Top Cybersecurity Companies in World

The worldwide cybersecurity market grew 15.9% year on year in Q3 2022, to US$17.8 billion, despite deteriorating economic conditions, though vendors saw a tightening in the SMB sector. Top Cybersecurity Companies in World 2022

Palo Alto Networks was the number one vendor in the quarter, growing 24.9% year on year and increasing its market share to 8.4%, up from 7.8% in Q3 2021. Cisco was the second-largest cybersecurity vendor, with a growth rate of 16.7% and a flat market share of 6.9%. Fortinet placed third, achieving growth of 29.9% to reach a 6.7% market share, up from 6.0% a year ago.

Endpoint security was the fastest-growing category, up 18.7% year on year at US$2.7 billion. Network security was the largest category, representing US$5.1 billion and growing by 14.8%.

The technology sector faces deteriorating economic conditions, increasing uncertainty, and greater scrutiny of IT spending, factors that most vendors considered in their forecasts. Falls in new business, reductions in spending commitments, and delays to subscription start dates were worse than expected, which will filter into future results.

“Many cybersecurity vendors have shifted toward subscription-led business models, which also helped to shield them from the immediate impact of the economic slowdown,” said Matthew Ball, Chief Analyst at Canalys. “The move to subscription-based platforms and increased focus on upselling existing accounts will sustain revenue growth for cybersecurity vendors over the next 12 months.”

|

Worldwide cybersecurity market share Q3 2022 Vendor |

Q3 2022 |

Q3 2021 |

Annual |

|

|

Palo Alto Networks |

8.4% |

7.8% |

24.9% |

|

|

Cisco |

6.9% |

6.9% |

16.7% |

|

|

Fortinet |

6.7% |

6.0% |

29.9% |

|

|

Check Point |

3.8% |

4.0% |

8.4% |

|

|

CrowdStrike |

3.2% |

2.4% |

52.9% |

|

|

Okta |

3.1% |

2.6% |

38.4% |

|

|

Trellix |

3.1% |

3.6% |

0.8% |

|

|

2.9% |

3.2% |

3.4% |

||

|

2.9% |

2.4% |

38.6% |

||

|

Trend Micro |

2.4% |

2.6% |

8.7% |

|

|

IBM |

2.3% |

2.7% |

-1.3% |

|

|

Zscaler |

2.1% |

1.6% |

52.1% |

|

|

Others |

52.1% |

54.1% |

11.6% |

|

|

|

|

|

|

|

|

Total |

100.0% |

100.0% |

+15.9% |

|

Note: Percentages may not add up to 100% due to rounding

|

|

|||

Palo Alto Networks

Topping this list is Palo Alto Networks (PANW), and for one very good reason: no vendor offers better security. The company’s results in rigorous independent tests have been stellar, whether in next-gen firewalls (NGFW), endpoint detection and response (EDR) or any other area. Its endpoint security tests have been consistently excellent, including the new MITRE protection tests. And cybersecurity buyers have taken notice. Revenue at the 16-year-old Santa Clara firm is expected to grow 23% this year to top $4 billion.

Headquarters: Santa Clara, California

Founded: 2005

Annual Revenue: $4.2 billion

Fortinet

With $2.6 billion in revenue and growing at a healthy 17%, Fortinet is expected to hit $3 billion in sales this year. The network security vendor is another that doesn’t shy away from rigorous testing. Fortinet has been steadily building a reputation as one of the top security companies around. Customer satisfaction ratings are high, and analysts have lauded the company too.

Headquarters: Sunnyvale, California

Founded: 2000

Annual Revenue: $2.6 billion

Cisco Top Cybersecurity Companies in World 2022

Cisco has used its market dominance to move into adjacent markets, among them network security. With $3.2 billion in revenue and double-digit growth, security is one of Cisco’s strongest markets. Customers are often Cisco shops gravitating toward its firewall, endpoint and other products, but when you have nearly $50 billion in annual sales, your existing customers are a pretty big market, and Cisco has had its wins elsewhere too.

Headquarters: San Jose, California

Founded: 1984

Annual Revenue: $49.7 billion

Check Point Top Cybersecurity Companies in World 2022

Check Point’s 4% revenue growth may not turn heads, but it offers as complete a security portfolio in the industry, and with strong security and value too. Firewalls, gateways, UTM, EDR, threat intelligence, incident response, encryption and data loss prevention are just some of the areas the company ranks highly in.

Headquarters: Tel Aviv, Israel, and San Carlos, California

Founded: 1993

Annual Revenue: $2.14 billion

CrowdStrike

While CrowdStrike (CRWD) made four of our lists – EDR, XDR, MDR and cybersecurity – coming out on top of the very competitive EDR market is no small accomplishment, and the company’s XDR platform leaves it well positioned for the future too. Apparently IT security buyers agree: Analysts expect stunning 56% revenue growth this fiscal year to rocket past the $1 billion sales mark.

Headquarters: Sunnyvale, California

Founded: 2011

Annual Revenue: $1.4 billion

Okta

Okta has a unique value proposition as a quick and easy way for organizations to get started implementing zero trust. With easy-to-use, deploy and manage products, it’s no wonder revenues are expected to soar 46% to $1.2 billion this year. In addition to zero trust, the 12-year-old San Francisco-based company also made our top IAM, network security and single sign-on lists.

Headquarters: San Francisco

Founded: 2009

Annual Revenue: $1.2 billion

Channel sales

Channel sales accounted for 90.6% of the overall market, with the other 9.4% of sales done directly with customers. Channel sales grew by 15.9% year on year, outpacing direct sales.

Channel partners remained optimistic about the opportunities in cybersecurity. 27% expected their cybersecurity revenue to grow by more than 20% in 2023, according to a Canalys poll of 393 respondents taken between 21 November 2022 and 9 December 2022. Another 27% anticipated growth of 11% to 20% next year. Only 10% of partners expected cybersecurity sales to decline.

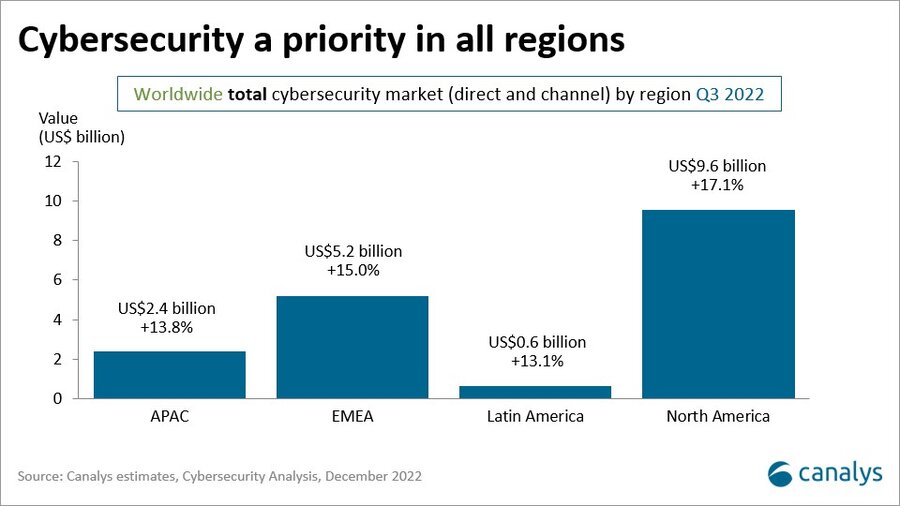

US$9.6 billion of sales came from North America, which remained by far the largest cybersecurity market, representing 53.8% of global spending. It was also the fastest-growing market at 17.1%. EMEA sales reached US$5.2 billion, APAC US$2.4 billion and Latin America US$0.6 billion.