The Green Travel Revolution: Consumer Spending Priorities 2023

The second edition of the “Consumer travel spend priorities” research, by Outpayce, a wholly owned Amadeus company, reveals that consumer demand for travel is expected to remain robust over the coming twelve months, despite continuing economic uncertainty. travel spend 2023

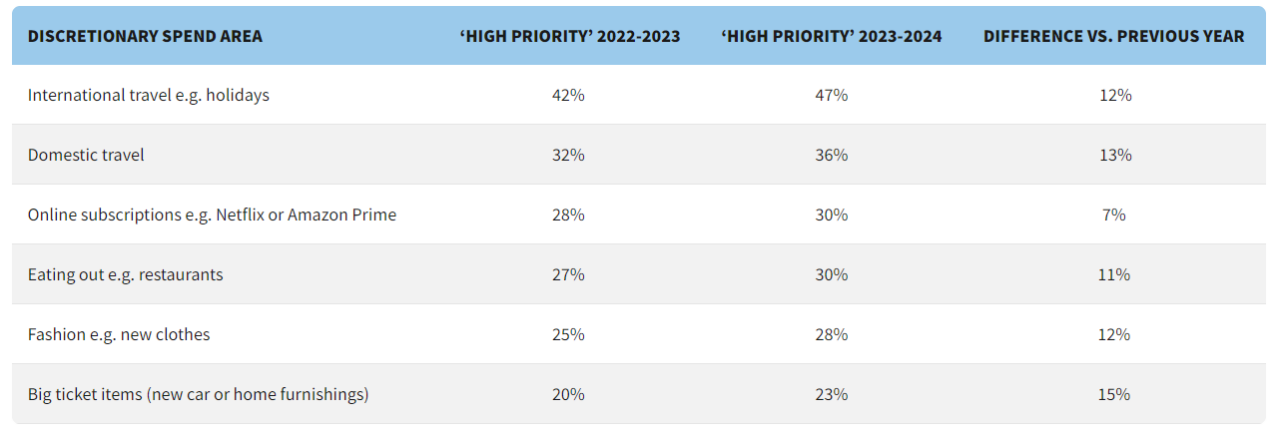

“International travel” was once again ranked by consumers as the highest discretionary spend priority from a basket of six categories.

All spending categories edged up compared to last year’s study pointing to a tentative jump in overall consumer confidence. However, the number of people ranking travel as a ‘high priority’ for the coming twelve months increased by the largest margin, rising to 47%, up 12% year-over-year. Travelers expect to spend significantly more on international travel during the coming year with an average expected spend of $3,422, an increase of $753 per consumer, or 28%, compared to last year.

Why people are prioritizing travel spend travel spend 2023

Consumers were divided on their reasons for prioritizing travel. Motivations included COVID-19-sourced reasoning, like the hardship of the last few years (33%), pandemic savings (31%) and an easing of travel restrictions (24%). Other reasons include the ability to see friends and family (27%) and pay rises (27%). Consumers were similarly divided last year, and this suggests that the desire for travel is multifaceted.

Increased desire for travel isn’t a temporary blip travel spend 2023

As you may have noted, COVID-19-sourced reasoning still remains the most popular justification for the increased priority placed on international travel. This seems to suggest that travel is still experiencing a tailwind as travelers compensate for COVID-19 savings and an inability to travel by boosting spending on experiences. However, in comparison to last year’s study, pandemic-related justifications have fallen in significance. Consumers were 13% less likely to justify travel by appealing to challenging times, 9% less likely to reference savings and 25% less likely to travel due to easing restrictions.

When we combine this with the fact that more consumers are prioritizing travel, this implies that the increased desire for travel isn’t a temporary blip. Instead, we could infer a strong longer-term trend to pursue new experiences through travel.

It should also be noted that travelers viewed all areas of spending as more of a priority in 2023 than they did in 2022. This suggests an overall jump in consumer confidence. However, this does not account for all of this increased prioritization of travel. Travel was cited as a high priority by more people than any other discretionary area and by 12% more people than last year. This signals that travel is a special priority for consumers.

Consumer Confidence in Germany

leads European peers

Consumer confidence in Germany surpasses its European peers, with German travelers expecting the highest average spend of $3,121.60 over the next year. Travel is a top priority for 52%, exceeding the European average by 11%.

Notably, there’s a notable shift in payment preferences among Germans, with 32% expressing a likelihood to utilize installment plans directly with travel providers—a 39% increase from the previous year. This growing preference for flexible payment options presents an opportunity for travel providers to offer more installment plans tailored to German travelers’ needs.

French travelers look to dip into savings to fund international trips

French travelers plan to boost their international travel spend by $314.90 (15.7%) compared to last year. Notably, 49% of respondents intend to finance their trips by tapping into their savings, surpassing the global average of 40%.

French travelers also show a high sensitivity to foreign exchange, with 69% closely monitoring it in the next 12 months. This may explain why they are the only ones planning to reduce travel spending over the coming year. The narrow gap between domestic (32%) and international (38%) travel priorities might be a result of economic uncertainty potentially driving a boost to domestic French tourism.

Buoyant US Consumer Confidence Drives Robust Travel Demand and Spending

US travelers’ strong confidence fuels resilient travel demand, with 70% intending to maintain or increase international travel spending. They are willing to spend the most on average, with an average self-reported spend of $5,213.10 for the next year, a remarkable 59% increase from the previous year. US travelers are also open to alternative financing options and prefer paying in USD. Their confidence in personal finances (average rating of 7.1) and positive outlook (average of 6.9) support discretionary spending. Transparent foreign exchange practices are essential to the US market, with 68% preferring providers with clear FX fees. Travel companies can capitalize on this by displaying prices in US Dollars.

UK Travel Spend Driven by Older Generations Amid Economic Uncertainty

Despite a gloomy economic outlook in the UK, older generations (55+) are driving higher travel spend, with an average expected expenditure of $3,611.50 compared to the UK average of $2,844.80. Younger travelers (18-34) plan to spend only $1,867 on average, 48% less than the older group. Despite their concern about rising costs, 62% of UK respondents plan to increase or maintain their international travel spend next year. UK travelers prioritize travel quality and are the least likely to compromise on flight or hotel choices. Their focus on personal finances drives a desire for transparent pricing, with 40% preferring travel providers with clear FX fees and currency options. 19% are inclined to use Buy Now Pay Later services amid economic uncertainty.

Singaporeans Increase Travel Spend, Age Influences Spending

Singaporeans plan to boost their travel expenditure over the next year, with an average of $3,712.40—second only to the US. A significant 42% intend to increase their travel spending in the next 12 months, reflecting 45% who prioritize international travel during this period.

Age-wise, Singaporean travelers aged 55+ estimate an average spend of $5,571.20, 61% higher than the global average for the same demographic.

Concerning foreign exchange, 80% seek to minimize FX charges and prefer pre-paid card providers with multiple currencies. Singaporean travelers also demonstrate openness to innovative FX solutions.

Jean-Christophe Lacour, SVP Global Head of Products Management and Delivery, Outpayce from Amadeus commented: “This year’s research shows that consumer demand for travel remains strong. People are clearly prepared to spend savings that may have been amassed during the pandemic, and to make sacrifices in other areas, to dedicate more funds to international travel. But there’s no room for complacency, travel companies that clearly price their products in the traveler’s native currency, offer flexible ways to pay and focus on delivering a smooth retail experience stand the best chance of converting shoppers into paying customers.”

Moderation in demand for short-term credit

Last year a huge 75% of consumers said they were ‘more likely’ to use Buy Now Pay Later (BNPL) services to fund travel. This number dropped to a still significant 33% of travelers being ‘more likely’ to choose BNPL to fund travel over the coming twelve months, suggesting continued demand for BNPL, albeit at a reduced growth rate. This trend is evident across all forms of short-term credit with significantly fewer consumers saying they are ‘more likely’ to use credit cards or payday loans to fund travel this year.

Instead, 40% of consumers said they plan to pay for travel by dipping into their savings and a third confirmed they will reallocate spend from areas like clothing and home improvement to fund travel plans.

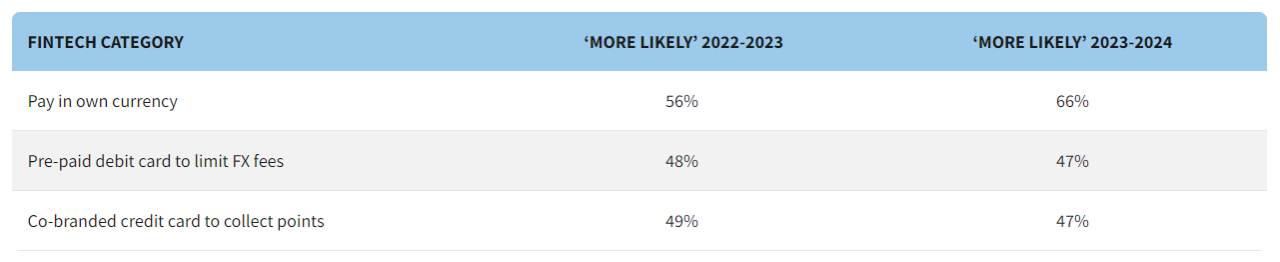

Travelers value fintech that provides transparency and limits fees

Travelers continue to value fintech services that offer transparency and help them avoid foreign exchange (FX) fees when traveling. Notably, 66% of travelers said they would be more likely to select a travel company that allowed them to pay in their own currency so they could better understand the cost of travel, which reflects a notable jump of 18%compared to last year. 68% of respondents said they will pay close attention to FX fees incurred when traveling. travel spend 2023