Summer Means More Debt: 8 in 10 Travelers Will Use Credit Cards to Get Away

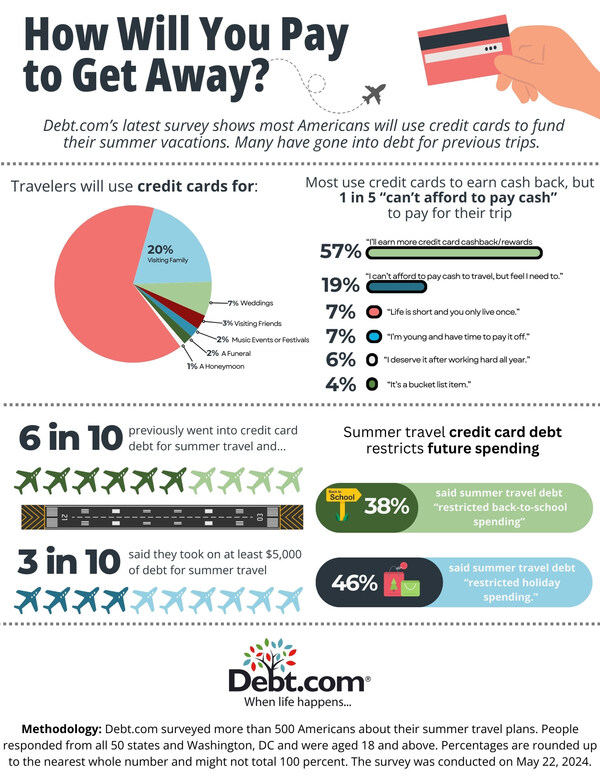

When Americans travel this summer, most will put those travel expenses on their credit cards – and more than a quarter (30%) will charge at least $5,000. Summer Travel Debt

A new Debt.com survey shows 83% will pay for their trip using credit cards. More than half (56%) say they’ll earn cashback and rewards, while 19% can’t afford to pay cash, but still feel the need to get away this summer. For many, this is a recurring practice.

The Generation Gap in Vacation Debt

Interestingly, different generations seem to have varying attitudes towards vacation debt. While Gen Xers are most likely to have incurred such debt in the past, Millennials aren’t far behind. Baby Boomers are generally more cautious, with fewer admitting to past vacation debt. As for Gen Z, they seem to be the most financially savvy of the bunch, with the lowest percentage of those admitting to previous debt.

The Hidden Costs of Summer Fun

So, what’s the big deal about vacation debt? It’s not just about the immediate financial strain. For 46% of respondents, that summer debt later restricted their holiday spending. Imagine having to cut back on Christmas gifts or New Year’s celebrations because you overspent on your summer vacation. That’s the kind of trade-off many people are making.

One result stands out to Debt.com President Don Silvestri: “Nearly 60% have incurred debt for summer travel before,” he says. “That’s a big problem because it means Americans are growing accustomed to vacation debt. This country already has a problem with running up debt over the winter holidays. Are we going to go into debt for every holiday? This concerns me.”

Other key takeaways:

- Of the summer travelers who will use credit cards to pay for a vacation, 7% plan to charge $15,000 or more

- Out of the people who will finance their vacation with credit, 25% of Gen X and 18% of Millennials say it’s because they can’t afford to pay cash

- Of those who have previously gone into credit card debt for summer travel, 66% are Gen X, with 64% of Millennials

- Of the 46% of respondents who say summer travel debt later restricted their holiday spending, more than half (57%) are Gen X, 47% are Millennials, 46% are of Gen Z, and 22% are Baby Boomers.

“By planning carefully and making smart financial decisions, you can enjoy a memorable summer vacation without the burden of debt,” Silvestri advises, “but the key is planning,”

Tips for a Debt-Free Summer Getaway

1. Set a Realistic Budget

Before you start daydreaming about luxury resorts and endless cocktails, figure out how much you can realistically afford to spend. Factor in all your expenses, from airfare and accommodation to meals, activities, and souvenirs. Sticking to a budget will help you avoid those impulse buys that can quickly derail your finances.

2. Maximize Rewards, Minimize Interest

If you do use credit cards, be strategic. Choose cards that offer travel rewards or cashback, but make sure you can pay off the balance in full each month to avoid those pesky interest charges. There’s no point in earning a few hundred points if you’re going to end up paying hundreds in interest.

3. Prioritize Your Pleasures

What are the non-negotiables for your dream vacation? Is it a beachfront hotel, gourmet dining, or thrilling excursions? Once you’ve identified your priorities, allocate a larger portion of your budget to those and cut back on the less important stuff. Remember, it’s about quality, not quantity.

4. Explore Local Gems

You don’t have to travel far to have a memorable vacation. Consider exploring nearby destinations that offer unique experiences without the hefty price tag of international travel. You might be surprised at the hidden gems right in your own backyard.

5. Be Flexible with Your Dates

If your schedule allows, be flexible with your travel dates. Sometimes, shifting your trip by a few days can result in significant savings on flights and accommodations. Use fare comparison tools and set up price alerts to snag the best deals.

6. Resist Impulse Spending

Vacations can be a time of indulgence, but don’t let that lead to financial regret. Set a small allowance for spontaneous spending, but once it’s gone, stick to your budget. Remember, those souvenirs might look cute now, but the debt they bring won’t be so charming later.

The Bottom Line: Vacation Smart, Not Broke

Summer is a time for fun and relaxation, not financial stress. By following these tips, you can enjoy a fantastic vacation without sacrificing your financial well-being. So, go ahead and plan that getaway, but remember to keep your spending in check. After all, the best souvenirs are the memories you make, not the debt you accumulate.