Mobile Experts Inc. Unveils Private LTE Benchmark Report

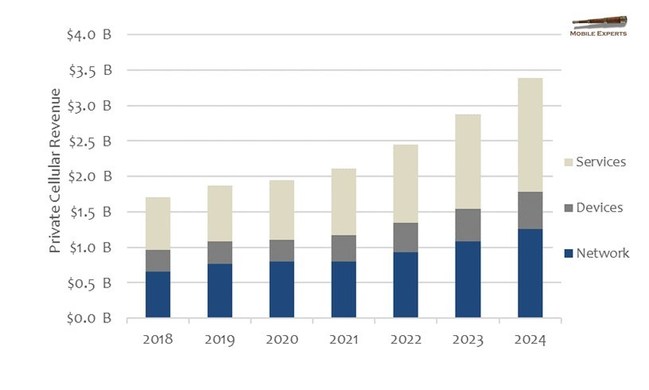

As the connectivity market reaches for more reliable, secure, and predictable solutions, major industry verticals including Mining, Oil & Gas, Utility, Government, Manufacturing, and others, are considering ‘Private LTE.’In a brand new report, Mobile Experts details how the global Private LTE and 5G market is forecasted to grow at over 10% CAGR to about $3.4 Billion by 2024.

Sectors such as Government, Transportation, Oil & Gas, and Utilities require coverage for large areas, and the opportunity for growth and development is equally large. Manufacturing and Mining will see impressive rates of growth with either indoor or more focused areas of coverage. For all sectors, industrial automation driven by IoT sensors and analytics will highlight the requirement for the deterministic wireless connectivity that Private LTE and 5G provide.

“There’s a long legacy of GSM-R and other private cellular systems for special use cases, but recently the variety of use cases has started to blossom. Over the next five years, the majority of Private Cellular equipment will be based on LTE rather than 5G, as most industrial applications can be handled with LTE mobile broadband features,” commented Principal Analyst Kyung Mun. “Then, as 5G URLLC features in 3GPP Release 16 come to market, we expect 5G to take an increasing share of the Private Cellular market. The 5G ecosystem will scale beyond our current forecast period, so eventually we expect it to become the dominant technology choice in many Private Cellular deployments.”

According to the Mobile Experts report, the Private LTE/5G ecosystem is coming together just as the industry verticals seek new connectivity platforms to handle more complex industrial automation with sensors and analytics.

New business models will also arise, pitting mobile operators against small network suppliers that take advantage of privately owned or shared spectrum.

“Small cells with virtualized core networks offer a self-contained solution that enterprises can deploy locally. Meanwhile, enterprises have more spectrum bands such as CBRS or other privately-designated bands to consider for Private LTE systems. What’s more, the MulteFire Alliance is looking to broaden LTE use in unlicensed spectrum ranging from 800/900 MHz band for NB-IoT to 2.4 and 5 GHz unlicensed band for mobile broadband. The pieces are falling into place even now,” commented Principal Analyst Kyung Mun.