Why Silent Roamers Are the Telecom Industry’s Biggest Missed Opportunity

It’s one of the most curious phenomena in the telecom and travel space today: millions of international travelers switch off mobile data the moment they land abroad. They silently slide into airplane mode, hunt for free hotel Wi-Fi, hop between café hotspots, and rely on public networks like digital nomads on a mission.

These are the “Silent Roamers.”

They’re not technically offline—they’re just avoiding traditional roaming charges. And they represent one of the most overlooked revenue opportunities in global connectivity.

But here’s the kicker: thanks to data analytics, mobile operators and eSIM providers are finally waking up to this gold rush.

Let’s break it down.

Who Are the “Silent Roamers”?

At its core, the silent roamer is a hyper-connected traveler who refuses to pay expensive roaming fees. They’re savvy. They know the tricks—whether it’s disabling roaming, grabbing a local SIM, or relying solely on hotel Wi-Fi.

And they are everywhere.

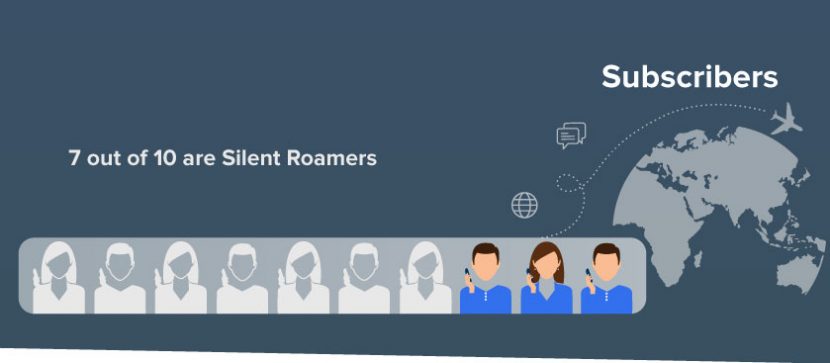

According to GSMA Intelligence, roughly 70% of global mobile users turn off mobile data when traveling internationally. That’s nearly 800 million people globally opting out of traditional roaming services.

Why? Because for years, roaming was ridiculously overpriced. Many still associate roaming with horror stories of surprise €300 phone bills just for checking Google Maps in Rome.

So they’ve learned to avoid it. But avoiding roaming doesn’t mean they don’t want to be connected. In fact, these users still consume data—just not through their primary mobile operator.

This is where the opportunity lies.

The Billions Hidden in Wi-Fi Habits

Most mobile operators and travel connectivity players focus heavily on “active roamers”—those who use roaming packages, eSIMs, or global data bundles.

But what about the massive chunk who don’t roam at all?

Here’s where things get interesting.

Studies have shown that while silent roamers avoid roaming, they are often willing to pay—just not at the prices or terms they’ve historically been offered. They value simplicity, transparency, and short-term flexibility.

According to Juniper Research, the value of lost roaming revenue from silent roamers exceeds $8 billion annually. And this number is only growing as global travel bounces back post-pandemic and eSIM adoption accelerates.

These users are like “off-the-grid customers” hiding in plain sight—and now, with the help of AI and analytics, MNOs can track, understand, and target them.

How Data Analytics is Uncovering the Silent Roamer Segment

Silent roamers don’t announce themselves. They don’t buy roaming plans, and they don’t show up in the usual data dashboards. But guess what? Their absence is the data.

Here’s how analytics is helping operators identify them:

1. Network Detachment Patterns

When a subscriber’s SIM is logged into a foreign network but no data usage is recorded, it’s a strong sign of silent roaming behavior. Analytics tools can pick up on these passive signals.

2. Wi-Fi Dependency Signals

Operators can detect when users connect to Wi-Fi networks abroad but don’t use mobile data. Combine that with location tracking and you have a behavioral profile: a Wi-Fi-first traveler.

3. SIM Swap and Multi-IMSI Data

Users who remove their SIMs and replace them with local ones, or switch eSIM profiles, leave traces. These are often your high-frequency travelers and digital nomads—ideal candidates for targeted offers.

4. App Usage Analysis

Even without data usage, apps like WhatsApp or Google Maps might still be used over Wi-Fi. Analyzing app activity from overseas IP addresses offers another layer of visibility.

In short, telecoms can now identify who isn’t using their service abroad—and why.

Targeting Silent Roamers: What Works?

Once identified, the question becomes: how do you win them back?

The answer isn’t complex—you just have to offer what they actually want.

✅ Transparent, No-Surprise Pricing

Offer simple day passes, capped data plans, or even pay-as-you-go pricing that mirrors the affordability of local SIMs.

✅ One-Click eSIM Activation

If someone is skipping roaming because buying a local SIM is easier, that’s a UX failure. With instant eSIM provisioning, operators can reduce friction and win these users over.

✅ Personalized Pushes

Using travel detection algorithms, telcos can push relevant roaming or eSIM offers just as the user lands in a new country. Bonus points if it’s geo-aware (“Welcome to Portugal! Here’s 1GB for €3/day”).

✅ Bundled Offers With Travel Perks

Travelers aren’t just looking for data—they want convenience. Why not bundle data with airport lounge access, VPNs, or language translation tools?

✅ Partnering with Travel Platforms

Airlines, OTAs, and booking sites are ripe for telco partnerships. Target silent roamers before they travel—not after they’ve already gone dark.

Why This Matters for MNOs, MVNOs, and eSIM Providers

Ignoring silent roamers means leaving billions on the table. But there’s a bigger strategic issue here: brand relevance.

If your customers feel they need to ditch your service when they travel, that’s a red flag. It’s a sign your brand doesn’t match their lifestyle needs. And it opens the door for eSIM-first brands, travel tech startups, or super apps like Revolut or Airalo to sweep in.

On the other hand, if you act now—armed with analytics—you can reposition your brand as a smart travel companion, not a roaming trap.

This is especially relevant for eSIM providers, who are uniquely positioned to target silent roamers with pay-per-country or regional data packs, in-app onboarding, and pricing that undercuts traditional MNOs.

Looking Ahead: Turning the Silent Majority Into Active Revenue

We’re entering a new era where the power lies not in having the customer, but in understanding them. Silent roamers are telling us what they want through their actions—even if they’re not saying it outright.

With the right data strategy, telcos can:

- Predict travel intent

- Segment by behavior and value potential

- Trigger real-time, hyper-relevant offers

- And most importantly, recapture a customer they never truly lost—just ignored.

As travel normalizes and cross-border movement increases, the silent roamer market will only grow. Those who act fast—using analytics, behavioral insights, and flexible products—stand to win big.

It’s not just a connectivity play anymore. It’s a brand loyalty, UX, and data-driven growth game.

Conclusion: This Isn’t a Trend—It’s a Wake-Up Call

The silent roamer isn’t an edge case. It’s the default traveler of the modern age—informed, cautious, and cost-sensitive. If you’re still betting all your roaming revenue on a shrinking group of active users, you’re missing the point.

The gold rush is here. But it’s silent.

Now’s the time to listen.