Huawei Overtakes Apple and Become World’s 2nd Largest Smartphone Vendor

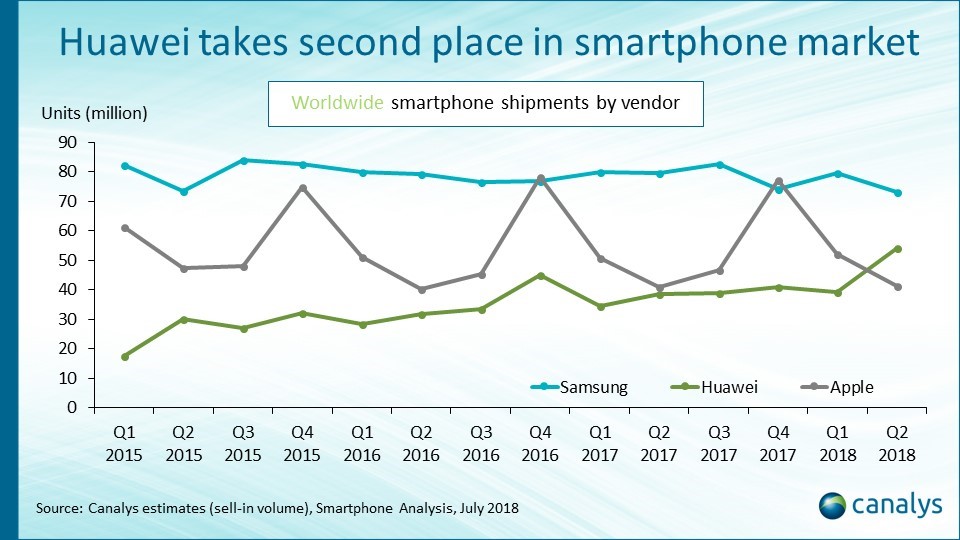

Huawei achieved a major milestone in Q2 2018 – in other words Huawei overtakes Apple, becoming the world’s number two smartphone vendor.

It shipped 54 million handsets, up 41% year on year. This performance is partly due to strong sell-in of its latest flagship, the P20, which exceeded launch quarter sell-in of both the P10 and P9. Another big reason for Huawei‘s success is its Honor sub-brand, which accounted for two thirds of the near 16 million jump that Huawei made this quarter. Samsung remained the top vendor in Q2, but felt the impact of Huawei and others, slipping 8% to 73 million shipments. Apple fell to third, shipping 41 million iPhones, a 1% year-on-year growth.

Huawei’s strategy has evolved significantly over the last six months; said Mo Jia, Canalys Analyst based in Shanghai. “It is the first time in seven years that Samsung and Apple have not held the top two positions”

Despite its failure to strike a US carrier partnership earlier this year, the company has turned around quickly, moving away from its drive for profitability and focusing instead on finding volume growth at the low end. Honor, which has long been a major brand in China but relatively small overseas, has taken a pivotal role in this strategy.” Honor’s share of Huawei smartphone shipments increased from 24% in Q2 2017 to 36% this quarter.

Huawei shipped close to 4 million Honor-branded smartphones outside of China in Q2, representing 150% year-on-year growth, albeit from a small base. Honor is quickly building and deploying an independent sales force, parallel to Huawei’s, driving the brand into new markets, and consequently democratizing Huawei’s flagship technology. Its focus on an open-market strategy has made it particularly potent in Russia, India and Western European markets.

Apple’s iPhone sell-in of 41 million units for Q2 is within its typical range for the second quarter. “Q2 has always been seasonally weak for Apple; said Canalys UK-based Senior Analyst Ben Stanton.

While the iPhone X succeeded in generating volume in the previous quarters despite its hefty price tag, it has been unable to sustain that volume this quarter. But for an Apple flagship, this is normal. In addition to this, models such as the iPhone 7 and 7 Plus are also losing steam, given a high sell-in in Q1. But an uptick in iPhone 8 and 8 Plus, helped in part by the Product Red campaign, was enough to offset this trend.” Canalys estimates that Apple shipped over 8 million iPhone Xs in Q2, down from 14 million in the previous quarter.

Linda Sui, Director at Strategy Analytics, said, “Global smartphone shipments fell 3 percent annually from 360.4 million units in Q2 2017 to 350.4 million in Q2 2018. The global smartphone market has slowed down this year, due to longer replacement rates, diminishing carrier subsidies, and a lack of new hardware design innovation.”

Neil Mawston, Executive Director at Strategy Analytics, added, “Samsung shipped 71.5 million smartphones worldwide in Q2 2018, tumbling 10 percent annually from 79.5 million units in Q2 2017. This was Samsung’s worst quarterly performance since the third quarter of 2016. Samsung is being squeezed by Chinese rivals, like Xiaomi and Huawei, across major Asian markets such as China and India. Huawei soared 41 percent annually from 38.4 million smartphones shipped worldwide during Q2 2017 to a record 54.2 million units in Q2 2018. Huawei overtook Apple for the first time ever to become the world’s second largest smartphone vendor. Huawei captured 15 percent global smartphone market share in the quarter. Huawei’s midrange Android models, such as Nova 2S and Nova 3e, are proving wildly popular across Asia and Europe.”

Linda Sui, Director at Strategy Analytics, added, “Xiaomi shipped an impressive 32.0 million smartphones and held fourth position with a record 9 percent global marketshare in Q2 2018, lifting from 6 percent share a year ago. Xiaomi’s growth increased 38 percent annually in the quarter, but this was down from the 58 percent rate it hit a year ago. Xiaomi is now slowing, due to fresh competition from Huawei in its key markets of India and China. OPPO held fifth place, capturing 9 percent global smartphone marketshare in Q2 2018, up slightly from 8 percent a year ago. OPPO has been hit hard by Xiaomi’s rapid expansion in the past year, but OPPO is finally stabilizing and fighting back with keener pricing and enhanced new models such as the R15 with dual SIM cards.”

Exhibit 1: Global Smartphone Vendor Shipments and Marketshare in Q2 2018 1 |

||||

Global Smartphone Vendor Shipments (Millions of Units) |

Q2 ’17 |

Q2 ’18 |

||

Samsung |

79.5 |

71.5 |

||

Huawei |

38.4 |

54.2 |

||

Apple |

41.0 |

41.3 |

||

Xiaomi |

23.2 |

32.0 |

||

OPPO |

29.5 |

30.2 |

||

Others |

148.8 |

121.2 |

||

Total |

360.4 |

350.4 |

||

Global Smartphone Vendor Marketshare (%) |

Q2 ’17 |

Q2 ’18 |

||

Samsung |

22.1% |

20.4% |

||

Huawei |

10.7% |

15.5% |

||

Apple |

11.4% |

11.8% |

||

Xiaomi |

6.4% |

9.1% |

||

OPPO |

8.2% |

8.6% |

||

Others |

41.3% |

34.6% |

||

Total |

100.0% |

100.0% |

||

Total Growth: Year-over-Year (%) |

5.5% |

-2.8% |

||

Source: Strategy Analytics |

||||