Cloud, smart mobility & alternative realities – focus for 5G investors

Investors will put $59bn into the 5G this year, with the largest portion going on cloud computing, according to a study commissioned by service provider World Wide Technology (WWT). The study asked 100 investment agents, venture capitalists and investors what areas of technology they would invest in, if the conditions were right. Of the 100 in the sample, 92 percent said they would invest in 5G. 5g investments

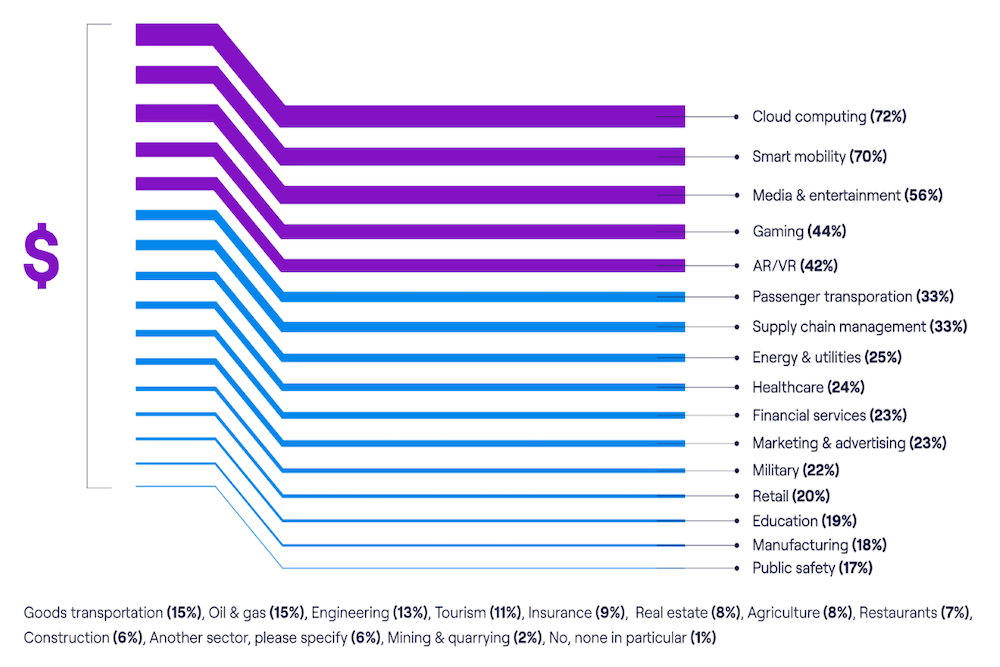

The top five categories for likely investment were identified as the cloud (approved of by 72 percent of the survey sample), smart mobility (with 70 percent recognition), entertainment/media (56 percent), gaming (44 percent) and augmented and virtual reality (42 percent).

They’ve got their bread in the cloud 5g investments

Disappointingly perhaps, the two industrial sectors that could actually catalyse wealth generation and productivity, Health and the Supply chain, were not listed as the top five priorities for 5G investment, being ranked sixth and seventh. The respondents were reportedly ‘bullish’ about the prospects for mobile operators and service providers in the 5G era.

When asked, ‘Can you name any 5G-enabled companies that are expected to make it big in the next 12 months?’ 41 percent of investors replied by naming an operator. However, mobile network operators came second to suppliers of components and hardware who were named by 47 percent of the survey.

Good news for mobile operators 5g investments

A survey sample of 92 companies, taken from unnamed employees, is not always statistically significant. However, Victor Holmin, director of discovery and innovation at World Wide Technology, said: “Now is the time to invest in the foundational technologies of 5G. Our research has clearly shown that there is clear excitement in 5G among investors – and that these five sectors, in particular, are ripe for growth.” Holmin had a message for mobile network operators. “Service providers need to make the investment in foundational technologies, such as Edge, and look to build a platform that will enable them to deploy services which can build the promise of 5G into a reality.”

Conclusion: Learning from the past 5g investments

5G is hot and it’s getting hotter – that’s the investor’s view. Survey respondents see massive opportunity in various applications that use the technology, the businesses that provide them, and those that facilitate their delivery.

However, to revisit the contention from the introduction of this report: we are at a stage where 5G has launched, but there has been no big bang, either for its consumers or its providers.

Now, network operators are in danger of finding themselves in a similar situation to the one they did midway through the 4G era. Laden with high network costs and mired in a race to the bottom to capture subscribers, infrastructure became commoditized, without the opportunity to generate new revenues from value-add technologies. While technology companies that used operators’ infrastructure thrived, the revenues of operators themselves dwindled.

Becoming the 5G Application Enabler 5g investments

But it’s not just Facebook, Amazon Web Services and Uber that will generate revenue from 5G-dependent services. What operators need to do is take a slice of the revenue from the services that businesses like this create.

You’ll have heard of the dangers of operators acting as ‘dumb pipes’ for smart services and endpoints. But if operators build their networks with the provision of new applications in mind, they won’t just help make them possible; they can make them work better.

Partnering with a hyper scaler is by itself unlikely to dramatically enhance operators’ revenue streams with the spoils of 5G. Even with a partnership in place, it will remain essential that they bring unique, service-enhancing value to the table.