$400bn B2B Opportunities for Telcos: Cloud, IoT, and Cybersecurity

The future of telecommunications lies beyond traditional connectivity. GSMA Intelligence’s latest report highlights a staggering $400 billion opportunity in B2B technology services for telcos, urging them to think bigger and broader. But how can operators seize this opportunity? B2B Opportunities for Telcos

Let’s dive into the key insights, breaking down how telcos can transform their B2B strategies and explore massive growth in areas like cloud, cybersecurity, IoT, and AI.

Why Traditional Connectivity Isn’t Enough Anymore

Telcos have long relied on basic services like SD-WAN, unified communications, and mobile voice and data for the bulk of their B2B revenue. But guess what? These services only offer modest growth, with a projected Compound Annual Growth Rate (CAGR) of 3% from now until 2030. That’s not going to cut it in a rapidly evolving landscape.

The Pivot: Advanced Tech Services

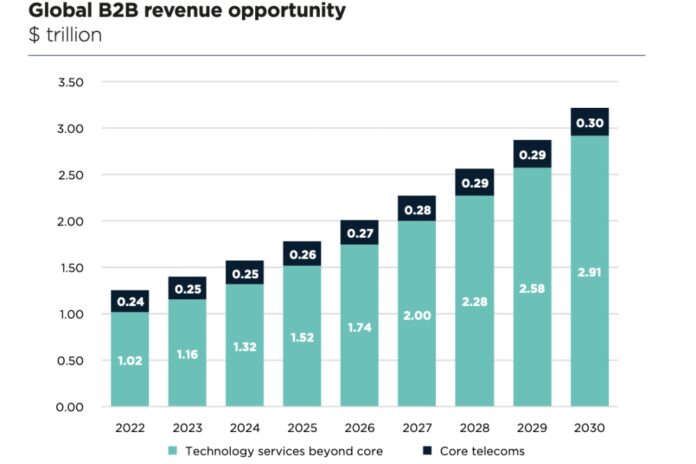

Here’s the kicker—enterprise spending on advanced technology services is already five times that of traditional telco services. In 2023, companies spent a whopping $1.16 trillion on areas like cloud, cybersecurity, IoT, AI, and analytics. By 2030, this number is expected to balloon to $2.91 trillion, with a much healthier CAGR of 14%.

What Does This Mean for Telcos?

For telcos to stay competitive, they need to pivot fast. Simply focusing on connectivity-driven solutions will lead to stagnant growth. Instead, they must double down on advanced network solutions like:

- Network slicing: Allocating separate slices of network bandwidth for specific enterprise needs.

- Private networks: Dedicated, secure networks tailored to enterprise requirements.

By integrating these services with IoT, AI, and analytics, telcos can offer end-to-end solutions that meet the diverse needs of today’s enterprises. B2B Opportunities for Telcos

Key Verticals Offering Massive Potential

Four industries stand out as prime targets for telcos to focus their efforts on: financial services, manufacturing, automotive, and aviation. In 2023 alone, these sectors represented an addressable market worth $159 billion. And the future looks even brighter with projected growth across the board.

Manufacturing: The Data Goldmine

Manufacturing is a powerhouse for telcos. With companies adopting IoT, edge computing, and AI, massive data volumes are being generated across factories. The challenge? Managing this data effectively to unlock business value. Telcos can step in with: B2B Opportunities for Telcos

- IoT integration: Seamlessly connecting devices to enable smarter production.

- AI-driven analytics: Providing insights to optimize processes and reduce downtime.

- Cybersecurity: As IT and OT (Operational Technology) converge, manufacturers are more vulnerable to cyber threats. Telcos can help mitigate this with robust security solutions.

Financial Services: The Tech Transformation

The financial sector is undergoing a tech revolution. With $59 billion in market potential in 2023, this industry is ripe for disruption. Telcos can support financial institutions by offering:

- Cloud-based services: Enabling faster, more secure transactions.

- AI-enhanced analytics: Improving decision-making with predictive insights.

- Blockchain: Revolutionizing the way financial transactions are managed, ensuring transparency and security.

Automotive & Aviation: Driving Innovation

The automotive and aviation industries are experiencing rapid growth, with CAGR projections of 12% and 8.4%, respectively, until 2030. Telcos can accelerate this growth by delivering:

- Connected car technology: Enhancing vehicle safety and user experience through IoT.

- Private 5G networks: Ensuring seamless communication and data transfer in airports and across flight operations. B2B Opportunities for Telcos

Expanding Beyond the Core 4: Other Sectors to Watch

While manufacturing, financial services, automotive, and aviation are the big players, telcos shouldn’t overlook the remaining 63% of their addressable market. This includes sectors like:

- Healthcare: Telemedicine, IoT-enabled health devices, and data analytics.

- Smart cities: Supporting urban development with connected infrastructure.

- Energy and utilities: Driving operational efficiency through smart grids and IoT.

- Retail: Enhancing customer experiences with AI and augmented reality.

The diversity of these sectors means telcos can tailor their offerings to specific business needs, further increasing their market penetration.

The Competition: Hyperscalers and Security Vendors

Telcos aren’t the only players eyeing this lucrative market. Hyperscalers like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure are formidable competitors, especially in edge networking and cloud services. 24% of operators see them as a major threat.

Why Security Matters More Than Ever

Cybersecurity is another battleground. As businesses become more connected, the attack surfaces grow larger, especially in industries like manufacturing and financial services. Security vendors are stepping up, with 41% of operators identifying them as key competitors.

Balancing Internal Investments with Partnerships

To compete effectively, telcos must strike a balance between investing in new capabilities and forming strategic partnerships. Building in-house solutions can be costly and time-consuming, while partnerships allow for quicker scalability and resource optimization.

Jo Gilbert, Technical Director and GSMA Connected Manufacturing and Production lead, said,

“To bolster operational efficiency, resilience, agility, and flexibility, manufacturing companies are investing in advanced connectivity, IoT, edge, and AI technologies. These innovations are generating massive data volumes across factories, requiring stronger data management capabilities to unlock business value. Furthermore, the growing convergence of IT and OT systems has expanded cyberattack surfaces, making cybersecurity a key priority for manufacturers.”

How Telcos Can Succeed in the Long Term

To unlock the $400 billion B2B opportunity, telcos need to rethink their strategies. It’s not just about selling connectivity anymore; it’s about offering a full suite of integrated solutions that align with the evolving needs of modern enterprises.

What Enterprises Want

Enterprises today are looking for service providers that can integrate a blend of technologies into their existing infrastructure. They don’t just want connectivity; they want solutions that:

- Enhance operational efficiency: Whether through automation, analytics, or IoT.

- Boost resilience: Private networks and cybersecurity measures can safeguard against disruptions.

- Drive innovation: AI, blockchain, and cloud services open up new possibilities for growth.

The Power of Customization

Customization is key. By offering tailored solutions that fit the unique needs of each business, telcos can position themselves as indispensable partners in enterprise growth.

From 5G to 2030: The Roadmap for Telcos

The shift towards B2B services is already happening. GSMA Intelligence’s survey revealed that 36% of operators now prioritize market leadership in enterprise connectivity and services. This is a significant change from previous years when basic connectivity was the top focus.

5G Beyond Connectivity

The adoption of 5G is accelerating, with 64% of telcos already offering services beyond basic connectivity. This includes innovations like:

- 5G IoT: Enabling smart cities, connected factories, and more.

- Mobile Edge Compute: Allowing for real-time processing of data closer to the end user.

- Private networks: Ensuring secure, reliable communication channels for enterprises.

These advancements signal a shift towards services, where connectivity is bundled with other offerings to create comprehensive, value-driven solutions.

The Bottom Line: A $2.91 Trillion Market Awaits

By 2030, the enterprise tech services market is expected to reach $2.91 trillion. For telcos, this represents an unprecedented opportunity to expand their reach and increase their revenue streams. But to get there, they need to move beyond traditional offerings and invest in the technologies and partnerships that will drive future growth.

Summary

In summary, telcos stand at the brink of a massive opportunity in the B2B sector. The key to unlocking this potential lies in embracing advanced technology services like cloud, cybersecurity, IoT, and AI, while also forming strategic partnerships to stay competitive. By focusing on industries like manufacturing, financial services, automotive, and aviation, telcos can capitalize on the growing demand for integrated solutions that go beyond simple connectivity. The future is bright for those who are ready to evolve.