, September 2024).

Peace of Mind, Every Transaction

Apple Pay takes the worry out of payments. Unlike traditional methods, your actual card number is never shared with merchants, minimizing the risk of fraud. This robust security framework fosters trust and allows users to focus on enjoying a seamless payment experience.

Beyond Payments: The Rise of Apple Wallet

The vision of Apple Pay extends beyond transactions. It aims to replace the physical wallet altogether with a secure and convenient digital alternative: Apple Wallet. Here, users can securely store and access event tickets, transit cards, keys, government IDs, and more, all in one place. The focus on expanding functionality further enhances the convenience and value proposition of the entire Apple Pay ecosystem.

A Glimpse into the Future: Expanding Functionality

A Glimpse into the Future: Expanding Functionality

Apple Pay is constantly evolving, and the future is bright. New features on the horizon include the ability to redeem rewards points and access installment loans directly at checkout with select issuers and lenders. This integration provides users with greater flexibility in managing their finances, while simultaneously strengthening connections between Apple Pay and participating financial institutions.

Rewards Made Easy

Imagine seamlessly redeeming your rewards points while paying with Apple Pay. This exciting future is becoming a reality, with Apple introducing the option to use Discover cash back rewards directly at checkout for eligible users in the U.S. Similar functionalities are planned for other issuers and markets, further enhancing the appeal of Apple Pay for both consumers and financial institutions.

Financing Options for a Flexible Future

Financial flexibility is at the core of the upcoming installment loan integration. With select partners like Affirm, Monzo Flex, and Klarna, users in various countries will have the option to spread out payments for purchases made with Apple Pay. This empowers users to manage their finances more effectively and make informed purchasing decisions.

Beyond the iPhone: Expanding Accessibility

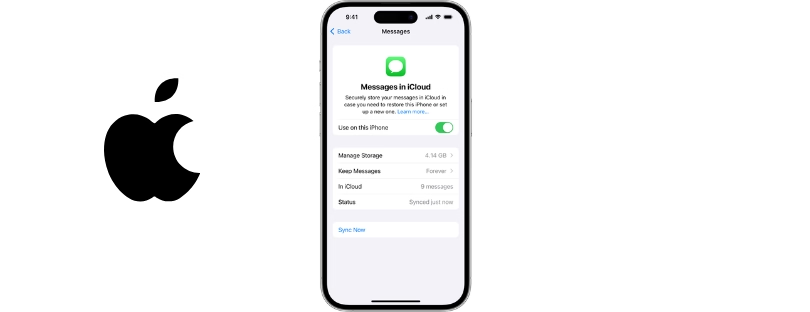

Apple Pay isn’t limited to iPhones. Users can now also access Apple Pay on third-party web browsers and computers. Additionally, the Tap to Provision feature makes adding new cards to Apple Wallet a breeze. These developments ensure broader accessibility and a more unified user experience across various devices.

The Journey Continues

The past decade has been a remarkable journey for Apple Pay. With its commitment to security, convenience, and innovation, Apple Pay has redefined how we pay. Looking ahead, we can expect even more exciting features and functionalities that pave the way for a truly cashless future. apple pay payment features