Travel eSIMs, 5G SA, and Satellites: Juniper’s Take on Roaming’s Next Big Shift

The global roaming market is standing at a critical inflection point. As travel rebounds, data consumption surges, and IoT deployments multiply, roaming is no longer just about connecting your phone abroad—it’s about enabling seamless, high-performance connectivity across people, devices, and even satellites. Roaming technology trends 2025

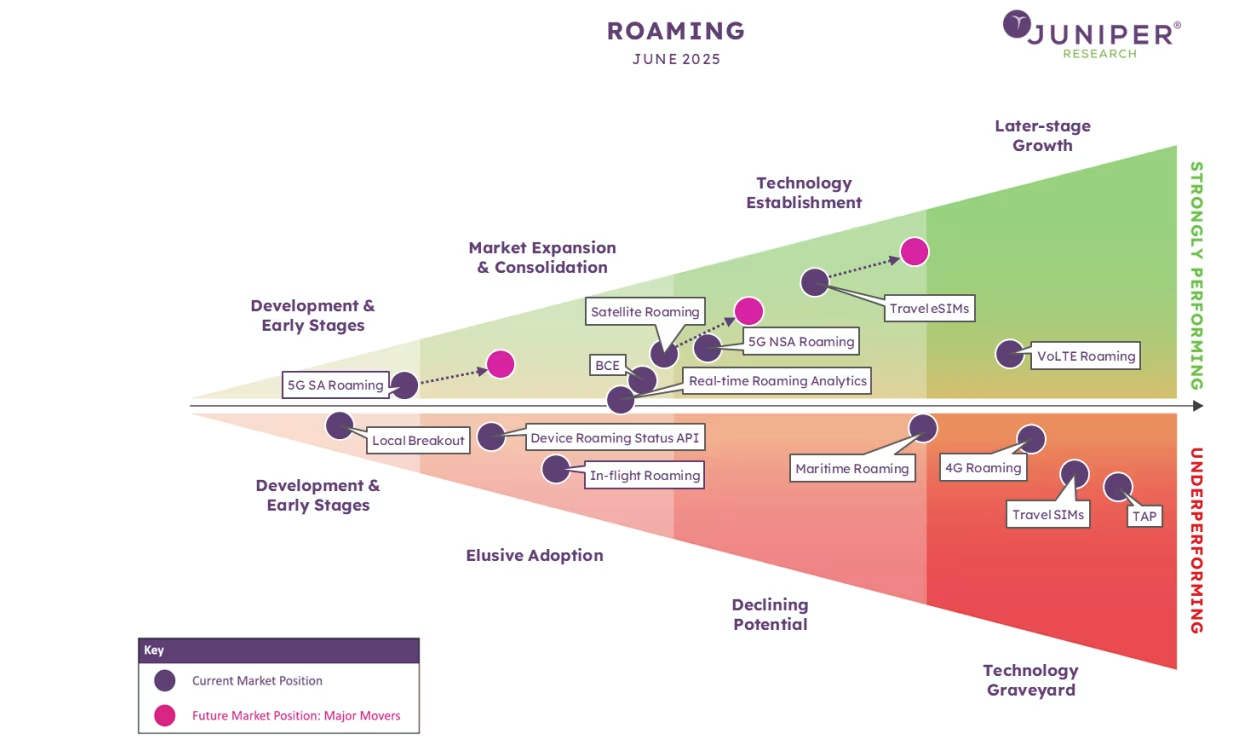

Juniper Research’s Roaming Tech Horizon 2025 offers a detailed scorecard, classifying each roaming technology as either above-the-line (strongly performing) or below-the-line (underperforming) based on adoption, market momentum, and ability to meet expectations.

The result is a clear snapshot of where operators should double down, where caution is warranted, and which innovations could redefine roaming revenues over the next 12 months.

The Top 3 Market Movers

1. Travel eSIMs—From Alternative to Mainstream

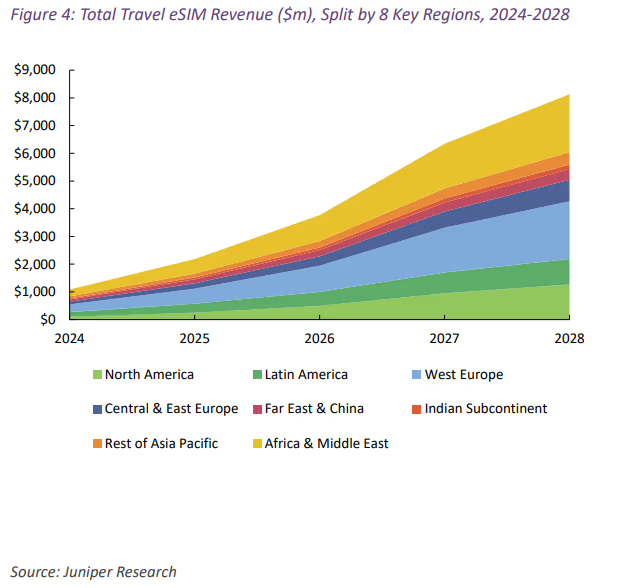

Once a niche product for tech-savvy travelers, travel eSIMs are rapidly becoming a mainstream roaming alternative. According to Juniper, adoption accelerated sharply in 2024, with players like Airalo, Nomad, and Saily making eSIMs accessible to mass consumers, while unexpected entrants — such as Swiss International Airlines and Revolut—have introduced their own solutions.

The driving force? Price and convenience. Travel eSIMs cut out delivery delays, physical card swaps, and the extra phone number issue that plagues physical travel SIMs. In markets like Asia Pacific, where roaming costs are notoriously high, eSIM adoption is surging, while in Europe’s “Roam Like at Home” zone, uptake is strongest among travelers heading beyond EU borders.

Juniper Research anticipates this trend to continue to grow, with an ever-increasing number of enterprises launching their own travel eSIM offerings for consumers. We can expect more airlines to sign partnerships with travel eSIM providers or launch their own travel eSIMs; allowing the technology to grow as a competing service to established roaming.

Industry parallel: This mirrors the global shift toward embedded connectivity. A GSMA Intelligence report from 2024 noted that by 2030, eSIM-capable devices will account for 80% of smartphone shipments, cementing the eSIM as the default standard.

2. 5G Standalone (SA) Roaming – The Long Game Begins

2. 5G Standalone (SA) Roaming – The Long Game Begins

5G SA is the “pure” form of 5G, using a dedicated 5G core and delivering ultra-low latency, high capacity, and advanced network slicing. Its roaming variant, however, is still in early development. The first cross-operator 5G SA roaming connection was only demonstrated in April 2025 by Vodafone Germany and A1 Bulgaria.

Technical and commercial hurdles remain—from negotiating new roaming agreements to ensuring coverage and capacity parity between networks. Still, Juniper expects acceleration in the next year, especially in high-investment markets like China, India, and the US.

Industry parallel: Just as 4G LTE roaming took years to fully mature, 5G SA roaming will likely follow a gradual curve. The difference this time is the pressure from enterprises seeking global 5G services for latency-sensitive applications like industrial IoT and AR/VR, which may push adoption faster.

3. Satellite Roaming—The Rural & IoT Enabler

Satellite roaming is stepping out of the margins and into mainstream operator strategy. Agreements between telcos like Telefónica, Verizon, and Deutsche Telekom with satellite providers are expanding coverage into remote regions and enabling IoT deployments that require uninterrupted service.

For now, the focus is heavily on cellular IoT, such as asset tracking and environmental monitoring in areas without terrestrial coverage. As more operators integrate satellite into their roaming portfolios, Juniper expects satellite roaming to enter full market establishment within the year.

Industry parallel: The growing Starlink and AST SpaceMobile ecosystems show how satellite-to-device connectivity could eventually eliminate “no service” zones entirely. For roaming, this adds resilience and service differentiation.

Above-the-Line Winners: Established or Surging

- Billing and Charging Evolution (BCE): A flexible, near-real-time settlement standard replacing the outdated TAP protocol. BCE is increasingly essential for monetizing complex services like 5G SA and IoT roaming.

- Real-Time Roaming Analytics: With roaming connections set to grow from 2 billion in 2025 to 2.6 billion by 2029, operators will need analytics to detect fraud, maintain quality of service, and manage high-volume IoT connections.

- VoLTE Roaming: A critical bridge during 2G/3G network sunsets, ensuring legacy voice services work over LTE and early 5G deployments. While Voice over 5G (VoNR) is on the horizon, Juniper expects VoLTE to dominate voice roaming for now.

- 5G Non-Standalone (NSA) Roaming: Already established and dominant, NSA will remain the primary form of 5G roaming until SA becomes widely commercial.

Trend watch: The focus on analytics and flexible charging aligns with TM Forum’s 2025 Digital Transformation Tracker, which highlights automation, agility, and revenue diversification as core telecom priorities.

Below-the-Line Laggards: Fading or Stalled

- Travel SIMs: Losing relevance due to eSIMs’ instant activation and convenience.

- In-Flight Roaming: Technically available through airline partnerships (e.g., Vodafone), but expensive, inconsistent, and often overshadowed by bundled in-flight Wi-Fi. Low-cost passengers tend to skip it, while premium travelers expect it included in ticket prices.

- Maritime Roaming: Serving cruise passengers, crew, and maritime IoT, but now facing competition from high-performance satellite internet like Starlink Maritime ($260/month + $1/GB).

- Local Breakout: Promises lower latency by routing traffic through the visited network but lacks the standardization and security protocols for mass adoption.

- Device Roaming Status API: Could power fraud prevention, targeted content, and compliance, but suffers from poor developer awareness.

- TAP Protocol: In use since 1991 but now a barrier to monetising 5G SA and IoT roaming—being phased out in favor of BCE.

Industry parallel: This “natural selection” resembles the decline of SMS-based roaming alerts, replaced by richer, app-driven onboarding experiences.

Strategic Implications for Operators and Stakeholders

- Early mover advantage is real—particularly in travel eSIMs and satellite roaming, where market share can be locked in through partnerships before mass adoption.

- BCE is not optional—as Juniper warns, sticking with TAP risks leaving “value on the table” and failing to monetize new roaming forms.

- Analytics will be the backbone – Scaling without intelligent traffic and fraud management will be unsustainable in a world of billions of connections, including IoT.

- Service bundling matters – From airlines offering eSIMs to fintechs embedding connectivity, roaming is moving into unexpected verticals.

The Bigger Picture

The Roaming Tech Horizon 2025 paints a roaming landscape in flux—one where traditional revenue streams like 4G roaming plateau, while new models like embedded, software-based connectivity accelerate.

This reflects a broader telecom truth: technology adoption doesn’t happen evenly. Some innovations—like travel eSIMs—can leap from niche to mainstream in a few years, while others—like local breakout—linger for a decade without real traction.

For 2025 and beyond, the winning formula will blend infrastructure readiness, strategic partnerships, and a willingness to replace legacy processes before they become revenue bottlenecks.

Conclusion

Juniper’s Roaming Tech Horizon 2025 aligns closely with broader market signals from GSMA Intelligence, Ericsson, and GSMA Open Gateway: the next year in roaming will be defined by monetisation agility (BCE), embedded connectivity (travel eSIMs), and hybrid terrestrial–satellite coverage. Where Juniper is most convincing is in identifying travel eSIMs as an immediate mass-market shift and satellite roaming as a near-term differentiator—both areas already seeing aggressive moves from global operators like Telefónica and Deutsche Telekom.

Compared with similar market trackers, Juniper takes a more grounded view of 5G SA roaming, recognising the commercial lag behind NSA despite high network availability. It also correctly positions BCE as critical to capturing new revenue in 5G and IoT—echoing GSMA’s own urgency on TAP replacement.

The competitive split is becoming clear: early BCE adopters and eSIM–satellite integrators will lead on both reach and profitability, while slow movers risk being undercut by eSIM aggregators and outflanked by coverage-led offers. In 2025, the winning operators will treat these shifts not as threats, but as levers to reset roaming’s value proposition.

In other words, in the new roaming economy, agility is the real currency.

2. 5G Standalone (SA) Roaming – The Long Game Begins

2. 5G Standalone (SA) Roaming – The Long Game Begins