Holafly’s Global eSIM Plans Signal a Shift Toward Subscription Connectivity?

Spanish travel tech start-up Holafly is widening its reach with a new generation of gIobal eSIM plans designed for frequent travelers and business users — a clear signal that the company is stepping beyond its roots in country-specific, short-term eSIMs.

Until now, Holafly’s model was simple: buy an eSIM for a single country or region, valid for a fixed number of travel days. But with global mobility surging and roaming still frustratingly expensive for many companies, the brand is now chasing a new customer segment — those who travel regularly and need consistent, borderless connectivity.

From Country eSIMs to Global Data

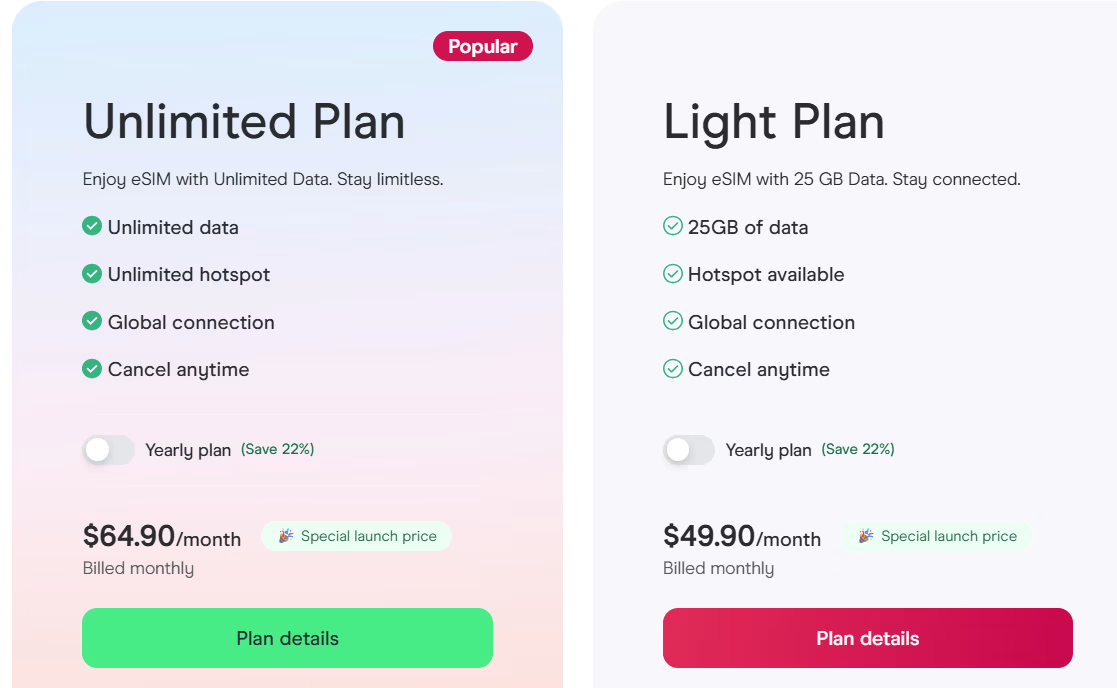

The company’s new “Light” plan offers 25 GB of data for €50 per month, valid in 160+ destinations. It’s live now and automatically renews monthly unless canceled. A “Global Unlimited” plan is next, priced at €65 per month for unlimited data — a bold attempt to bring simplicity to a fragmented roaming landscape.

If you pay yearly, you can save 22%.

The offer primarily targets business travelers, a group that Holafly CEO Pablo Gómez says faces “disproportionately high roaming costs,” even though only about 3% of business trips from Germany go outside Europe. Those few long-haul journeys, however, generate the lion’s share of corporate mobile expenses.

The Roaming Shift Is Accelerating

“Roaming as we know it today will cease to exist,” Gómez predicts. He’s not alone. As eSIM adoption rises, the traditional model of operator roaming partnerships is being disrupted. Travelers no longer need to rely on physical SIMs or operator-issued roaming bundles — they can switch networks on the fly with just a QR code.

Analysts at Juniper Research forecast that global travel eSIM revenue will jump from $990 million in 2023 to $1.8 billion in 2025, and further to $8.7 billion by 2030. That’s an extraordinary growth curve driven by digital nomads, remote workers, and global businesses rethinking how they stay connected.

Meanwhile, operators like Vodafone are already pivoting with their own eSIM options, while fintechs such as N26 and Revolut are embedding eSIM connectivity directly into their financial ecosystems — turning “connectivity-as-a-service” into the next frontier of customer engagement.

A Growing Battle for the Global Traveler

Holafly’s move into monthly global plans puts it toe-to-toe with Airalo, Nomad, Ubigi, GigSky, Airhub, and BNESIM, all of which have been experimenting with flexible global or regional packages.

- Airalo, for instance, offers global data plans at lower entry prices and more flexible durations, giving travelers the freedom to buy smaller data bundles for shorter periods — a structure that still makes it one of the more cost-effective options in the global eSIM market.

- GigSky, Ubigi, and Nomad eSIM have also been exploring hybrid models that blur the line between consumer and business plans, with shared accounts and multi-user management tools for teams on the go.

What differentiates Holafly here is not the pricing—it’s the positioning. This is one of the first mainstream travel eSIM brands openly chasing corporate mobility users, a group that accounts for 10–15% of B2C eSIM purchases but remains underserved by most retail providers.

The Bigger Picture: eSIMs Are Growing Up

Holafly’s shift reflects a broader maturation of the travel eSIM ecosystem. As the novelty of prepaid, destination-specific eSIMs fades, the next phase is about recurring connectivity — predictable, subscription-style services for people who are never in one place for long.

Still, the pricing gap between global and local options remains a hurdle. At around €50–65 per month, Holafly’s plans rival European mobile subscriptions — a tough sell for casual travelers, but potentially worth it for professionals who value frictionless access across 160+ countries.

In the long term, Holafly’s move may push the market toward greater standardization and better business tools — think shared data pools, invoice management, or integration with corporate travel platforms. If they can pull that off, Holafly could evolve from a travel eSIM brand into a global connectivity service provider.

Conclusion: A Smart but Competitive Play

Holafly’s new global plans are a strategic evolution that make sense in a market increasingly defined by flexibility and cross-border demand. The pricing may raise eyebrows compared to Airalo’s more modular global options or Nomad’s pay-as-you-go flexibility, but Holafly is betting on simplicity and trust rather than rock-bottom rates.

The real opportunity lies in bridging the B2C–B2B gap — serving business travelers who need reliability more than savings. With the right mix of automation, billing, and analytics, Holafly could carve out a premium niche before telecom operators and neobanks fully close in.

The eSIM revolution is no longer about ditching plastic cards — it’s about who owns the relationship with the traveler. And in that race, Holafly just took a decisive step forward.

- aloSIM

-

eSIM for

Europe

32 countries

-

1 GB – 7 days – €5.00

3 GB – 30 days – €13.00

10 GB – 30 days- €36.00

- iRoamly

-

eSIM for

Europe

39 countries

-

1 GB – 7 day – €6.83

3 GB – 15 days – €10.24

10 GB – 30 days – €18.77

- Maya Mobile

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – –

5 GB – 15 days – €5.99

10 GB – 30 days- €13.99

- VOIA

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – €2.69

3 GB – 15 days – €5.05

10 GB – 30 days- €11.70

The Best eSIM Finder brings together 100+ providers in one place, giving you a clear view of everything from data limits and business options to tethering, crypto payments, coverage, travel extras, refund policies, discounts, and reviews—so you don’t just compare plans, you understand which one truly fits your needs. Start exploring today and find the plan that fits you best.