Satellite-to-Phone Demand Surges as 60% Will Pay More

Satellite connectivity is no longer the futuristic add-on that the mobile industry once treated as a niche. New research commissioned by Viasat shows just how mainstream the appetite for direct-to-device (D2D) satellite services has become: more than 60% of global smartphone users would pay extra to guarantee better coverage. And if you ask people in high-growth markets like India, that number jumps to nearly nine out of ten.

The study, titled The Great Connectivity Convergence: NTN in Consumer Mobile, was conducted by GSMA Intelligence and surveyed more than 12,000 smartphone users across 12 global markets. Its goal was straightforward: understand how consumers view satellite connectivity as a complement to terrestrial mobile networks, especially in places where traditional infrastructure still falls short.

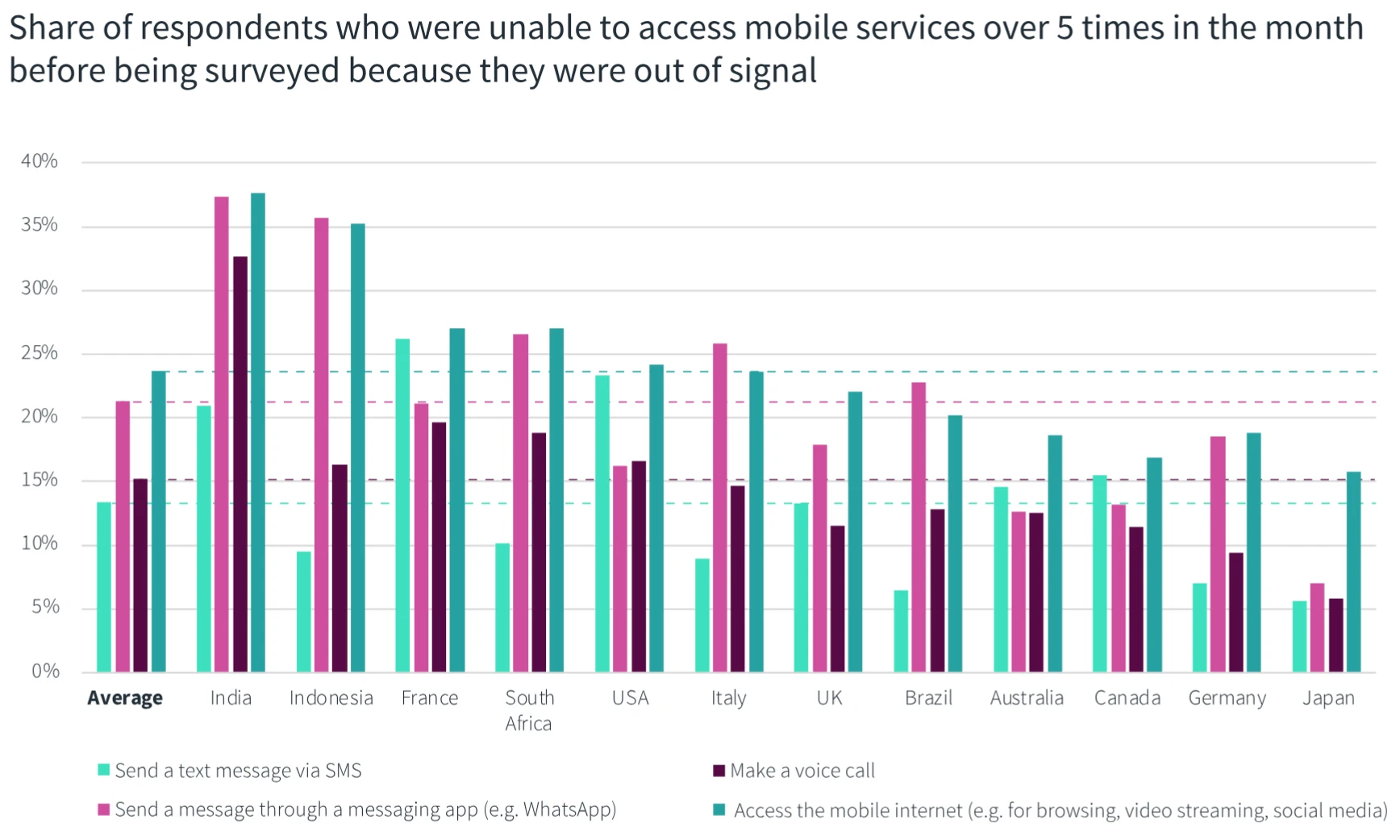

The frustration with “best effort” mobile coverage

One of the starkest findings: more than a third of respondents lose access to basic mobile services at least twice a month. For an industry that has spent the last decade promising gigabit speeds, the reality is still uneven and often unreliable.

And here’s the interesting part — these outages aren’t only happening on remote mountaintops or rural roads. Anyone who has tried to get online at London’s Waterloo Station or King’s Cross knows that mobile connectivity can fail in the most ordinary, high-density locations. Yet the industry continues to frame satellite as a solution primarily for “hard to reach” locations — typically illustrated with a stock photo of someone standing on a ridge in hiking boots.

But if everyday commuters can’t load a train ticket or open WhatsApp in the middle of a capital city, is the problem really about remote geography? Or is the definition of “hard to reach” due for an update? D2D satellite services could play a much more integrated role in shoring up coverage gaps everywhere, not just in wilderness scenarios.

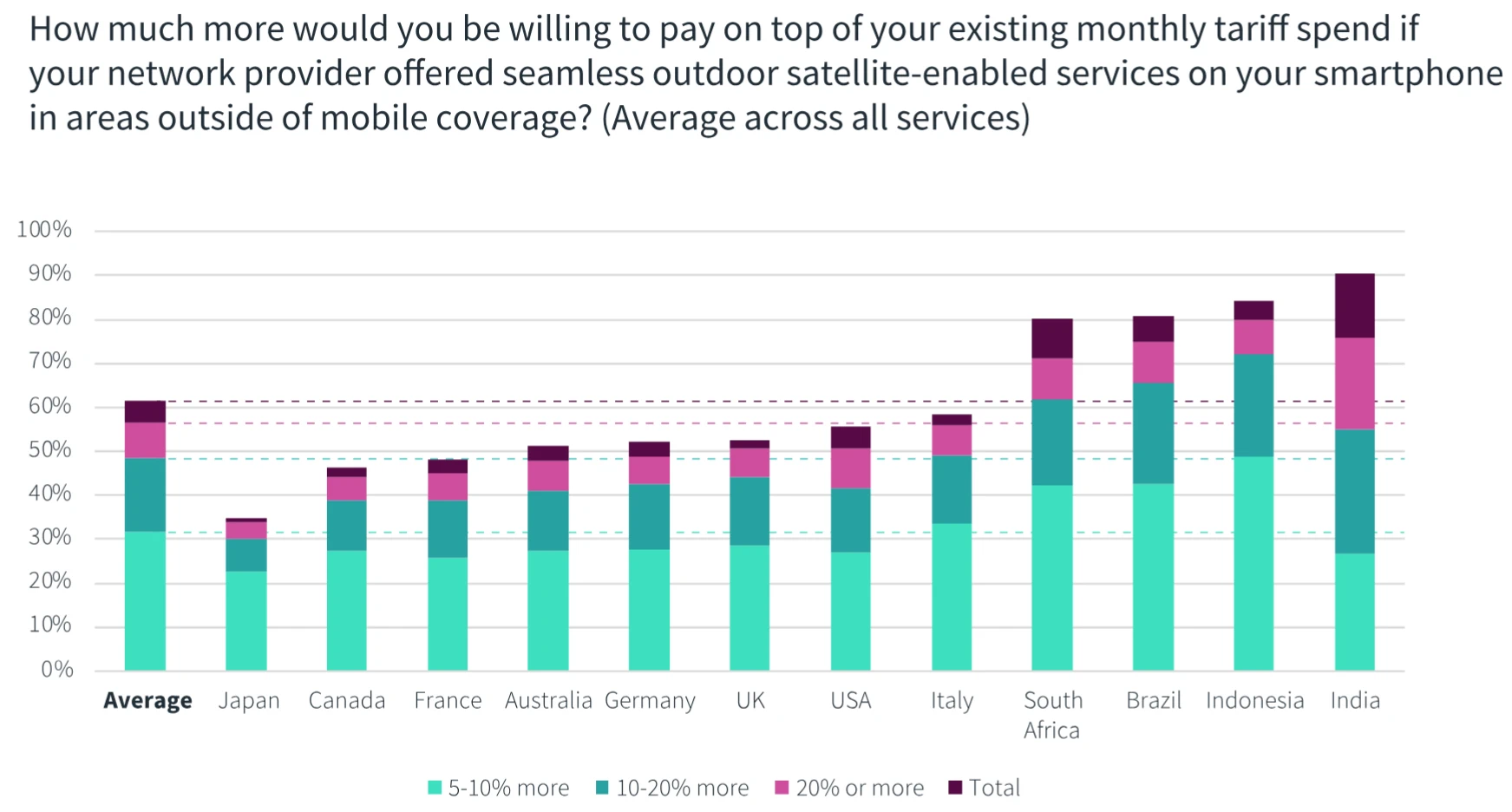

Willingness to pay differs sharply by market

The report reveals a major commercial opportunity — and a geographical divide. Here’s what the survey showed about consumers willing to pay more for D2D services:

Percentage of users willing to pay extra

India: 89%

Indonesia: 82%

US: 56%

France: 48%

Even in Europe and North America — where 5G networks are heavily marketed as reliable and ubiquitous — more than half of users say they would pay extra for true reliability. That alone should be a wake-up call for operators.

What’s even more striking is the revenue upside in markets with lower average revenue per user (ARPU). India’s ARPU is just $2.35 compared to $45.57 in the US, yet Indian consumers are willing to increase their monthly spend by an average of 9%. With roughly 735 million smartphone users, that translates into a massive addressable opportunity.

And this is where Viasat sees the inflection point. Andy Kessler, Vice President of Viasat Enterprise, said the data shows not only consumer frustration but also a readiness to switch providers for more reliable connectivity. In a market where loyalty is fragile, D2D could become a powerful differentiator.

Why this matters now: competition, timing, and emerging NTN ecosystems

The satellite-to-smartphone race is accelerating fast. Viasat is not alone. Apple and Globalstar kicked off mainstream awareness with Emergency SOS via satellite. SpaceX’s Starlink and T-Mobile are preparing their own D2D services. AST SpaceMobile recently completed successful 5G satellite-to-phone testing. Qualcomm and Samsung have demonstrated chipsets with built-in NTN capabilities.

Put simply: this space is getting crowded — and expensive — very quickly.

What makes Viasat’s report particularly timely is that it frames D2D as more than a novelty or a backup for hikers. It positions satellite connectivity as an everyday reliability layer, one that could sit invisibly beneath terrestrial networks and activate seamlessly when coverage drops.

GSMA Intelligence, Ericsson Mobility Reports, and ITU analyses all point to the same trend: as mobile data consumption grows, networks struggle with congestion, not just coverage. Satellite services could become the new safety valve — not only for remote areas, but for dense urban zones where infrastructure simply can’t keep up.

Revenue potential and user expectations

Respondents who said they would pay more indicated an average willingness of 5–7% above their current bill. That’s not a small premium. For operators facing tightening margins and high 5G investment costs, D2D could become the next major upsell category — similar to how roaming bundles and device insurance became reliable revenue streams in the past decade.

But telecoms must be careful: consumers are not paying for novelty. They’re paying for reliability. They want their phones to work everywhere — seamlessly, instantly, without “best effort” excuses.

A growing push toward digital inclusion

Kessler also framed satellite connectivity as an inclusion tool. This matters. In markets where fixed broadband penetration is low and mobile networks are patchy, D2D can help bridge digital divides, support safety during natural disasters, and enable economic participation for communities left behind by infrastructure gaps.

And as more devices — not just phones — become satellite-capable, we’ll see new applications emerge across agriculture, transportation, tourism, and emergency response.

Conclusion: Satellite is shifting from nice-to-have to necessity

The Viasat survey reinforces a truth the industry has been slow to admit: consumers don’t care whether their signal comes from a tower, a satellite, or a hybrid network. They just want it to work. With Apple, SpaceX, AST SpaceMobile, Iridium, and now Viasat pushing aggressively into the D2D space, the competitive landscape is reshaping fast. The players who succeed won’t be the ones with the highest towers — but the ones who offer the smoothest, simplest experience.

Reliable sources like GSMA Intelligence, Ericsson, and ITU all show the same trajectory: demand for universal connectivity is skyrocketing, and terrestrial networks alone can’t keep up. The winners of the next connectivity era will be the operators and satellite providers who collaborate, integrate, and treat D2D not as a premium perk but as a foundational part of the mobile experience.

If mobile operators don’t seize this moment, someone else will.