Travel eSIM Becomes Default Choice: Industry Eyes $25B Opportunity

For more than two decades, international roaming has been one of the most controversial aspects of mobile connectivity. For travelers, it has often meant confusing tariffs, unpredictable bills, and a lingering sense of being overcharged for something as basic as data access. For mobile network operators (MNOs), roaming has historically been a lucrative revenue stream — but also a reputational minefield that sparked regulatory intervention, most notably the European Union’s “Roam Like at Home” (RLAH) framework. Against this backdrop, the rise of the embedded SIM (eSIM) has been nothing short of transformative. Initially launched as a technical upgrade to replace the physical SIM card, eSIM has unlocked something far more profound: a new way for travelers to control their connectivity. travel esim 2025

No longer dependent on physical cards or opaque roaming packages, a traveler can now download a data plan directly to their device, often within minutes, at a fraction of the cost of traditional roaming.

By 2025, this capability has shifted from an early-adopter convenience to a mainstream expectation. The convergence of several factors explains why:

- Device penetration: Apple, Samsung, Google, and other major OEMs have standardized eSIM support across flagship and mid-tier smartphones, making the technology accessible to the mass market.

- Digital-first travel behavior: With flights, hotels, and insurance already purchased through mobile platforms, travelers naturally expect connectivity to be part of their pre-trip checklist.

- Price transparency: After years of bill shock, consumers are gravitating to solutions that guarantee control over spending.

- Competitive ecosystems: Hundreds of new entrants, from global eSIM marketplaces to niche providers, have created an unprecedented level of choice.

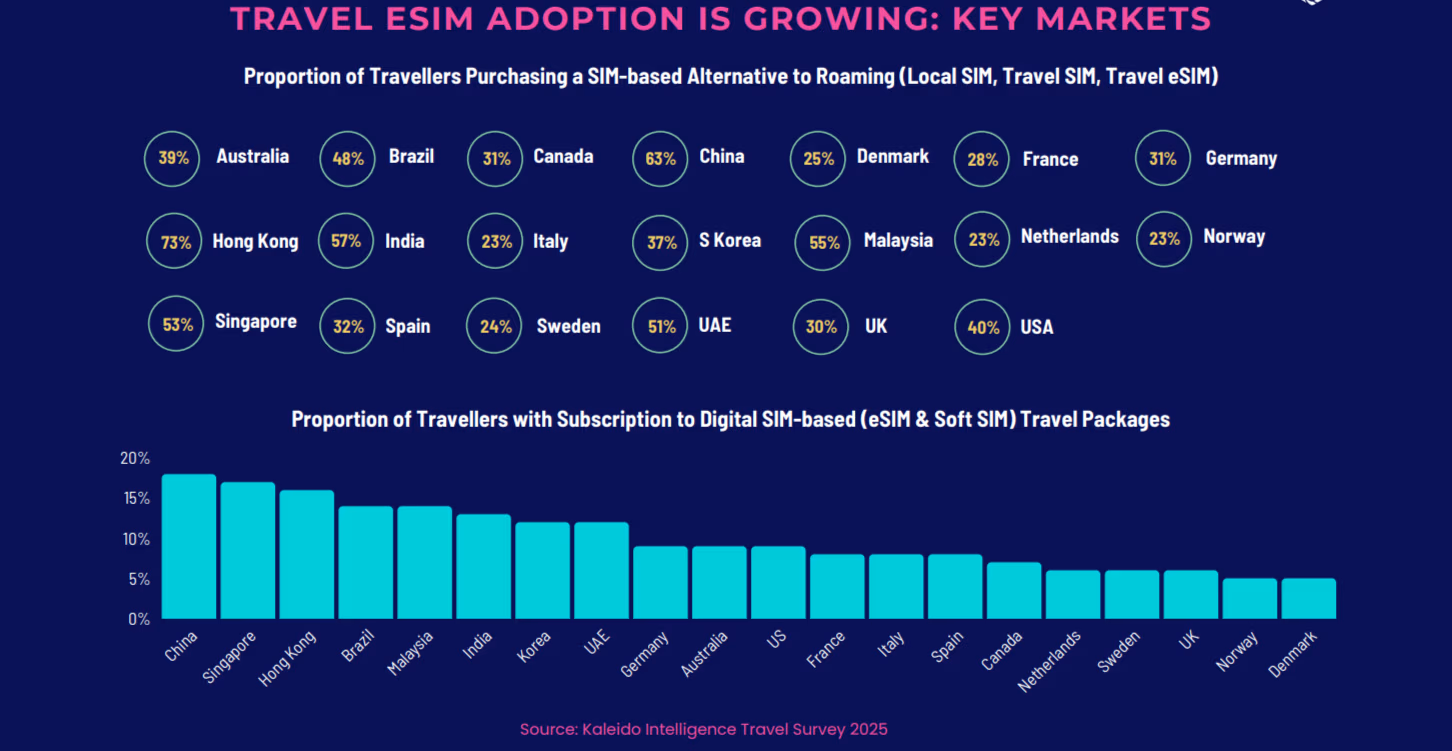

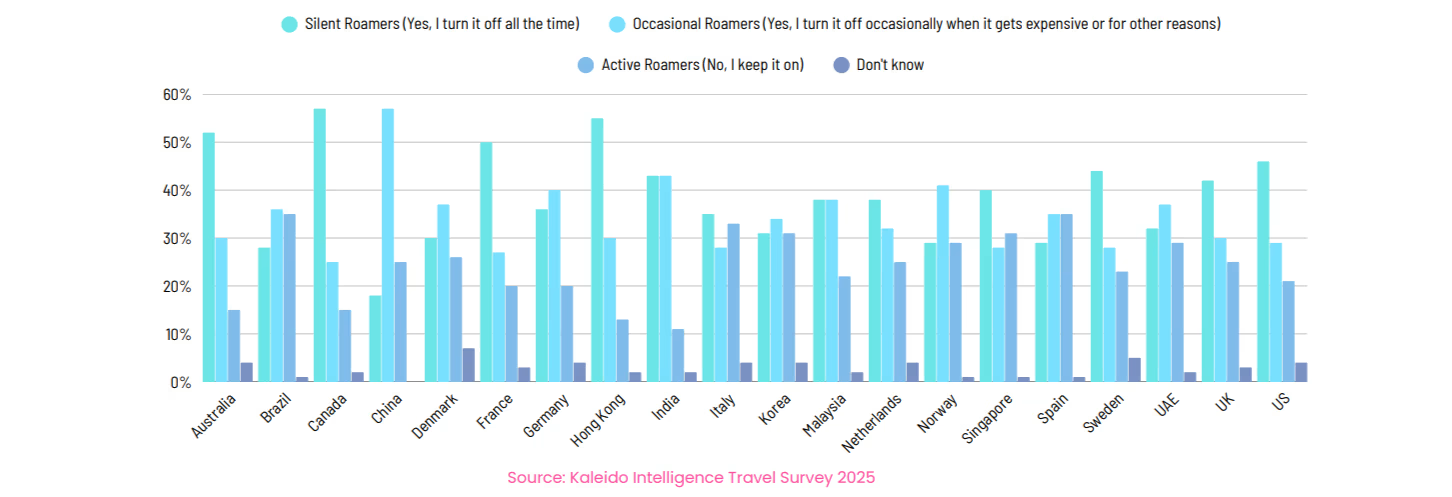

This shift is not incremental — it represents a structural reordering of the travel connectivity landscape. Kaleido Intelligence’s 2025 survey captures the scale of change: adoption of travel eSIMs is growing at ~25% annually, the average spend per package is falling as price competition intensifies, and most purchases are now made before departure, often bundled into wider travel planning flows. At the same time, the rise of the silent roamer — nearly four in ten international travelers who now refuse to use traditional roaming at all — signals a decisive break with legacy models.

For MNOs, this is a moment of reckoning. The $25 billion inbound roaming market projected by 2028 will not be captured evenly; operators who fail to adapt risk losing out to agile eSIM-first providers and digital travel platforms embedding connectivity into their customer journeys. For travel eSIM brands, the challenge is no less complex: adoption is rising, but average revenue per user (ARPU) is under pressure as per-GB prices collapse. Winning will require scale, differentiation, and smart distribution partnerships, not just low pricing.

In short, 2025 is not just another year in the evolution of mobile roaming — it is a crossroads. The industry is now deciding whether eSIM will remain a fragmented, low-margin add-on or become a core pillar of the travel experience, embedded into the very fabric of global mobility.

Travel eSIMs have crossed from early-adopter novelty into mainstream relevance in 2025, propelled by expanding device support, sharper pricing, and frustration with bill shock and opaque roaming offers. Kaleido Intelligence’s latest research points to a market growing ~25% annually, with most purchases happening before departure and a broad shift in traveler behavior toward low-friction, app-first connectivity.

Key takeaways at a glance:

- Silent roamers—travelers who avoid data roaming altogether—now account for ~39% of international travelers, underscoring a structural turn away from traditional roaming.

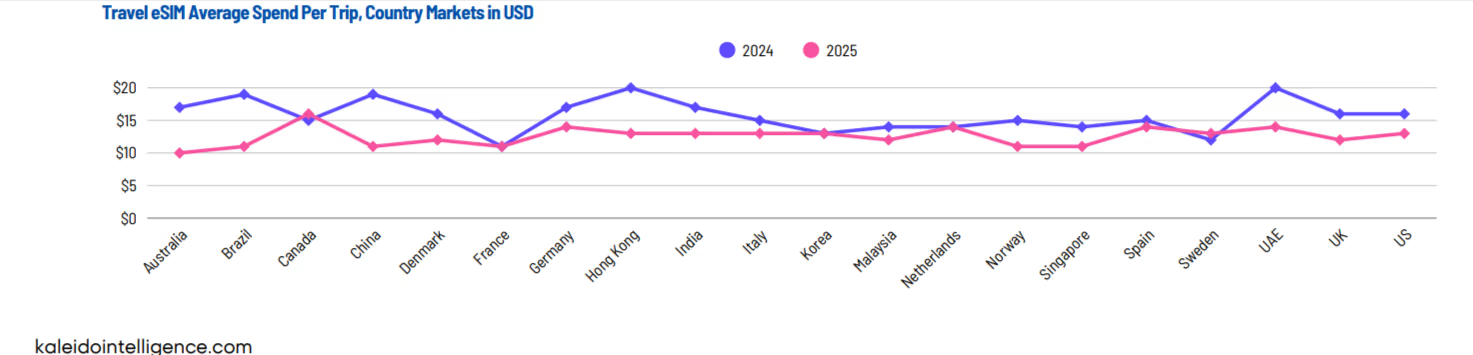

- Average travel eSIM spend per trip is ~$12 (down from ~$16 in 2024), while traditional roaming still averages ~$46 per trip outside RLAH regions—a 4x gap.

- Adoption is forecast to grow ~25% per year, with 85–90% of spend occurring pre-departure (over 90% in parts of Asia).

- Inbound roaming revenues across MNO and travel eSIM channels could reach $25B by 2028, as operators revisit retail and wholesale strategies.

- The market is fragmenting on price but converging on experiences: embedded, context-aware connectivity via airlines, events, ticketing, and super apps is the new battleground.

1. The behavior shift: Silent roamers are the new normal

Kaleido’s Q2-2025 survey (5,000 travelers across 20 outbound markets) finds that while 58% still identify as active or occasional roamers, 39% now class themselves as silent roamers—people who turn data off abroad or rely on Wi-Fi, local SIMs, or travel eSIMs. The drivers are familiar: high costs, lack of transparency, and poor control.

What silent roamers actually do:

- 33% avoid roaming to prevent extra charges

- 29% rely on Wi-Fi

- 23% choose local SIMs

- 22% switch to OTT apps (e.g., WhatsApp) instead of mobile calls/SMS

These are price- and control-seeking behaviors, and they’re sticky. Kaleido notes that features once considered “appealing” to this cohort now matter less—the disengagement is structural, not just feature-driven. Only 13% say they’d accept even a $1/day roaming charge; 24% won’t pay extra at all.

Why it matters: Silent roamers are primed for travel eSIMs: instant activation, clear pricing, and device-native management. As these options mature, they don’t just substitute for roaming—they replace it for a growing share of trips.

2. Adoption and spend: Growth is strong, but price pressure bites

2. Adoption and spend: Growth is strong, but price pressure bites

Adoption growth: Kaleido forecasts ~25% average annual growth in travel eSIM package adoption through the medium term. Availability (more eSIM-capable devices), awareness, and the ubiquity of pre-trip digital planning are key accelerants.

Where purchases happen: Between 85% and 90% of travel eSIM spend occurs before departure, especially in Asia, where >90% of users prefer buying in advance. This aligns with modern “trip kit” behavior—bookings, insurance, and now connectivity handled pre-trip via mobile.

Spend dynamics: Average travel eSIM spend per trip fell to ~$12 in 2025 (from ~$16 in 2024) as new entrants undercut per-GB prices by 50–60% compared with established brands. Leading providers, however, still report $17–$25 per trip, where positioning and product quality support it. Meanwhile, traditional roaming averages ~$46 per trip (outside RLAH), highlighting both eSIM’s consumer value and the monetization challenge for vendors.

Implication: Price competition has broadened access but compressed margins. Differentiation—coverage quality, speed, onboarding, and value-adds—becomes critical to sustain ARPU and LTV.

3. Why travelers choose travel eSIMs: the four big drivers

Surveyed travelers rank the following as the most important reasons to use a travel eSIM or SIM instead of roaming, each cited by ~40% globally:

- Lower cost than roaming

- Better connectivity/coverage

- Convenience & ease of use

- Protection from bill shock

Together, these speak to transparency, control, and reliability—and they map neatly to eSIM’s core proposition.

Where they buy: Purchase intent spans airports, hotels, payment card providers, airlines, and online travel agents/booking sites—clear evidence that distribution will be omnichannel, with strong “point-of-journey” touchpoints and pre-trip digital flows.

4. Regional notes and market penetration

Kaleido’s country analysis shows broad-based adoption growth across major outbound markets, with Asia (e.g., China, Singapore, Hong Kong) particularly advanced thanks to device penetration and digital retail habits. Europe and North America show healthy uptake against a backdrop of established operator offers and RLAH dynamics, while KYC-heavy or operator-centric markets still leave room for MNO-led eSIM/roaming strategies.

5. The new competitive order: from price wars to embedded experiences

The 2025 market is crowded—hundreds of providers vying for attention—and sustained price wars are likely to trigger consolidation (acquisitions and exits) while MNOs sharpen their retail and revisit dynamic wholesale models.

Where growth is concentrated:

- Embedded & contextual eSIM: Bundles inside airline apps, event ticketing, super apps, and loyalty ecosystems that activate on arrival or by geofence. High-demand moments (global sports, festivals) are proving grounds.

- Operator strategies: Rethinking roaming to balance retail price perception with wholesale realities; in some markets, local brands and regulation (KYC) keep operators central.

- Retention via the “save habit”: Users tend to keep an eSIM profile after a trip, creating ready-to-reactivate demand with timely top-ups and re-engagement nudges.

- Wholesale watchpoint: Traditional roaming wholesale has trended down; inbound wholesale prices for travel eSIMs may stabilize or rise per some players—pressuring margins unless offset by scale and value-add.

6. What each stakeholder should do next

For travel eSIM brands & enablers

- Differentiate beyond price: Lead with coverage quality, speed consistency, and transparent fair-use policies. Publish network partners and expected performance by city/airport corridor.

- Own pre-departure: Optimize funnels for T-7 to T-1 purchase windows; bundle with trip content (checklists, e-tickets, insurance) to cement habit formation.

- Embed smartly: Co-create offers with airlines, OTAs, events, and super apps—context-aware activation beats generic discounting.

- Monetize the “saved” profile: Lifecycle messaging (reactivation reminders, geo-aware prompts, loyalty credits) to lift return rates.

- Educate, don’t just promote: Only ~22% of users report adopting eSIMs due to promotions; education and onboarding still move the needle.

For mobile network operators (MNOs)

- Clarity wins: Introduce simple, low-friction roaming with hard spend caps or auto-top-ups that mirror eSIM transparency. Silent roamers won’t return without it.

- Dynamic wholesale: Rethink partner economics to remain competitive as travel eSIMs scale and as some inbound prices harden.

- eSIM-native offers: Lean into device-native provisioning and try micro-passes for messaging/social/GPS as hook products.

For airlines, airports, hotels, and payments

- Bundle connectivity within the traveler’s existing purchase flow (ticket confirmation, lounge access, mobile key). The intent to buy from these venues is already present.

- Event partnerships: Curate temporary “venue eSIMs” with local QoS guarantees during peak events—visibility is high and usage concentrated.

7. Pricing, margins, and the path to premium

Low per-GB pricing expanded the market but squeezed margins. Providers reporting $17–$25 per trip tend to pair competitive prices with service guarantees, clear UX, and value-add (e.g., data sharing across devices, in-app support, quick number/VoIP add-ons). The lesson: win trust, then upsell.

8. Risks & counter-currents to watch

- Wholesale volatility on inbound rates for travel eSIM traffic.

- Regulatory friction (KYC, numbering) that favors operator-led retail in some markets.

- Device compatibility gaps for legacy or budget models are delaying adoption at the margins.

- Price-only competition is eroding support quality and brand trust without sustainable scale.

Methodology notes

Findings draw on Kaleido’s Q2-2025 Travel Survey (5,000 respondents, 20 outbound markets; both leisure and business travelers) and a Q2-2025 MNO survey of ~75 operators across Europe, APAC, the Americas, and Africa–Middle East. Results emphasize behavior splits (active/occasional vs. silent roamers), purchase channels, spend patterns, and operator strategy outlooks.

Conclusion: From connectivity add-on to journey staple

In 2025, travel eSIMs are no longer an optional hack for savvy travelers—they’re becoming the default for anyone who values cost control, instant activation, and reliable coverage. Growth will stay strong, but the winners won’t be the cheapest alone. They’ll be the brands and operators that embed connectivity where it’s most useful, prove network quality, and educate travelers better than the rest. As consolidation unfolds and wholesale dynamics evolve, expect a smaller field of stronger, better-integrated players—and a traveler base that never again leaves home without an eSIM plan queued up.

Not sure which eSIM is best for you? Check out the Best eSIM Finder.

2. Adoption and spend: Growth is strong, but price pressure bites

2. Adoption and spend: Growth is strong, but price pressure bites