Portugal’s Telecom Prices Rise, Exceed EU Average

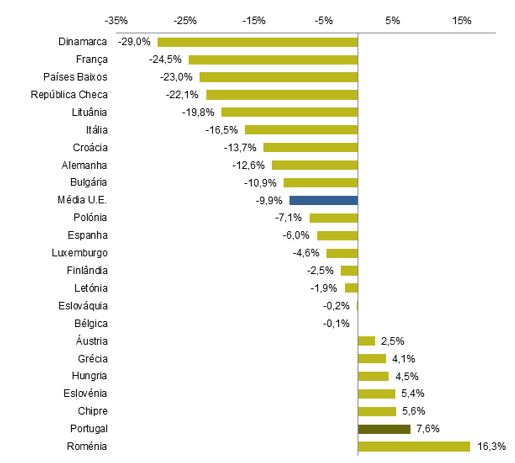

Between 2009 and 2019, telecommunications prices in Portugal increased by 7.6%, while in the European Union, they fell by 9.9%.

The difference narrowed in 2019 due to the entry into force of the European Regulation that reduced the prices of intra-EU phone calls (EU Regulation 2018/1971).

Figure 1 – Evolution of the HICP of telecommunications in the EU between December 2009 and December 2019

Unit: %

Source: ANACOM, based on EUROSTAT data.

Note: Information not available for the United Kingdom, Ireland, Malta, Sweden and Estonia.

According to international comparative studies of telecommunications prices promoted by independent institutions (European Commission, OECD, ITU), the prices of mobile services, individualised Internet services, and service packages for lower levels of use are above the average of the countries that were considered.

For example, according to the more recent price comparison studies promoted by the European Commission in 2018 and 2019:

- The prices of the Internet + fixed telephone + television packages were higher than the EU28 average by 2% to 12.7%. The exception was the 1Gbps offers that show lower prices that the EU28 average (-22.3%), but which only represent 1.6% of total accesses;

- In the case of the Internet + fixed telephone package, the prices applied in Portugal were higher than the EU28 average by 1.3% to 19.3%. The exception was the offers with speeds of 1 Gbps (1.6% of total accesses), with prices in Portugal being 20% lower than the EU28 average;

- For offers of double-play package with Internet and television, the price of the cheapest offers in Portugal was 22.8% to 3.5% higher than the EU28 average in the 12Mbps–200Mbps ranges, and lower than the average in all other cases;

- The prices of fixed broadband single-play offers in Portugal were 9.3% to 28.7% higher than the EU average, with the exception of speeds above 1 Gbps, where prices in Portugal were 16.9% lower than the average but only represent 1.6% of total accesses;

- With respect to mobile voice and Internet packages for mobile telephones, Portugal had prices ranging from 19% to 98% higher than the EU28 average. More than three quarters of European countries have prices lower than those applied in Portugal;

- In the case of fixed broadband single play offers in Portugal for PC/Tablet, the prices applied in Portugal were 25% to 110% higher than the EU28 average, for all user profiles, except for offers of larger traffic volume (50 GB) where the difference is -36%. The prices applied in Portugal are always in the second half of the cheapest prices in the EU28, actually being positioned in the last places (27th and 28th), in the case of lower user profiles.

The main electronic communications providers (MEO, NOS and Vodafone) increased the monthly charges and other pricing elements of residential telecommunications services in Portugal between 2009 and 2016, normally at the beginning of each year. During this period, telecommunications prices grew by 12.4%.

From 2017 onwards, the “price adjustments” started to be implemented only by some providers and only affected contracts concluded in previous years, not implying significant changes of the prices publicized for new customers. In 2020, MEO and NOS announced new “price adjustments” of the value of 1%, a figure higher than the inflation of the previous year (0.3%).

The consumers experienced these increases, especially when seeking to renew their contract, at the end of the loyalty period and were unable to keep the previously contracted conditions at the original price.

Prices rise and revenues fall Telecommunications prices in Portugal

These price increases in residential services can occur simultaneously with a reduction of unit revenue due, for example, to the reduction of premium channels, change of provider, downgrade to a cheaper offer, upgrade to a cheaper convergence offer, etc. Indeed, during the period under review, this type of change of consumption pattern did in fact take place.

The Annex presents various numerical examples demonstrating this. It is fully demonstrated that not only is it possible for prices and total revenues and unit revenues to have a divergent evolution, as it is inappropriate – and could be misleading – to criticise the results of a price index based on the evolution of unit revenues, the value of average bills or €/RGU (revenue generating unit).

The changes of consumption patterns observed in Portugal, over the last few years, contributed to reductions of revenues despite the price increases. This fact is confirmed both by the statistical data collected by ANACOM (e.g. evolution of revenues, the evolution of subscription to premium channels, convergence packages, changes to the operator with significantly cheaper offers) and by the actual providers in their Annual Reports, as illustrated in detail in the disclosed review.

In addition to this, the total revenues and unit revenues of the sector include all the providers and all customer segments (residential and non-residential). Thus, it is possible that, for example, certain providers or segments (for example, business customers) are declining and causing a reduction of total revenues while the prices charged to another customer segment (for example, residential customers) are increasing. The providers’ Annual Reports show that the non-residential segment’s revenues decreased dramatically, mostly as a result of the economic conditions (bankruptcies, cost-cutting, increased competition, etc.). Telecommunications prices in Portugal

A further situation that should be considered in the analysis of price variations involves the fact that, at the end of a loyalty period, the consumers are faced with an increase in the monthly charge if they do not wish to be bound to a new loyalty commitment, or, alternatively, there is a new loyalty period with a monthly charge that is higher than the original monthly charge but lower than the “non-loyalty” price. In these circumstances, an upgrade of the package or inclusion in a package of additional services that may not be used by the consumer is sometimes proposed. In other words, a price increase occurs.

On the other hand, it needs to be taken into account that, in other European Union countries, a similar evolution is taking place in terms of “quality” and “quantity” and that, on average, in these countries, prices have fallen over the last few years.