S22 Depreciates 3x Faster Than iPhone 13 Since Launch

It is known that Apple smartphones are usually better valued than their Android rivals. However, according to a study by SellCell (a specialist in smartphone price comparisons in the United States), there are large discrepancies between the top-of-the-range Samsung, a manufacturer that continues to sell more equipment, and its rival Apple. The company compared the depreciation between the iPhone 13, Galaxy S22, and Pixel 6 and found that even Google’s high-end smartphone depreciates more than Samsung’s. smartphone depreciation

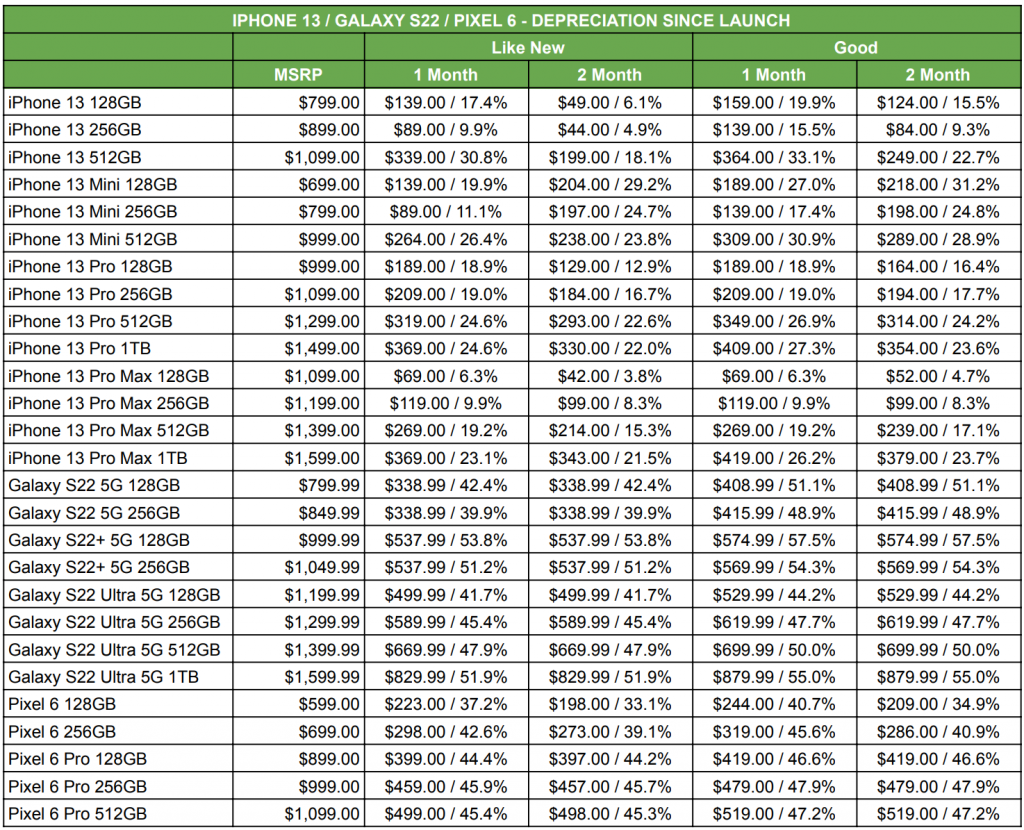

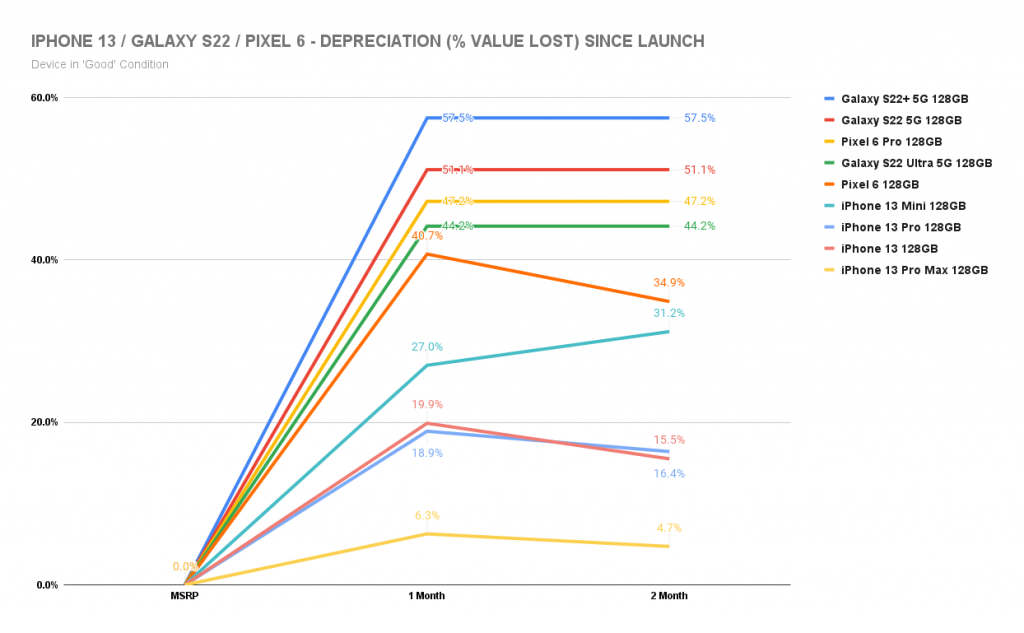

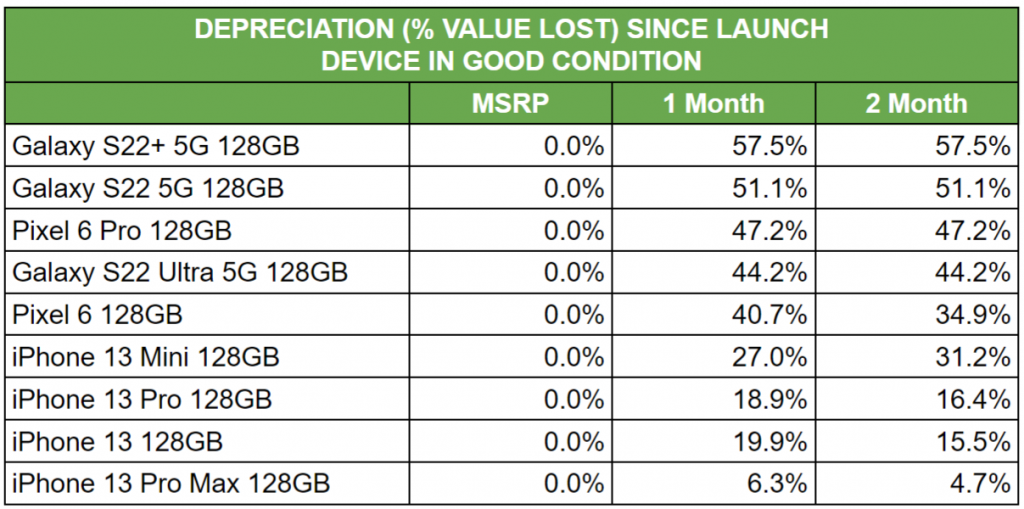

Using internal smartphone value data, SellCell has analyzed depreciation values (since launch) of Apple, Samsung, and Google’s flagship handsets. It has considered the trade-in value of all lines in each range (iPhone 13, Samsung Galaxy S22, and Google Pixel 6) based on the resale value of phones in “like new” and “good” condition. SellCell collected the data across months one and two since launch, to compare depreciation and to see which brands hold their value. SellCell is the US’ No.1 price comparison site for selling phones, so constantly monitors the value of these handsets across 40+ independent buyers.

Main Findings smartphone depreciation

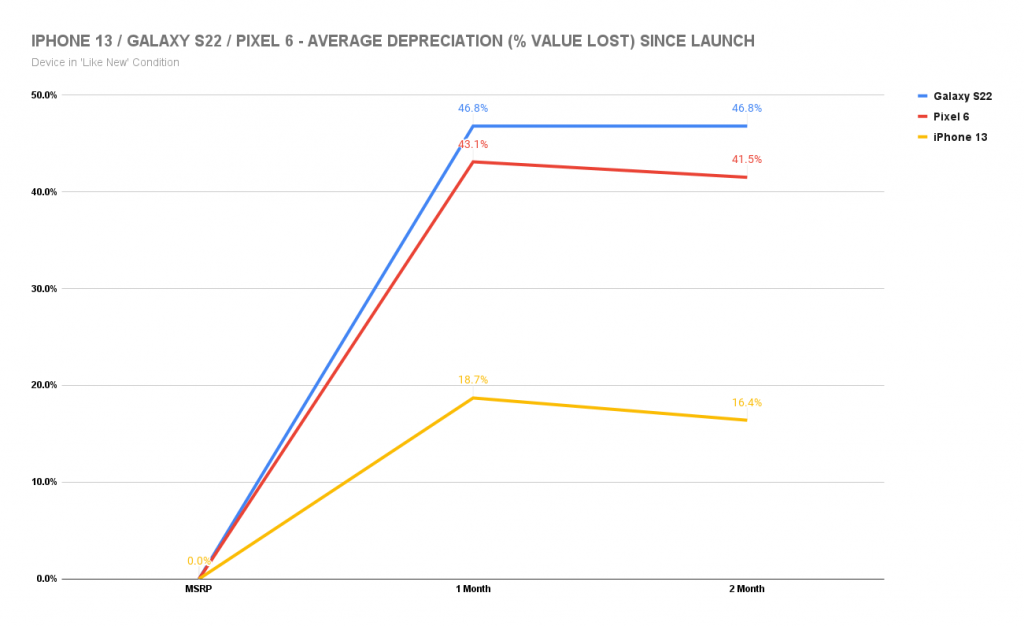

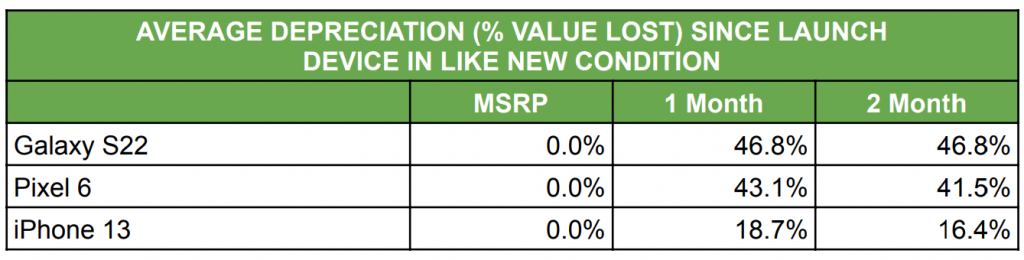

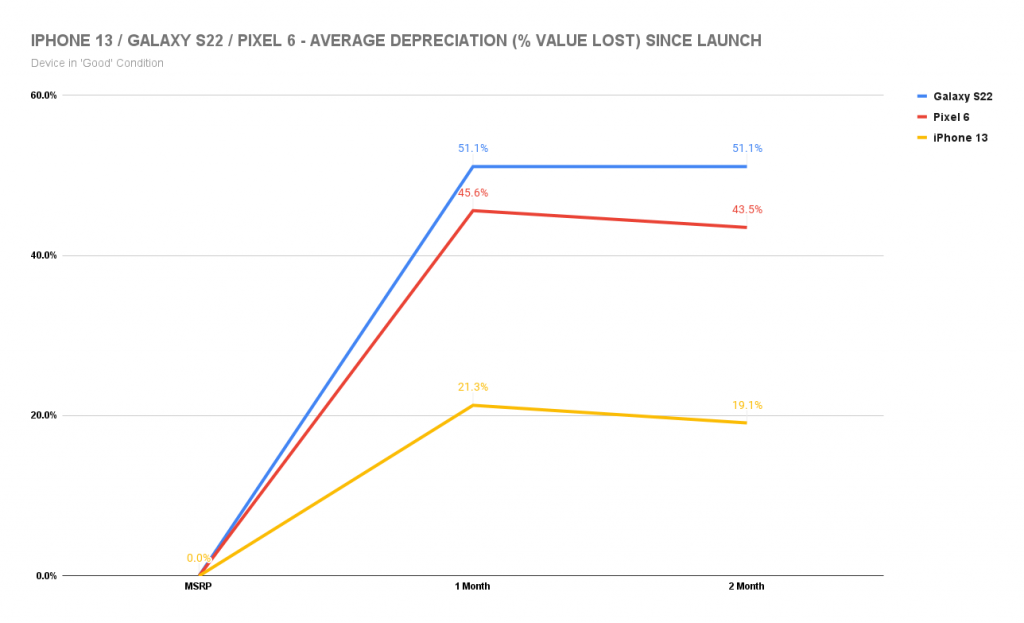

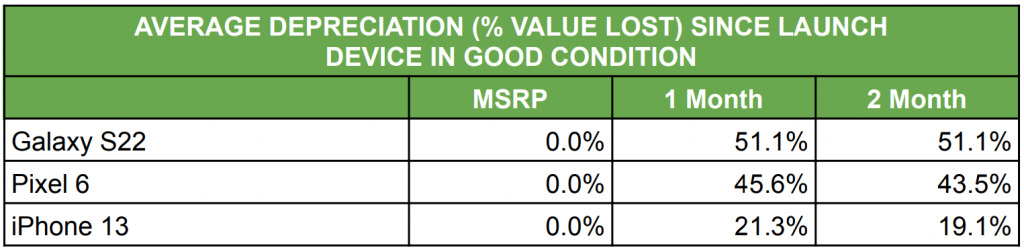

- The Samsung Galaxy S22 range loses the most value on average, at 51.1% (Good) and 46.8% (Like New), followed by Pixel 6 range at 43.5% and 41.5%, and the iPhone 13 range at only 16.4% and 19.1%.

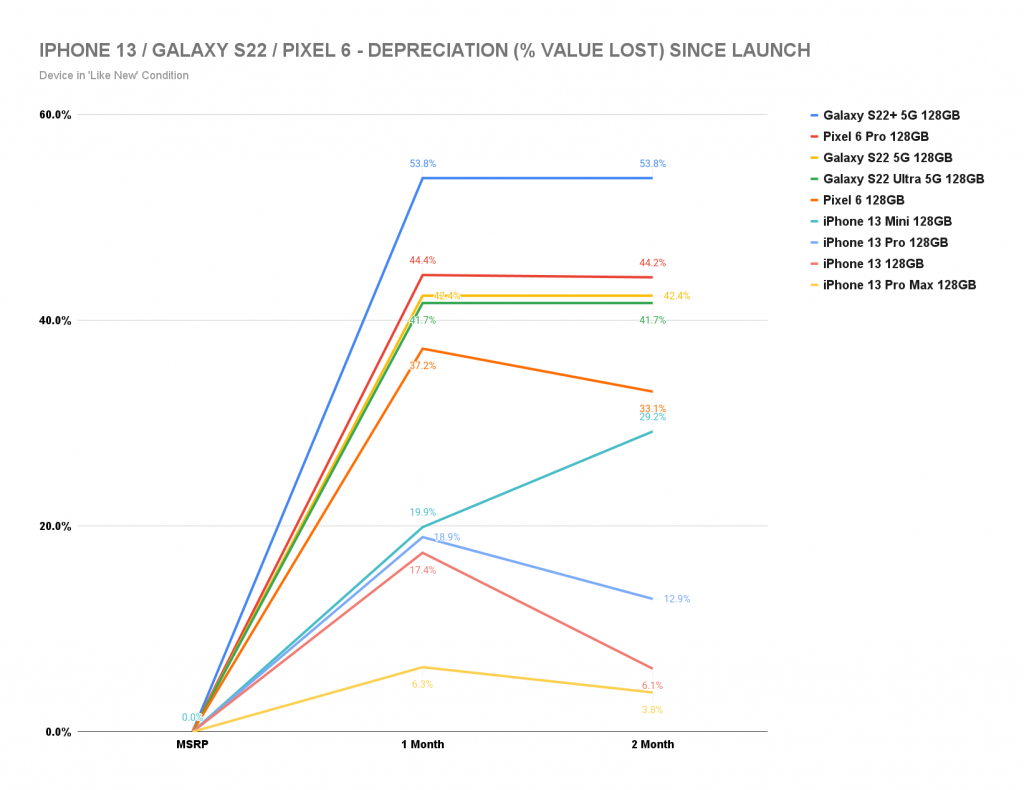

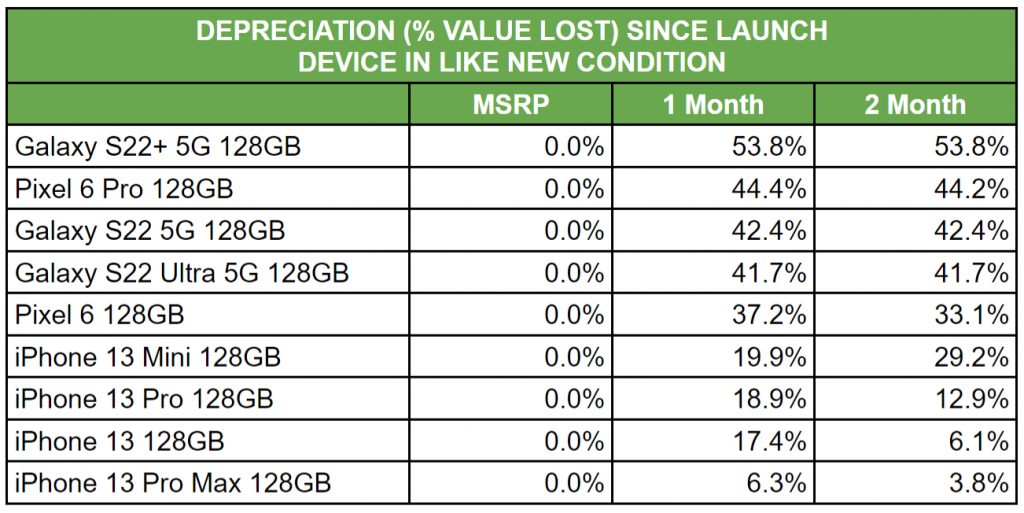

- The Samsung Galaxy S22+ 5G (128GB) is the worst performer, depreciating by an astronomical 57.5% (Good) and 53.8% (Like New) in the two months since its launch, equating to up to $574.99 in value lost.

- Google’s worst performer is the Pixel 6 Pro (256GB), which saw 47.9% (Good) and 45.7% (Like New) depreciation in the two months post-launch, which is up to $479.00 in cash terms.

- Apple’s iPhone 13 Pro Max (128GB) is the brand’s best performer, with depreciation in single figures at 4.7% (Good) and 3.8% (Like New), which is a maximum cash loss of $52 since its launch.

- Like the iPhone 12-series before it, the iPhone 13 range has started recovering its loss after month two, with 18.7% (Like New) and 21.3% (Good) depreciation by month one end, versus 16.4% and 19.1% at month two end.

- Surprisingly, the Pixel 6 range also appears to have recouped some of that initial loss, with 43.1% (Like New) and 45.6% (Good) after one month, versus 41.5% and 43.5% after two months; a recovery of 2% of the range’s initial MSRP.

Summary

SellCell reviewed internal smartphone value data across iPhone 13, Galaxy S22, and Pixel 6 ranges. Above, you can see the data for all models within those ranges.

Average Depreciation Across Ranges smartphone depreciation

As the above chart illustrates (for smartphones in like new condition), the Galaxy S22 range has lost the most value since launch, however, all is not lost for Samsung’s flagship range. It may have lost 46.8% of its value by the end of month one, but that figure hasn’t changed during month two. If S22 depreciation has plateaued in this way, then perhaps Samsung might see some value recovery moving forward.

At least, this is plausible when we look at the results for the iPhone 13 and (surprisingly) the Pixel 6 ranges. Both of these have shown a recovery in value vs. that initial loss in month one. SellCell stated this would happen with the iPhone 13 back in July ’21, and its prediction is ringing true. Not only does the iPhone hold its value better than any other smartphone, and more of it, but it actually recovers some of that initial value loss.

Perhaps unforeseen is the value recovery the Pixel 6 range is witnessing. Without casting aspersions on the worthiness of the Pixel 6 itself, it is promising news for Google after a launch that was—predictably—fraught with issues.

The story is the same when we look at depreciation of phones in good condition. The S22 has plateaued, while the Pixel 6 and the iPhone 13 ranges have both seen value recovery. But if we dive deeper still, how do the results look then? All is not as rosy as it might seem.

Depreciation by Individual Model

If we break it down model by model (for phones in Like New condition), then everything isn’t going as well as you might expect for Apple. While the iPhone 13 range has, on average, seen value recovery on that initial loss, the iPhone 13 Mini (128 GB) has actually lost a further 9.3% value in month two. It is only the performance of the other iPhone models that push the iPhone 13 range into value recovery.

As with the averages illustrated earlier, the S22 value has plateaued between month one end and month two end, following a drastic drop in value which sees some Galaxy S22 models losing over 50% of their value in like new condition.

The Google Pixel may have only seen value recovery of 0.2% for the 6 Pro 128GB, but it has clawed back a respectable 4.1% of its value with the standard Pixel 6 128GB between the end of month one and the end of month two. This is behaviour normally reserved only for iPhone, historically, so perhaps Google’s handsets are buoyed by increased demand now the dust has settled on the Pixel 6 launch.

Looking at the figures for phones in “good condition”, we mainly see the same patterns, aside from the Pixel 6 Pro levelling out rather than regaining some of the initial loss, and the standard Pixel 6 recovering 5.8% of its value between the end of month one and the end of month two.

iPhone Keeps Its Crown (and Its Value)

As we already knew, the iPhone is champion when it comes to value retention, seemingly dodging the knockout blows to value that initially felled the Galaxy S22 and Pixel 6 ranges. However, with an uptick in value for the Pixel 6, and a plateauing of value for the Galaxy S22, we may well see both flagship smartphone ranges recovering value in much the same way as the iPhone 13 has (again). Want to see for youself? You can see the prices to sell an iPhone yourself and view just how much value the devices retain!

Methodology

SellCell analysed sales data for iPhone 13, Samsung Galaxy S22, and Google Pixel 6 smartphone ranges, considering the trade-in value of all models from each respective range, in “good” and “like new” condition, to determine the value depreciation of the handsets in months 1 and 2 since launch.