How Taxes Affect Tourism: VAT Rates in Europe, 2024

Taxes play a crucial role in shaping the tourism industry, impacting both the cost of travel and the attractiveness of destinations. While taxes can be used to fund infrastructure and services that support tourism, they can also discourage travel and affect a destination’s competitiveness. vat europe

Taxes can add significantly to the cost of travel, potentially making a destination less affordable for tourists. For example, value-added taxes (VAT), which are levied on goods and services, can add up quickly, particularly for tourists who are spending a significant amount of time in a destination. vat europe

In addition to VAT, other taxes that can impact tourism costs include hotel taxes, airport taxes, and fuel taxes. These taxes can make it more expensive for tourists to book accommodations, travel to and from destinations, and enjoy activities.

The Impact of Taxes on Destination Competitiveness

The level and structure of taxes can affect a destination’s competitiveness in the global tourism market. Destinations with high taxes may find it more difficult to attract tourists, as travelers may be swayed by lower prices and more favorable tax regimes in other destinations.

High taxes can also make it difficult for businesses in the tourism industry to operate profitably, leading to reduced investment and job creation. This can further harm a destination’s competitiveness and limit its ability to attract tourists.

VAT Rates in Europe, 2024

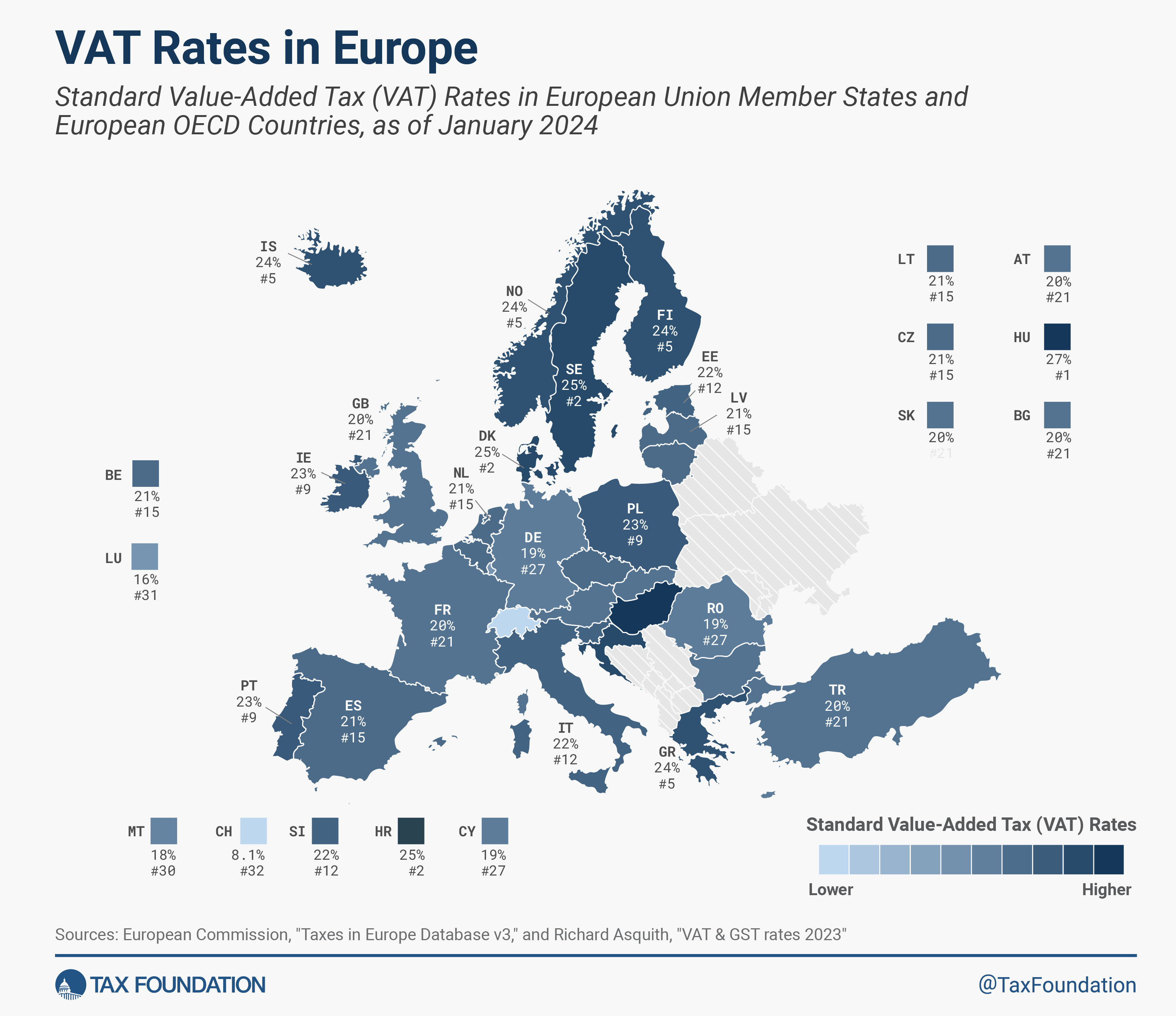

More than 170 countries worldwide—including all major European countries—levy a value-added tax (VAT) on goods and services. As today’s tax map shows, EU Member States’ VAT rates vary across countries, though they’re somewhat harmonized by the EU.

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent). The EU’s average standard VAT rate is 21.6 percent, more than six percentage points higher than the minimum standard VAT rate required by EU regulation.

Among the five European OECD countries that are not part of the European Union—Iceland, Norway, Switzerland, Turkey, and the United Kingdom—only Switzerland levies a standard VAT rate below the EU minimum at a rate of 8.1 percent. In comparison, in the United States, combined state and local sales tax rates averaged only 6.6 percent in 2023.

Generally, consumption taxes are an economically efficient way of raising tax revenue. To minimize economic distortions, there is ideally only one standard rate that is levied on all final consumption, with as few exemptions as possible. However, EU countries levy reduced rates and exempt certain goods and services from VAT.

One of the main reasons for reduced VAT rates and VAT-exempted goods and services is the promotion of equity, as lower-income households tend to spend a larger share of their incomes on goods and services such as food and public transportation. Other reasons include encouraging the consumption of “merit goods” (e.g., books), promoting local services (e.g., tourism), and correcting externalities (e.g., clean power).

However, evidence shows that reduced VAT rates and VAT exemptions are not necessarily effective in achieving these policy goals and can even be regressive in some instances. Such reduced rates and exemptions can lead to higher administrative and compliance costs and can create economic distortions. A recent study shows that scrapping VAT-reduced rates in EU countries will allow standard rates to drop under 15 percent. To address equity concerns, the OECD instead recommends measures that directly increase poorer households’ real incomes.

A few European countries have made changes to their VAT rates since last year. Estonia increased its standard rate from 20 percent to 22 percent. Switzerland increased its standard rate from 7.7 percent to 8.1 percent and its reduced rate from 3.7 to 3.8 percent. Turkey increased its standard VAT rate from 18 to 20 percent and its reduced rate from 8 to 10 percent. The Czech Republic has taken a step to reduce the complexity of its VAT system by consolidating its reduced rates of 10 and 15 percent into one reduced rate of 12 percent.

Balancing Tax Needs with Tourism Promotion

Governments need to strike a balance between raising revenue through taxes and ensuring that the tourism industry remains viable. Too high taxes can stifle tourism growth and development, while too low taxes may not generate enough revenue to fund important infrastructure and services.

Governments can explore various strategies to manage tourism taxes effectively, including:

-

Applying lower tax rates to tourism-related goods and services: This can make destinations more attractive to tourists and help to stimulate economic activity in the tourism sector.

-

Offering tax breaks or incentives to tourism businesses: This can help to offset the cost of taxes and encourage businesses to invest in the tourism industry.

-

Implementing progressive tax systems: This can help to ensure that the burden of taxes is shared more equitably among tourists and residents.

-

Promoting transparency and clear tax regulations: This can help to reduce uncertainty and make it easier for tourists and businesses to understand their tax obligations.

By carefully considering the impact of taxes on tourism, governments can help to ensure that the tourism industry remains a vital contributor to the economy and a source of enjoyment and prosperity for both residents and visitors.

2024 VAT Rates in Europe, as of January 2024

Notes: When one of the major EU VAT directives was adopted in 1991, some EU countries were applying reduced, super-reduced, or zero rates to goods and services that were not specified by the new regulations as falling within the zero-rate or reduced-rate categories. To ease the transition to a standard rate for these goods and services, a so-called “parking rate” was permitted. Although it was intended to be phased out, some countries still apply it. Since April 2022, to secure the principle of equal treatment, EU countries can apply two reduced rates not lower than 5 percent to several goods and services, one super reduced rate below 5 percent, and one exemption.

Tax-free shopping is a popular option for tourists in Europe, as it allows them to reclaim the value-added tax (VAT) that they paid on their purchases. This can save tourists a significant amount of money, particularly on high-ticket items such as electronics, clothing, and jewelry.

How does tax-free shopping work? vat europe

To qualify for tax-free shopping, you must be a non-resident of the European Union and have spent a minimum amount of money in the country where you are shopping. The minimum amount varies from country to country, but it is typically €100. You will also need to show your passport and the original receipts for your purchases.

What are the benefits of tax-free shopping?

There are several benefits to tax-free shopping:

- Save money: You can save a significant amount of money on your purchases by reclaiming the VAT.

- Easy to do: The process of applying for a VAT refund is relatively simple.

- Widely available: Tax-free shopping is available in most major cities in Europe.

How to apply for a VAT refund?

The process of applying for a VAT refund varies from country to country. However, the general steps are as follows:

-

- At the time of purchase, ask the cashier for a tax-free form.

- Fill out the tax-free form and attach your receipts.

- Have your passport stamped at the airport or border control.

- Send the completed form and receipts to the tax-free refund company.