“SIM-Swapping”: The Digital Heist You Didn’t Know Could Happen to You

You know how we always hear that cybercriminals are getting smarter? Well, SIM-swapping is one of those “I can’t believe this works” scams that proves it. And if you think it only happens to high-profile tech bros or crypto influencers, think again.

This one’s personal, sneaky, and yes — surprisingly effective.

So, what the heck is SIM-swapping?

Let’s break it down.

What is SIM-swapping?

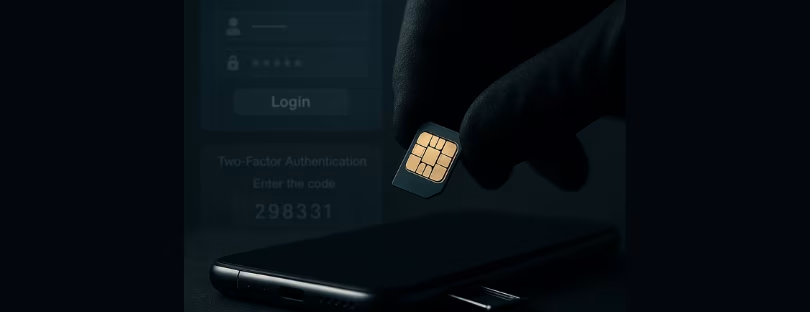

SIM-swapping (also called a SIM hijack or SIM swap scam) is when someone tricks your mobile carrier into giving them control of your phone number.

Yep. Your number. The same one connected to your bank, your email, your WhatsApp, and maybe even your two-factor authentication (2FA) codes. Once a hacker gets your number transferred to their SIM card, they essentially take over your digital life.

Imagine waking up and your phone has no signal. At first, you think it’s a glitch. Maybe your phone needs a restart. Maybe you forgot to pay the bill. But nope — it’s something much worse.

The scammer now receives your calls, your texts, and your 2FA codes. They can reset your email password, get into your PayPal, drain your crypto wallet, and even impersonate you on social media.

“Wait, how does this actually happen?”

You’d think it would be hard for someone to convince a telecom company to hand over your number, right?

Not really.

All a scammer needs is some of your personal info — which isn’t as hard to find as you might think. Maybe your data leaked in a past breach. Maybe they phished you. Maybe they dug around your socials and guessed your dog’s name, your birthdate, and your favorite vacation spot.

Then they call your carrier, pretend to be you, and say something like:

“Hey, I lost my phone. I got a new SIM. Can you activate it?”

And that’s it. If the customer service rep falls for it, your number gets transferred.

Once they’re in, they move fast. Most victims don’t even realize what’s happening until after their accounts are compromised.

Real people. Real damage.

You don’t need to be a millionaire or a crypto trader to get hit.

- Jack Dorsey, Twitter’s former CEO, got SIM-swapped in 2019. Hackers used his number to post offensive tweets from his account.

- Countless regular folks have reported losing access to their Gmail, Instagram, or even losing their savings after a SIM swap.

- Some attackers use it to bypass security and steal your entire identity — applying for loans, opening new accounts, or racking up debt in your name.

It’s brutal.

“But I use two-factor authentication! That protects me… right?”

Well, kind of.

You’ve probably been told (or begged) to use 2FA — and you should. But the type of 2FA matters.

If your 2FA sends a code via SMS (you know, those “Your code is 298331” texts), then SIM-swapping can blow right past it. Why? Because the hacker now receives those texts.

SMS-based 2FA is better than nothing, but not bulletproof. That’s why security experts recommend using authentication apps like Authy or Google Authenticator, or better yet, hardware security keys (like YubiKey) for your most important accounts.

How to know if you’ve been SIM-swapped

Here are the red flags:

- You suddenly lose mobile signal (and it’s not a coverage issue).

- You can’t log into important accounts — and the password reset emails are going to an unknown address.

- Your friends or bank tell you they received strange messages from “you.”

- You get email alerts about password changes you didn’t make.

If any of this happens, don’t wait.

What to do immediately if you suspect a SIM swap

- Call your carrier right away. Use another phone and tell them your number was hijacked.

- Freeze your accounts — especially your bank and crypto exchanges.

- Change all passwords and log out of all devices.

- Enable stronger 2FA on every account — switch from SMS to app-based or hardware 2FA.

- File a police report (yes, really) and notify your bank or financial institutions.

- Check your email inbox and filters. Hackers sometimes forward your emails to themselves so they can monitor your recovery attempts.

How to prevent SIM swapping

You can’t control how perfect a telecom’s customer service is. But you can make life a lot harder for scammers. Here’s how:

1. Use an authentication app

Stop relying on SMS codes for 2FA. Use apps like Authy or Google Authenticator wherever possible.

2. Add a PIN or password to your mobile account

Most carriers let you set a “port-out PIN” or “account lock.” This adds an extra step before anyone (even you) can move your number.

3. Use a separate number for 2FA

Consider using a VoIP number (like Google Voice or MySudo) only for 2FA — one you don’t share publicly.

4. Don’t overshare online

Scammers often collect personal data from your social profiles. Be careful what you post — birthdays, pet names, family members, locations.

5. Set up email account recovery properly

Your email is the gateway to everything. Use the strongest security you can, including recovery codes and trusted devices.

One more thing: be suspicious of weird calls and texts

Sometimes SIM-swapping starts with social engineering. You might get a call pretending to be from your bank, asking you to “verify” a code they just sent. Or a text that says “Click here to stop someone from taking over your account.”

Don’t fall for it. Always double-check using official channels. Never give out a code someone else requested.

TL;DR: SIM-swapping sucks. But you can fight back.

It’s wild that something as simple as your phone number can unlock your entire digital world. But that’s where we are.

So if you’ve never thought about protecting your number — now’s the time. Set that PIN with your carrier. Ditch SMS-based 2FA. Use better passwords (please). And stay sharp.

Because while scammers are getting smarter… so can you.

Got SIM-swapped or nearly did? Share your story in the comments — and let others learn from it. This is one scam that thrives in silence. Let’s make some noise.