Telecom Consolidation and Europe’s Digital Competitiveness

As Europe navigates the choppy waters of enhancing its digital landscape, the conversation surrounding telecom consolidation takes center stage. While the idea of fewer players in the telecom scene rings appealing to some, it also raises a host of critical questions about affordability, innovation, and overall service quality. Telecom consolidation in Europe is crucial for enhancing digital competitiveness and ensuring the region remains at the forefront of technological innovation. Right?

Let’s dive into this complex issue and explore whether consolidating telecom companies might be the golden ticket to elevating Europe’s digital prowess.

Understanding the Current Landscape of Telecom in Europe

The Current Telecom Market: A Snapshot

Europe’s telecom industry is a crowded arena, boasting 34 mobile network operators (MNOs) and a staggering 351 virtual operators (MVNOs). By comparison, the United States has just three MNOs (plus 70 MVNOs), while China operates with four MNOs (plus 16 MVNOs). This stark difference suggests a potential identity crisis for European telecoms, where nimbleness competes against the inefficiencies of over-fragmentation.

The Push for Consolidation

With these numbers in mind, we have to ask ourselves: could fewer telecom players lead to improved service quality? Proponents of consolidation argue that a concentrated market can enhance network performance and drive significant investments. Yet, it’s important to keep an eye on the detractors warning of the risks to pricing and innovative practices. As Europe seeks to bolster its digital infrastructure and competitiveness, the debate over telecom market consolidation has intensified, according to the Ookla.

The Case for Fewer Players

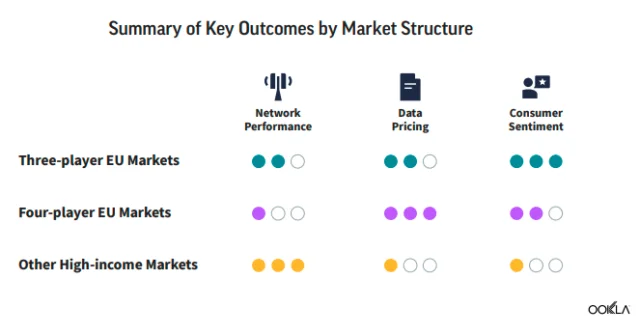

Superior Network Performance in Three-Player Markets

Data from Speedtest Intelligence paints a telling picture for Q2-Q3 2024. Countries with just three mobile operators consistently deliver superior network performance, eclipsing their counterparts in more fragmented markets. Seven out of the top ten EU countries ranked by median download speed operate with three players, boasting speeds that outpace four-player markets by 56%.

Why Does This Matter?

Why Does This Matter?

- Better Speeds: Higher median download speeds mean that consumers enjoy quicker, more reliable internet access.

- Increased Investment: A concentrated market often leads to better investments in infrastructure.

Four-Player Markets: The Flip Side

However, countries with four-player markets like Denmark and Sweden manage to compete effectively through network-sharing agreements. This collaboration—a mix of shared spectrum usage and shared infrastructure—illustrates that coordination can sometimes level the playing field, offsetting some disadvantages of fragmentation.

The Risks and Implications of Europe Telecom Consolidation digital competitiveness

Impact on Smaller Operators and Consumer Choice

While consolidation can enhance efficiency and reduce fragmentation, it also carries the risk of diminishing consumer choice. Smaller operators or niche players are often the driving force behind innovation, catering to underserved or specific market segments. These smaller entities can offer more flexible plans, unique services, and personalized customer experiences that larger operators may overlook. If the market becomes dominated by just a few large players, there’s a real risk of stifling the diversity of offerings available to consumers. This could lead to fewer options, less tailored services, and potentially higher costs. The critical question then becomes: Can Europe maintain a competitive telecom landscape while ensuring that consumers still have access to a broad range of choices that meet their specific needs?

Innovation and Digital Transformation

The concern about innovation in a more consolidated telecom market is significant. As telecom companies merge and streamline operations, they must strike a delicate balance between reducing costs and continuing to innovate. Consolidation might result in more financial resources for large-scale infrastructure investments in areas like 5G, IoT, and other next-generation technologies. However, there is a danger that the drive for cost-cutting could undermine the pace of innovation that consumers have come to expect. If the focus shifts too much toward network efficiency and consolidation, we may see less investment in cutting-edge services and innovative solutions. Therefore, it’s crucial that any market consolidation strategy preserves the competitive, forward-thinking nature of the telecom industry and fosters technological advancement alongside network improvements.

Data Privacy and Market Power

Another critical risk of telecom consolidation is the growing concentration of consumer data in the hands of a few dominant companies. With fewer players controlling a larger share of the market, the amount of personal and usage data accumulated by these firms increases significantly. This creates potential concerns about data privacy, market power, and consumer protection. Policymakers must closely monitor this trend to ensure that consumer rights and privacy are upheld in a more concentrated market. The consolidation of telecom companies could lead to fewer entities holding more power over pricing, service access, and even shaping consumer behaviors. As data becomes a more valuable resource, it is essential that robust regulatory frameworks are in place to protect consumers and prevent anti-competitive practices.

Socio-Economic Factors and Regional Disparities

In addition to market structures, socio-economic factors and regional disparities also play a crucial role in shaping the success of telecom services across Europe. While some areas benefit from a more competitive market, others may struggle due to variations in economic conditions, geographic challenges, and population density. For instance, rural areas often face slower digital transformation due to lower investment levels, even in more fragmented markets. In these contexts, consolidation might not lead to the same benefits seen in urbanized areas. Policymakers must address these regional disparities to ensure that consolidation does not exacerbate existing inequalities in access to high-quality telecom services. Tailored approaches that account for local economic and infrastructure conditions will be key to ensuring the success of consolidation in diverse European markets.

Long-Term Sustainability

Finally, the long-term sustainability of telecom consolidation needs to be carefully evaluated. While a more concentrated market may offer short-term benefits like improved network performance and increased efficiency, the long-term impact could be more complex. The telecom industry is rapidly evolving, and Europe may face new challenges from emerging global players, such as non-European telecom giants or tech companies venturing into the telecom space. A focus on short-term consolidation may leave the industry vulnerable to shifting market conditions, regulatory changes, and the entrance of new competitors. Europe needs a robust and adaptive telecom strategy that accounts for the fast-changing technological landscape and ensures the region remains competitive in the global market. This strategy must balance the need for consolidation with the preservation of innovation, consumer choice, and long-term industry sustainability.

5G Deployment: More Than Just Numbers

The 5G Challenge

When it comes to 5G coverage, merely having fewer competitors doesn’t guarantee success. The key players here are socio-economic conditions—think urbanization and levels of economic development. Wealthier nations attract more investment, resulting in better service coverage, irrespective of the number of telecom operators.

Disparities in Network Quality

Interestingly, in more fragmented four-player markets, we notice:

- Network Quality Gaps: Variability in service quality becomes a real concern, creating disparities that lead to inconsistent user experiences across different operators.

- Access Issues: In rural areas, these disparities can widen, shutting out parts of the population from reliable service.

The Pricing Dilemma: Balancing Costs and Investment

The Price of Competition

One of the standout benefits in the realm of telecom where competition thrives—like in Europe’s four-player markets—is the competitive pricing. This has led to consumer costs per gigabyte being nearly five times lower than in three-player markets.

The Cost of Cheap Services

However, we must ask: at what cost?

- Lower Revenue for Operators: This intense competition can lead to reduced average revenue per user (ARPU).

- Impact on Reinvestment: Less revenue may mean less money available for crucial investments in network upgrades.

Analyzing International Trends

What about operators in other regions? Outside the EU, we’ve seen that operators in concentrated markets may not feel the same financial pressure to upgrade networks.

One Solution Doesn’t Fit All

Learning from Exemplary Markets

Telecom consolidation isn’t a blanket solution for every market. Take Denmark—a four-player market with robust performance—or the Netherlands, where a three-player market thrives. These cases underline the idea that local contexts matter tremendously in determining success.

Strategic Policy Considerations

The Role of Policymakers

For policymakers looking to boost Europe’s digital competitiveness, a one-size-fits-all approach won’t cut it. Instead, the strategy should involve a blend of tactics:

- Encourage Network Sharing: Operators should collaborate more on infrastructure to optimize resources.

- Create Investment Incentives: Frameworks must be established to stimulate investment while maintaining cost-effectiveness for consumers.

- Tailor Regulations: Each market’s unique characteristics should guide regulatory decisions, ensuring a balanced approach.

Conclusion about Europe telecom consolidation & digital competitiveness: Charting a Path Forward

So, is telecom consolidation the ticket to enhancing Europe’s digital competitiveness? The answer is far from simple. While there are clear benefits to having fewer players, the risks to investment, innovation, and affordability are equally significant. As we look to the future, a balanced telecom strategy that promotes healthy competition embraces innovative practices, and protects consumers could be the key to unlocking Europe’s full digital potential.

Why Does This Matter?

Why Does This Matter?