The Evolution of IoT Roaming: Key Strategies & Forecasts by Kaleido Intelligence 2023-2028

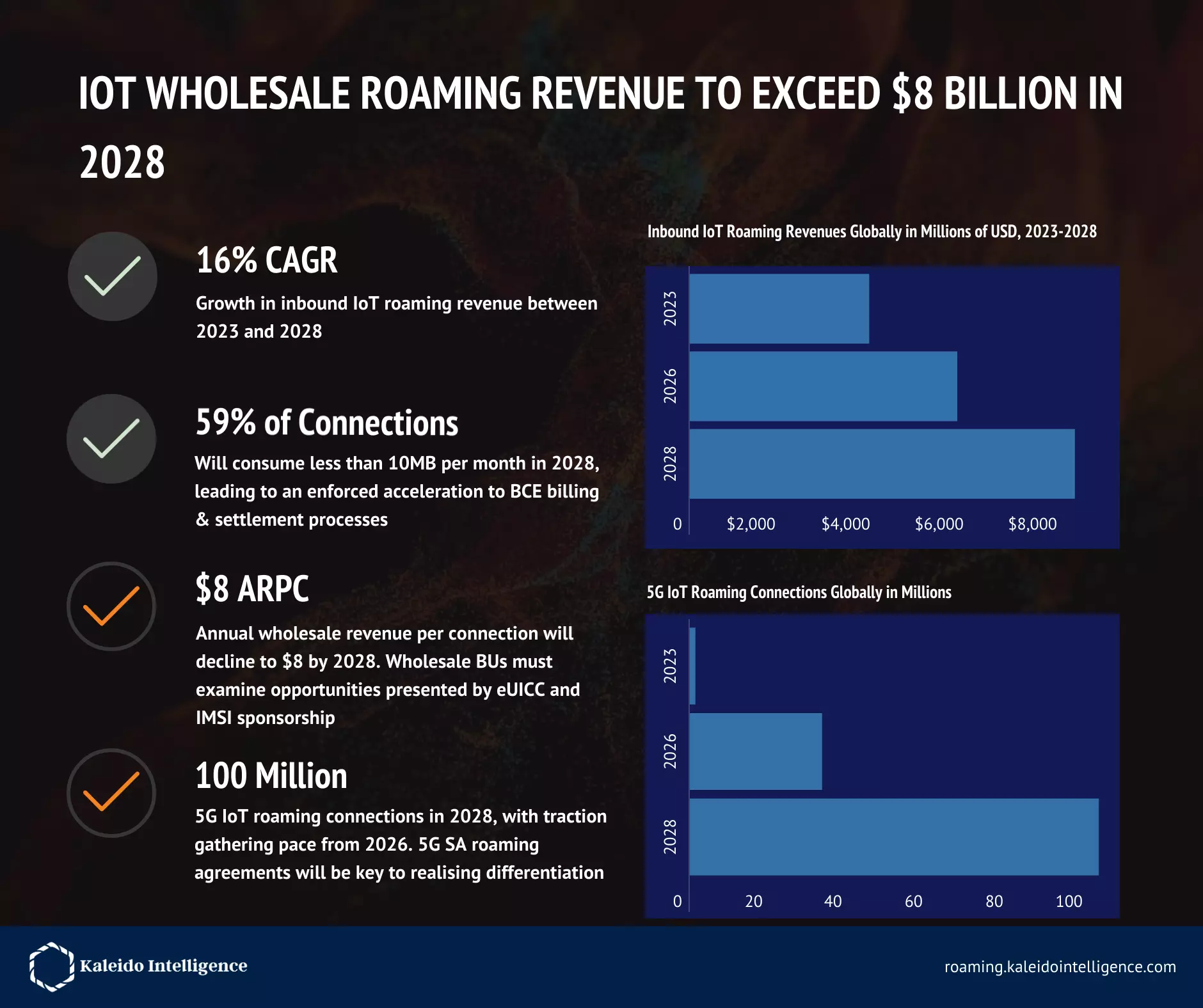

Kaleido Intelligence’s IoT Roaming: Market Strategies & Forecasts 2023 predicts a 16% average annual growth in wholesale IoT roaming revenues between 2023 and 2028, as shifts in the ecosystem status quo underline the importance of roaming to support international IoT connectivity requirements. IoT Wholesale Roaming Revenue forecast

Several market shifts are currently underway – including the acceleration of 2G and 3G network sunsets, the emergence of a simplified eSIM specification for IoT as well as direct-to-satellite communications networks. Combined, these factors offer a key opportunity for the industry to enhance the wholesale value proposition, although notable barriers remain in place.

Accelerated Migration to BCE Forced by Shifts in Ecosystem Status Quo

Take-up of BCE (Billing and Charging Evolution) for modernised billing and settlement for IoT monetisation has been slow, particularly as operators are resource-constrained owing to VoLTE roaming requirements and migration to 5G. However, as network 2G and 3G network shutdowns accelerate, large-scale migrations to cellular LPWAN roaming connectivity are expected. This demand will be compounded by the emergence of direct-to-satellite IoT connectivity use cases, which target NB-IoT radios at the outset.

Kaleido forecasts that growth in IoT roaming connections consuming less than 10MB per month will grow at 22% between 2023 and 2028, reaching 59% of the total IoT roaming connection base by the end of the forecast period. This growth will enforce an accelerated migration to BCE as a result of needing to provide differentiated billing based on Radio Access Technology, in addition to the need for a much-streamlined settlement process.

Monetisation Challenges Dominate IoT Roaming

With IoT connectivity now viewed as a commodity, pricing at both retail and wholesale levels has steadily dropped over the years: Kaleido anticipates that annual wholesale revenue per connection will average at only around $8 by 2028.

Aside from applying BCE, the report found that the simplification of the eSIM ecosystem (through the SGP.31/32 specification) in addition to a pressing need for IMSI sponsorship by tier 2/3 MNOs and IoT MVNOs offers incremental revenue opportunities. Wholesale monetisation for eSIM, in particular, is a current point of focus for several operators, and even under the new specifications, is likely to continue to rely on roaming architecture in many instances.

Steffen Sorrell, Research Lead at Kaleido Intelligence, added: “Enterprises suffer from significant challenges in securing a desired international connectivity footprint due to the need to establish multiple contracts and technical integrations. The expansion of eSIM and sponsored roaming solutions from individual providers forms a critical part of reducing this pain point, and offers wholesale business units with a new revenue stream opportunity.”

About Kaleido Intelligence IoT Wholesale Roaming Revenue forecast

Kaleido Intelligence is a specialist consulting and market research firm with a proven track record of delivering telecom research at the highest level.