Outlook on the Worldwide eSIM Industry to 2027

The eSIM market was valued at US$ 392.7 million in 2019 and is projected to reach US$ 2,282.3 million by 2027; it is expected to grow at a CAGR of 27.4% from 2020 to 2027. eSIM Industry

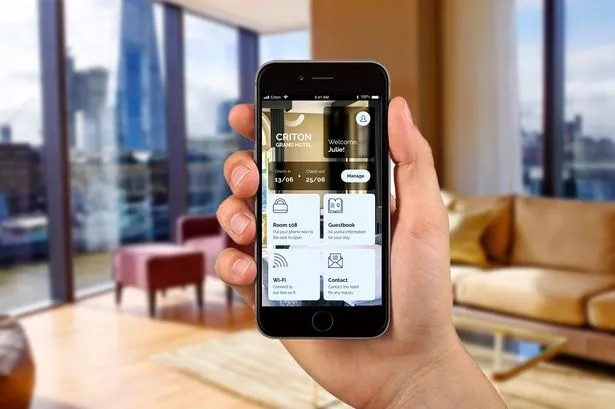

The tech-savvy millennial and middle-aged population across the world demand advanced technologies such as smartphones and smart wearables. Owing to this, several companies constantly engage themselves in developing robust technologies to ease their lifestyle. The US, China, Japan, Germany, India, and the UK are among the leading technologically developed countries and house a significant number of consumer electronics manufacturers and automobile manufacturers. Smartphone manufacturers contribute a significant revenue share in the embedded SIM (eSIM) market.

Based on application, the eSIM market is categorized into connected cars, laptops and tablets M2M, smartphones, wearables, and others. In 2019, the M2M segment dominated the eSIM market; however, the smartphone segment is anticipated to grow at the fastest growth rate.

The demand for eSIMs is constantly rising among smartphone manufacturers, automobile manufacturers, laptop manufacturers, and energy & utility sector players. The OEMs across the globe are robustly focusing on the development and integration of eSIM in various applications. The growing demand for miniaturization and IoT technology across various industries is also boosting the demand of eSIM globally.