Wearable Payment Devices

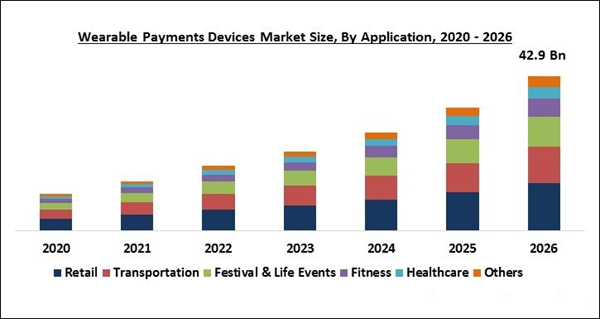

The global Wearable Payments Devices Market size is expected to reach $42.9 billion by 2026, rising at a market growth of 27.2% CAGR during the forecast period. The safe and secure payment method offered to the consumers for their purchase of products or services through the advanced integrated technology in their wearable devices is referred as Wearable payments.

This method provides vendors and retailers to go with a more secure and error-free payment method and hence, also known as tap-and-go payment method by many retailers and organizations. Moreover, several banks and financial institutions are offering wearable payment options for widening their customer base around the world while delivering better convenience in outdoor shopping. Additionally, the adoption of contactless payments and wearable payments has increased globally during recent years, owing to the increasing adoption of smartphones and ease in transactions compared to the traditional banking payment methods.

The growth of the market is attributed to the rising demand for Host Card Emulation (HCE) and the increasing adoption of cashless transactions. HCE helps mobile or wearable devices to allow card imitation on NFC-enabled devices without depending on the connection to an authenticated element. Moreover, the rising demand for Wearable Payments Devices is due to their fast payment feature, which is estimated to boost the market growth during the forecast period.

There are many e-banking platforms that are adopting Wearable Payments Devices. These e-banking platforms are aiming to integrate the Near Field Communication (NFC) technology into their transaction operations that facilitate smooth payments. Moreover, the reducing costs for implementing NFC technology are propelling the demand for the technology. This technology is broadly used in businesses to transfer data from their devices to several contactless payment terminals like NFC tags and smartphones.

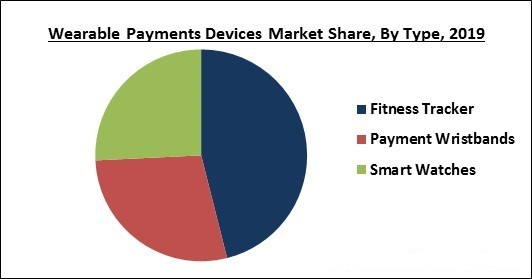

By Type

Based on Type, the market is segmented into Fitness Tracker, Payment Wristbands and Smart Watches. The segment of fitness tracker leads the market in 2019. These fitness trackers are estimated to propel the market due to the rising use of a wide range of fitness devices and a growing number of fitness enthusiasts around the world. Several vendors have initiated combining mobile payments into their fitness trackers. Furthermore, customers are broadly choosing fitness trackers due to their expanded safety feature that secures them from frauds and identity thefts during the payment processes.

By Technology

Based on Technology, the market is segmented into Barcodes, Near Field Communication (NFC), Quick Response (QR) Codes, Contactless Point of Sale (POS) Terminals and Others. The contactless Point of Sale (POS) terminals category is expected to record significant growth during the forecast period. The integration of NFC and IoT-based contactless payment features into wearable devices is estimated to boost the growth of the contactless POS terminals category. Vendors like Samsung Electronics and Apple, Inc. have brought on their own contactless POS terminals, consequently leading this category.

By Application

Based on Application, the market is segmented into Retail, Transportation, Festival & Life Events, Fitness, Healthcare and Others. The retail category has dominated the market in 2019. This category’s growth is attributed to the rising demand for cashless payments in local shops, markets, and e-commerce. Moreover, various retailers around the globe are aiming for creating awareness among the customers about contactless payment technology that will help them in promoting the usage of Wearable Payments Devices in the retail industry.

By Region

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific is expected to establish itself as the fastest-growing market in the region during the forecast period. The growth of the market is attributed to the existence of a huge population and rising demand for digital devices in the region. There are some factors like steady growth in building a cashless economy and conversion in payments technology that is estimated to propel the growth of the market. The rising number of new market players in the market is also an important trend in the market.

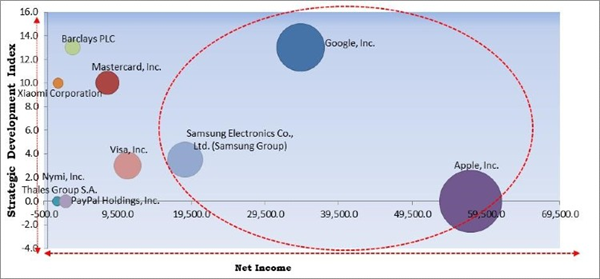

The major strategies followed by the market participants are Product Launches and Partnerships.

Key companies:

- Apple, Inc.

- Thales Group S.A. (Gemalto NV)

- Google, Inc.

- Mastercard, Inc.

- Samsung Electronics Co., Ltd. (Samsung Group)

-

- Xiaomi Corporation

- PayPal Holdings, Inc. (eBay)

- Visa, Inc.

- Nymi, Inc.

- Barclays PLC