Telecom Operators Chase $500 Billion B2B Transformation Opportunity — Can They Compete with Hyperscalers?

According to GSMA Intelligence, telecom operators are standing at the edge of a $500 billion opportunity within the enterprise digital transformation market. As businesses worldwide accelerate the adoption of AI, IoT, robotics, extended reality (XR), big data, and cloud computing, operators are being pushed to evolve from mere connectivity providers to digital transformation partners.

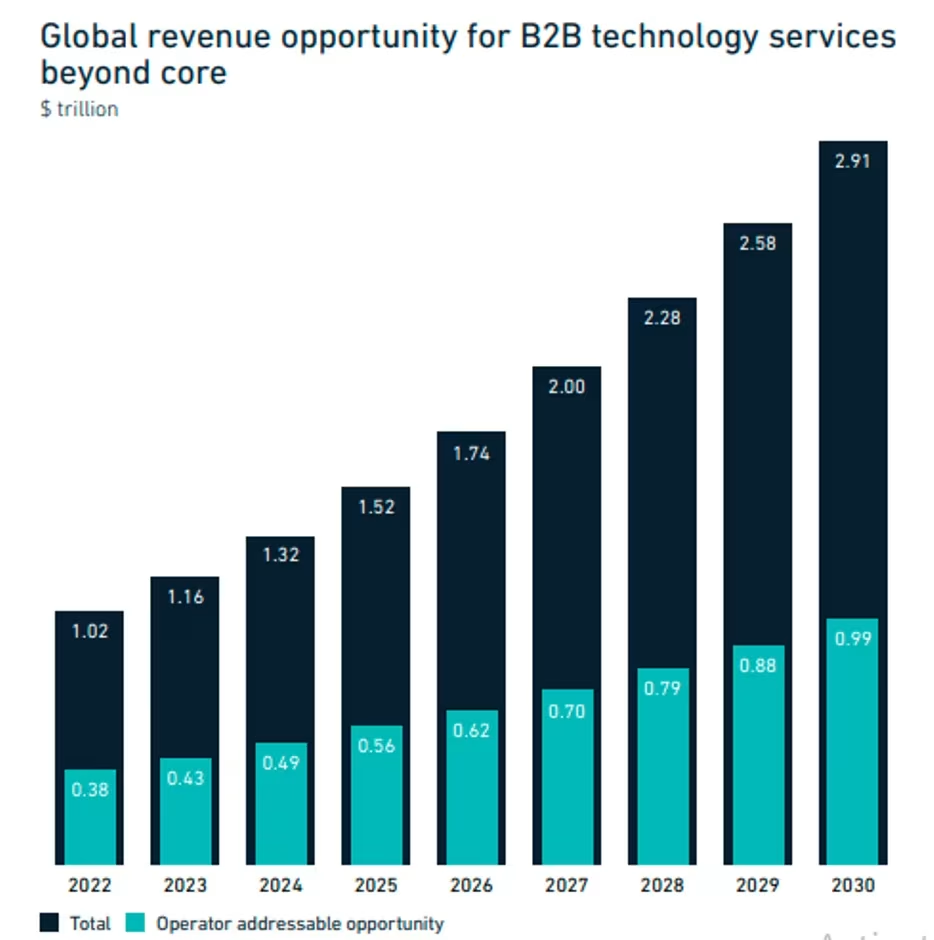

The GSMA Intelligence report, “The Opportunity for Operators in B2B Technology Services,” estimates that the global B2B tech services market will hit $2.91 trillion by 2030, and operators could capture nearly a third of that value — if they move fast and smart.

Where the Big Money Is

Four industries alone make up 40% of this addressable market: manufacturing, automotive, financial services, and aviation.

- Manufacturing and automotive lead the pack, accounting for roughly 19% of the opportunity. Think AI-driven automation, connected factories, robotics, and predictive maintenance — all built on reliable, low-latency connectivity.

- Financial services are betting big on cybersecurity, fraud prevention, and risk analytics. Here, telcos’ experience in secure data handling gives them a competitive edge.

- Aviation is modernizing legacy systems, optimizing fleet operations, and elevating customer experiences through connected technologies — from biometric boarding to predictive maintenance.

For telcos, these sectors highlight where they can move up the value chain — offering not just bandwidth but cloud integration, edge computing, and digital infrastructure as a service.

Cloud, Cybersecurity, and the New Core

The GSMA Intelligence report points to cloud, data centres, and cybersecurity as the three main engines driving telecom growth — collectively accounting for more than half of the B2B opportunity.

Yes, hyperscalers like AWS, Google, and Microsoft still dominate the public cloud, but operators have an ace up their sleeve: hybrid and multi-cloud orchestration. By leveraging local data centres and national networks, telcos can serve enterprises (especially SMEs) that demand sovereignty, compliance, and proximity — areas hyperscalers still struggle to localize.

Cybersecurity is where telcos already shine. They’re trusted for network security, identity and access management, zero-trust frameworks, and managed services — backed by decades of experience in monitoring and mitigating threats at scale.

Generative AI and APIs: The Next Big Wave

Operators are also investing in AI-driven services and network APIs to open new revenue streams. Chinese operators are already blending 5G, AI, and IoT to deliver industrial automation, while Telefónica, Vodafone, and Telkomsel are exploring how API-based models can help monetize 5G networks more intelligently.

GSMA Intelligence highlights that Generative AI has become central to enterprise transformation. Combined with edge computing, it enables ultra-low-latency applications like digital twins and industrial robotics — effectively blurring the line between connectivity and computation.

From Telco to “Tech-Co”

Here’s the real challenge: the old telco business model doesn’t cut it anymore. Pushing standardized products to broad customer bases won’t capture the B2B transformation market.

The new playbook? Act like tech companies, not utility providers. That means:

- Building customized, consultative partnerships instead of one-size-fits-all deals.

- Investing in AI and IT consulting talent — not just network engineers.

- Shifting internal culture to prioritize agility, co-creation, and innovation.

Yet, according to GSMA Intelligence, fewer than 30% of operator employees currently have advanced AI training. This skills gap could determine who wins the next wave of digital transformation — and who fades into the background.

Orange: Building France’s Trusted Cloud

A standout case comes from Orange, which joined forces with Capgemini to launch Bleu, a sovereign cloud venture built on Microsoft technology but operated independently in France.

Bleu supports Europe’s data sovereignty ambitions and meets Cloud de Confiance standards, serving high-sensitivity sectors such as defense, healthcare, and public administration.

It’s a smart move: trust, compliance, and local control have become strategic differentiators in a market where hyperscalers face growing scrutiny over data governance. But Bleu’s long-term success will depend on whether it can match the performance and scalability of AWS or Google Cloud while maintaining French control — a delicate balance of innovation and independence.

SK Telecom: The GPUaaS Pioneer

In South Korea, SK Telecom is taking a different route — turning AI infrastructure into a service. Its GPU-as-a-Service (GPUaaS) offering gives enterprises access to Nvidia H100 GPUs (and soon H200s) for developing AI models on demand.

Part of the operator’s AI Pyramid Strategy, this move positions SKT as a regional AI enabler rather than just a connectivity provider. Similar moves are emerging across Asia and Europe, with Singtel, Maxis, Swisscom, and Orange Business also entering the AI compute race.

However, the competition is fierce. AI-focused cloud startups and hyperscalers are scaling GPU clusters at unprecedented speeds, pushing telcos to differentiate through localized services, regulatory compliance, and enterprise trust.

Telstra: Turning Campuses Into Smart Networks

Australia’s Telstra Purple teamed up with Cisco to transform Victoria University into a connected campus using a software-defined access network (SDAN). The project aims to enhance digital experiences for students, staff, and partners — showing how telcos can merge infrastructure, data, and collaboration into real-world outcomes.

This project encapsulates the direction telcos must take: leveraging connectivity as a foundation for digital ecosystems, not just data pipes.

The Bigger Picture — and the Real Test

GSMA’s forecast of a $500 billion “addressable” opportunity is just that — addressable. It’s not guaranteed. The telecom industry faces tough competition from hyperscalers, SaaS providers, and agile startups that move faster and market smarter.

To compete, telcos need to reinvent themselves from within. That means rethinking pricing models, breaking down silos, and investing in cross-functional expertise.

As Tim Hatt, Head of Research at GSMA Intelligence, put it, “Operators must evolve beyond connectivity to capture value in cloud, data, and cybersecurity.”

And he’s right — but evolution isn’t enough. Success will come from integration: combining network assets, local trust, and enterprise consulting into one seamless value proposition.

Europe’s sovereignty push, Asia’s AI acceleration, and North America’s API monetization wave are all pointing to the same future: telcos that act like tech firms will thrive; those that stay in their comfort zone will vanish.

Conclusion: The Clock Is Ticking for Telcos

Telecom operators have never been closer to the heart of enterprise innovation — yet they’ve never faced tougher competition. As hyperscalers consolidate cloud power and startups redefine agility, telcos must choose: be the infrastructure or be the intelligence behind it.

Players like Orange, SK Telecom, and Telstra are showing what the new model can look like—localized, intelligent, and service-oriented. But widespread success will require a mindset shift across the entire industry, from network reliability to business transformation reliability.

If the GSMA numbers hold true, there’s half a trillion dollars up for grabs by 2030. The question isn’t whether telcos can capture it — it’s whether they can reinvent fast enough to deserve it.