Nearly half of Gen Z Plan to Buy Refurbished Smartphones — A Market Turning Point

A recent study by the Vodafone Institute, conducted with Kantar and supported by the Wuppertal Institute, reveals that Generation Z is at the forefront of adopting refurbished and repaired smartphones across Europe. More than 5,200 people were surveyed in Germany, France, Spain, Sweden, and the UK.

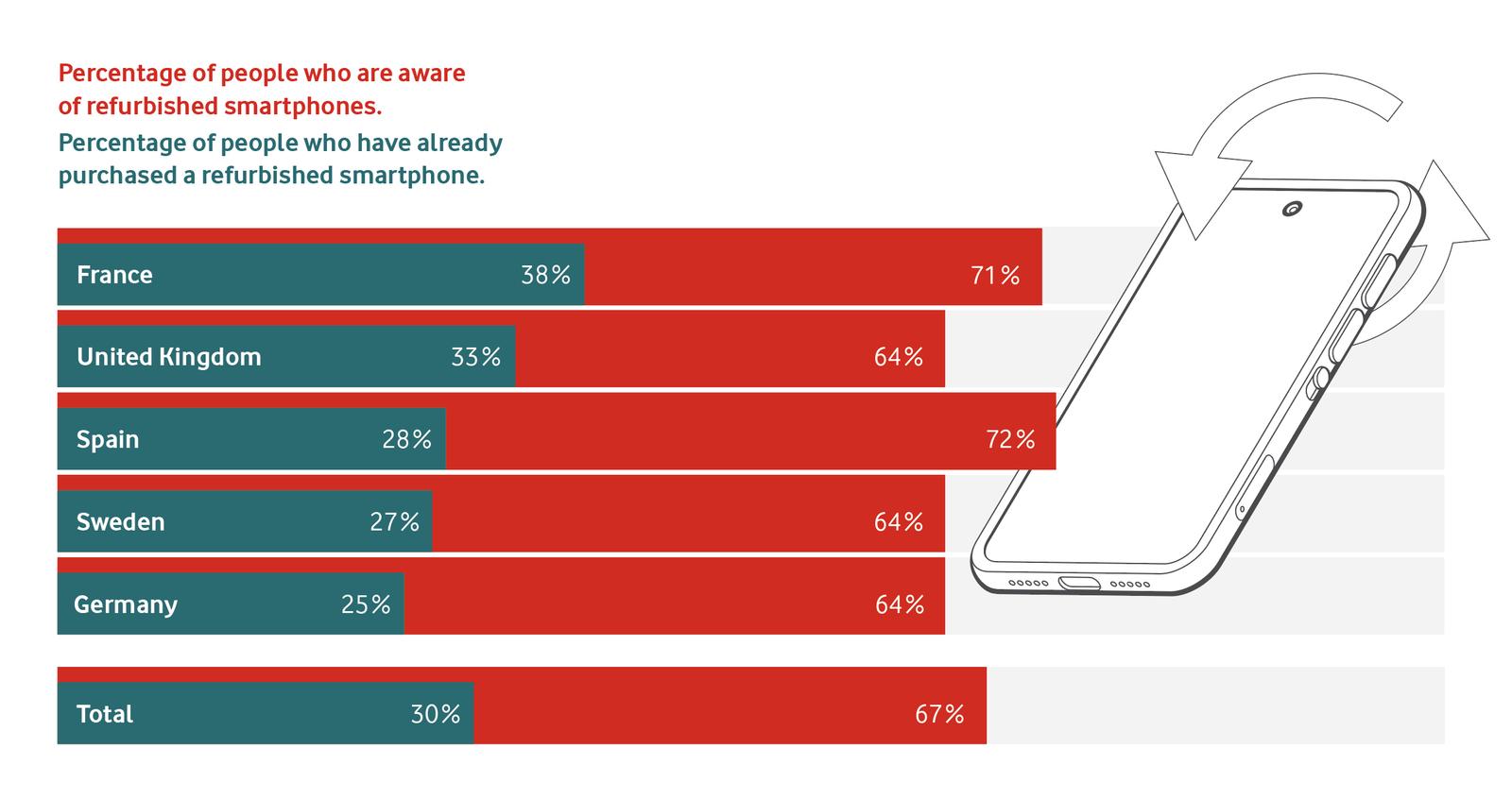

Despite high awareness—about 66% of respondents (67% among smartphone owners)—knowing that refurbished offers exist, only ≈30% have ever bought a refurbished device.

However, the future looks more promising: nearly 40% of those surveyed say they definitely or probably will buy their next smartphone refurbished. And among those who have already bought refurbished, 81% plan to do so again.

Generational & Geographic Variations: Who’s Leading, Who’s Lagging

- Gen Z vs Baby Boomers: Around 37% of Gen Z respondents have already bought a refurbished device, while for Baby Boomers the figure is about 18%.

- Country differences: In France, about 38% of people have purchased refurbished smartphones; Germany lags behind at 25%. Willingness to buy refurbished in future varies by more than 10 percentage points across these countries.

Joakim Reiter, Vodafone Group Chief External & Corporate Affairs Officer said: “Our research shows that although Gen Z consumers mostly embrace buying refurbished devices or have their current phone repaired, older consumers are slower to tap into the financial and environmental benefits of buying pre-owned. However, baby boomers tend to hold on to their smartphones for significantly longer.

While there is a small but avid group of sustainability-first consumers, most people say their decisions are driven by price and functionality. But buying a refurbished device from a reputable retailer is a win-win situation: all the apps that work on new devices, but at a more attractive price and with a lower carbon and materials footprint.”

Repair, Retention & Sustainable Attitudes

- Repair habits: One third (≈33%) of Gen Z have repaired their current phone (battery, screen, etc.), versus just 8% of Baby Boomers. By country, roughly 27% in Spain have had their devices repaired, compared to 14% in Germany.

- Keeping devices unused: Over half (51%) of users keep their old smartphone after upgrading—either as a backup or stored away. Only about 8% continue to use them in parallel.

- Reasons for holding on: A backup device is the most common reason (47%), followed by lack of knowledge what to do with old device (17%), concerns about data privacy (16%), sentimentality (13%), and effort required (11%). Sentimental value is especially high among Gen Z (20%) and tech enthusiasts (24%).

Types of Buyers & Usage Patterns

The Vodafone study classifies smartphone users by “usage/purchase type”:

- Tech Enthusiasts: Want the latest models as soon as they are released.

- Prestige Types: Aim for appearance and high quality; smartphone usually not older than two years.

- Functional Types: Happy to use their phone for more than two years so long as essential apps and updates work.

- Cost-Driven Types: Only replace when the device fails or repair is no longer feasible. Price is paramount.

- Sustainability Types: For whom environmental friendliness plays a central role in all purchasing decisions.

The two largest groups overall are the Functional and Cost-Driven types—together making up about two-thirds of all smartphone users. Sustainability Types comprise around 15%, consistent across countries. Younger people have higher representation among Tech Enthusiasts, Prestige Types, and Sustainability Types; older generations lean more toward Functional or Cost-Driven.

How Long Devices are Kept & Rate of Replacement

- Less than one-third of Europeans have used their current smartphone for more than two years. In France, Sweden, and Germany, this is about 32%; in the UK only 22%.

- Among Tech Enthusiasts and Prestige Types, this share is even lower (≈14% and 12%, respectively). Cost-Driven users are more likely to keep devices over two years (37%). Gen Z shows only about 21% with devices older than two years; Baby Boomers ~ 42%.

- Looking ahead, about 36% of users plan to buy a new smartphone within a year. This rises to 45% among Gen Z, 51% among Prestige Types, 60% among Tech Enthusiasts.

Repair Rates & Device Disposal

- Repair rate overall: About 22% of users have had their current phone repaired. By country: Germany ~14%; UK ~23%; Sweden ~25%; Spain ~27%. Among Gen Z the rate is 33%; Baby Boomers are at 8%.

- What happens to old phones: Of those who part with old devices, giving to family/friends is most common (15%), then private resale (10%), recycling (8%), and trade-in at retailer (7%).

What Motivates Purchasers—Price, Function & Sustainability

Although “sustainability” is increasingly part of the conversation, the survey shows cost and functionality still dominate purchase decisions. Many consumers primarily want a device that works well and doesn’t cost too much. For those buying refurbished, getting apps, updates, and basic performance comparable to new devices is key.

Additional Context: Environmental Benefits of Refurbished Devices

To deepen the picture:

- A comparative study by Refurbed & Fraunhofer Austria finds that refurbishing electronics (smartphones, tablets, and laptops) can save ~78% of CO₂ emissions, reduce water use by ~86%, and cut e-waste by up to 80% when compared to the manufacture of new devices.

- The Carbon Trust estimates that a new smartphone’s manufacture, packaging, and shipping emit roughly 60 kg CO₂e, whereas refurbishment can add only about 15 kg CO₂e for these same stages. Extending device lifespans significantly reduces annual carbon footprints.

- Another study shows that a single refurbished phone produces eleven times less carbon and saves around 261.3 kg of raw materials compared to a brand new model.

Implications & What Can Be Done

-

For Consumers: Be informed about refurbished options. Consider how long you’ll keep a device, whether repair is possible, and whether warranties are offered. Data security and condition are major concerns—make sure these are addressed.

-

For Policy Makers & Retailers:

-

Encourage “right to repair” regulations.

-

Offer incentives (e.g. reduced VAT, repair bonuses) for refurbished/sustainable devices.

-

Ensure clear labelling and reliable quality standards so consumers trust refurbished products.

-

-

For the Circular Economy: Encouraging reuse, repair, refurbishment, trade-in, and proper recycling can reduce environmental harms, conserve resources, and reduce demand pressures on new device production.

Conclusion: Refurbished Moves From Niche to Normal

Gen Z’s preference for refurbished isn’t a side trend—it’s a signal that the market has matured. While Back Market and Swappie lead in Europe, and Amazon Renewed plus first-party programs from Apple and Samsung normalize quality globally, the real differentiator will be trust and convenience. With the EU’s Right to Repair Directive coming into force, Europe is positioned to outpace the US and Asia in mainstreaming refurbished.

The players who succeed will be those who turn trade-ins, warranties, and transparent grading into seamless features rather than afterthoughts. In other words, refurbished is no longer a cheaper substitute but a parallel, policy-backed market—and the next growth frontier for the mobile industry.