Tesco Mobile is the Top UK Operator for Customer Satisfaction

With almost 85 million active connections in the UK market to date, the telecommunications market plays a vital role in today’s economy, with it being responsible for reliably connecting millions of individuals, groups, and devices through vast networks and communications channels. Market use cases include telephone services, Internet connectivity, wireless communications, reliable roaming agreements, non-terrestrial connectivity, 5G, future 6G, and cellular networks. UK Mobile Operators Customer Satisfaction

Over the last few years, navigating this industry has become increasingly complex as rapid growth, business digitalization

and shifting consumer demands force constant innovation. The advent of smart devices, fibre Internet and 5G advanced

technology has made telecommunications services integral to everyday life.

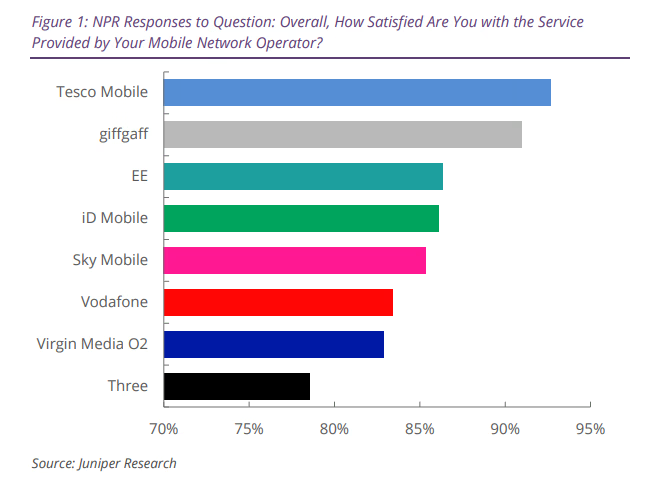

A new survey from Juniper Research, the foremost expert in the telecommunications market, ranked Tesco Mobile as the leading network operator in the UK for customer satisfaction in 2024. The comprehensive survey of 3,300 UK mobile subscribers assessed attitudes towards their chosen network operators and the services they provide.

- Tesco Mobile – 92%

- giffgaff – 91%

- EE – 86%

- iD Mobile – 86%

- Sky Mobile – 85%

An extract of the new report, UK Mobile Operator Consumer Satisfaction Survey 2024, is now available as a free download.

Price & Coverage Drive Tesco to Top Spot

While Tesco Mobile ranked first for overall customer satisfaction, the survey found Tesco Mobile subscribers are most satisfied with the cost of their subscription and the geographical coverage provided. This contrasts with overall responses, as these two factors were the most reported causes of customer dissatisfaction from all subscribers.

The UK Roaming Market UK Mobile Operators Customer Satisfaction

work there. This will reduce the use of long–term roaming, as individuals cannot travel for longer periods without visas.

The UK travel market saw a significant drop of the number of people travelling from the UK following the introduction of travel restrictions. Moreover, following the staggered lifting of regulations in 2021 and 2022, the UK travel market did not fully recover

until this year.

In addition, Brexit has changed how operators charge UK customers for international roaming. Many operators no longer offer the RLAH (Roam Like at Home) provision, where customers can use their SMS, voice and data allowances abroad. Operators have had to review their bilateral agreements for roaming, with prices becoming less favorable for UK outbound roamers. This allows consumers to evaluate the roaming options available, getting the best value for money. This scenario allows for travel SIMs and eSIMs to become a more viable option for travellers in this region, as they would provide a cost-effective alternative to roaming costs. However, not every UK operator offers these services. Some services such as roaming packages, 4G, 5G and eSIMs are key to ensuring a positive roaming experience.

Economic Pressures Diminishing Value for Money

Consumer inflation in the UK has increased pressure on subscribers to minimise outgoings, including their mobile contracts. Mobile subscribers are much more open to low-cost subscription offers and deals on handsets.

To capitalize on these findings, the report recommends operators expand their contract offers to cater to lower-spending subscribers.

Report author Elisha Sudlow-Poole commented: “The survey results show economic downturns of the last few years in the UK have impacted how subscribers approach their connectivity needs. It is evident operators in the UK must reassess their offerings to address this desire for low-cost service in the face of changing consumer demands.”