UEFA Champions League Matches Generate Over €5 Million Each in Tourism Revenue for Host Cities

As the league phase of the 2025/2026 UEFA Champions League heats up, the numbers are just as exciting off the pitch. A new analysis by Mabrian and The Data Appeal Company (Almawave Group), released at the World Football Summit in Madrid, shows that some of Europe’s biggest football nights are worth millions to their host cities—literally.

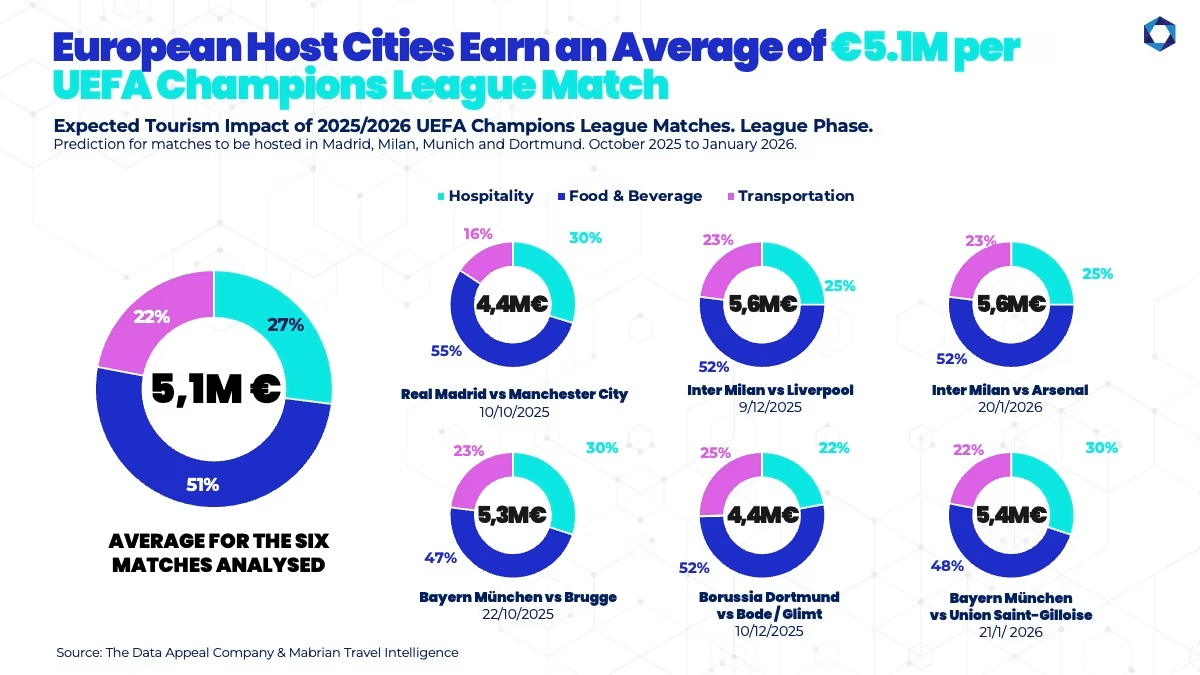

The study dives into six of the most anticipated matches across Spain, Italy, and Germany, revealing that each host city can expect an average direct tourism impact of €5.1 million. That’s not counting ticket sales or sponsorships—just the boost from hotels, restaurants, and local transport.

What the Data Says

Among the analyzed fixtures are some football blockbusters:

- Madrid: Real Madrid vs Manchester City (Dec 10, 2025)

- Milan: Inter Milan vs Liverpool (Dec 9, 2025) and Inter Milan vs Arsenal (Jan 20, 2026)

- Munich: Bayern München vs Brugge (Oct 22, 2025) and Bayern München vs Union Saint-Gilloise (Jan 21, 2026)

- Dortmund: Borussia Dortmund vs Bodø/Glimt (Dec 10, 2025)

On average, food and beverage spending accounts for 51% of this impact, followed by 27% on accommodation and 22% on transportation.

Milan tops the list with an estimated €5.6 million per match, each attracting more than 72,000 fans. Munich closely follows with €5.3 to €5.4 million, while Dortmund’s clash is projected at €4.4 million.

Spotlight on Madrid: Real Madrid vs Manchester City

When the reigning champions face off on December 10th, Madrid will not only host football royalty but a tourism surge worth €4.4 million. The match is expected to draw over 72,000 fans, with food and beverage leading the spending spree (€2.4M), followed by accommodation (€1.3M) and transportation (€721,000).

Interestingly, about 60% of attendees are Real Madrid season ticket holders — locals, not tourists — which makes the external tourism spend even more remarkable.

Mabrian’s analysis also highlights an 8.7% increase in flight capacity to Madrid during match week, including a massive +22.7% jump from UK airports and an impressive +58% rise from Manchester. Hotel prices are also climbing:

- +6.2% for three-star (avg. €154/night)

- +15.3% for four-star (avg. €211/night)

- +30.6% for five-star (avg. €452/night)

The message is clear — demand spikes wherever the Champions League goes.

Beyond the Stadium: How Destinations Can Capitalize

“Sporting events like these are powerful catalysts for a destination’s brand,”

said Carlos Cendra, Partner and Marketing Director at Mabrian. “But understanding their economic ripple effect is what really helps destinations plan smarter, extend visitor stays, and amplify long-term benefits.”

Mabrian’s data-driven approach shows how host cities can do more than just fill stadiums. By using analytics to anticipate visitor behavior, destinations can develop complementary tourism experiences — from fan zones and local tours to culinary events — that stretch the visitor spend well beyond match day.

What This Means for eSIM Providers

Sport tourism is one of the fastest-growing travel verticals — and connectivity is at its heart. For eSIM providers, major events like the Champions League are golden opportunities. Thousands of international fans travel for just a few days and want instant, hassle-free mobile data the moment they land.

We’re already seeing smart moves in this space. Vodafone’s new UEFA Fan eSIMs, launched earlier this season, set a fresh benchmark by combining event-specific perks, exclusive fan experiences, and international roaming — all tied to the tournament itself. Meanwhile, many eSIM brands have been tailoring regional data plans for short-term travelers.

But there’s still room for innovation. Imagine time-based or event-specific bundles — say, a “Champions Week” eSIM plan offering seamless roaming across Spain, Italy, and Germany. As football continues to bring global audiences together, on-demand connectivity is becoming as essential as accommodation or transport — and providers who blend tech, timing, and fan engagement will win big.

The Bigger Picture: Data, Tourism, and Strategy

Mabrian’s insights echo a broader trend across travel tech — data-driven tourism management. As platforms like ForwardKeys and Sojern highlight, predictive analytics are becoming essential for destinations navigating post-pandemic travel demand. The ability to forecast visitor flow, spending patterns, and accommodation pressure isn’t just useful; it’s now a competitive advantage.

However, many destinations still lack real-time tourism intelligence or fail to link event data with tourism strategy. In that sense, Mabrian and Data Appeal’s collaboration shows how sports tourism—often treated as a short-term boost—can evolve into a strategic pillar for sustainable destination growth.

Looking ahead, as football becomes more global and fans more mobile, cities that blend live event hosting with smart data and digital connectivity (yes, including eSIM integration) will set the standard for the future of sports tourism.

Conclusion:

The UEFA Champions League is no longer just a football tournament; it’s an economic engine. Mabrian’s analysis confirms what savvy destinations and travel tech players already know—that data, mobility, and connectivity now define the real winners off the pitch. Cities that harness these insights can turn a 90-minute game into long-term tourism value. For eSIM and travel tech brands, this intersection of sport, travel, and data is where the next big play begins.

About Mabrian

Mabrian Technologies (Mabrian), the global travel intelligence and tourism advisory partner, is a company specializing in providing travel intelligence services worldwide. Founded in 2013, Mabrian joined The Data Appeal Company – Almawave Group in 2023.

Combining Big Data and Artificial Intelligence (AI) techniques, simultaneous insights from over 30 global data sources, and the comprehensive travel intelligence expertise of its team of specialists, Mabrian is able to identify and predict tourism dynamics and trends worldwide. Mabrian’s modular dashboard grants access to a holistic monitoring centre that traces, measures and cross-analyses travellers’ full journey: air connectivity and demand, hotels, holiday rentals, travellers’ sentiment and demand drivers, spending patterns and behaviour, mobility, and sustainability.

- AIRALO

-

eSIM for

Europe

39 countries

-

1 GB – 7 days – €4.27

3 GB – 30 days – €11.09

10 GB – 30 days – €31.57

- AIRHUB

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – €2.99

3 GB – 30 days – €5.12

10 GB – 30 days – €11-09

- aloSIM

-

eSIM for

Europe

32 countries

-

1 GB – 7 days – €5.00

3 GB – 30 days – €13.00

10 GB – 30 days- €36.00

- GigSky

-

eSIM for

Europe

36 countries

-

1 GB – 7 days – €6.99

3 GB – 15 days – €11.19

10 GB – 30 days – €27.99

- iRoamly

-

eSIM for

Europe

39 countries

-

1 GB – 7 day – €6.83

3 GB – 15 days – €10.24

10 GB – 30 days – €18.77

- Maya Mobile

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – –

5 GB – 15 days – €5.99

10 GB – 30 days- €13.99

- NOMAD

-

eSIM for

Europe

36 countries

-

1 GB – 7 days – €4.71

3 GB – 15 days – €10.27

10 GB – 30 days – €15.41

- UBIGI

-

eSIM for

Europe

29 countries

-

500 MB – 1 day – €2.00

3 GB – 30 days – €8.00

10 GB – 30 days – €19.00

- VOIA

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – €2.69

3 GB – 15 days – €5.05

10 GB – 30 days- €11.70

The Best eSIM Finder brings together 100+ providers in one place, giving you a clear view of everything from data limits and business options to tethering, crypto payments, coverage, travel extras, refund policies, discounts, and reviews—so you don’t just compare plans, you understand which one truly fits your needs. Start exploring today and find the plan that fits you best.