One in two UK consumers would consider a payments chip implant

Just over one in two (51%) UK consumers would consider making payments using a chip implanted in their hand provided it met certain criteria including medical safety and privacy protection, a new survey reveals. payments chip implant

Of these, 8% said they would be comfortable using a payments chip implant “if its privacy measures were water-tight”, 23% if it was “proven to be medically safe” and 20% “simply said they would be comfortable using this payment method”.

“The vast majority (83%) think a microchip implant would make them ‘feel like they are in a sci-fi movie’ and nearly half (48%) feel the chip would be useful if they were caught without cash or card,” the researchers say.

“However, invasiveness and security issues remain major concerns.”

The survey forms part of research published in The European Payments Landscape in 2030 report and also covers other existing or potential payment technologies, including cashierless shopping and AI-powered smart wallets or smart bank accounts.

It found that 30% of survey participants have used cashierless stores such as Amazon Go, 37% have not yet done so “but would like to” and 22% think the technology “is cutting edge”.

Trust in AI payments chip implant

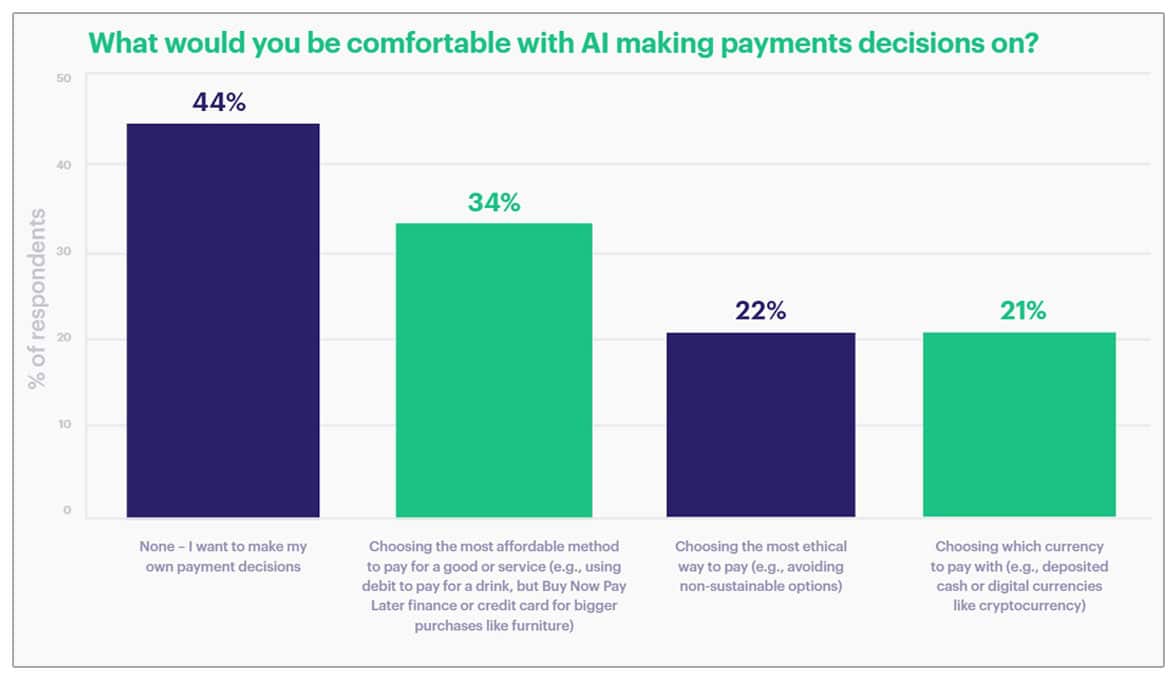

On the subject of AI-powered solutions such as smart wallets that “can decide in an instant what the most sensible payment is for any given purchase” and smart bank accounts that “could automatically move surplus funds to savings, or put the brakes on overspending”, the survey reveals that, while 44% “would not feel comfortable with AI making automated purchasing decisions on their behalf”, a third (34%) would “trust AI to choose the most affordable method to pay for goods or services, 22% to select the most ethical way to pay, and 21% to choose which currency to pay in”.

Based on the results of the survey, the researchers predict that “consumers’ love of convenience could see purchasing power handed over to AI”, that “payments will become increasingly invisible as cards and even devices begin to disappear from the transaction” and that “cash will give way to digital, but is unlikely to disappear entirely”.

Disappearing cash and the exclusion problem

Disappearing cash raises concerns for many around exclusion, with ‘cash tribes’ of people who find it difficult to move to digital payments, or who simply do not want to – such as the elderly, the unbanked, and digital skeptics. 75% of people surveyed aged 65+ said they have felt pressure to ditch cash due to places only taking card/contactless payments, while 83% of consumers surveyed said the decline of cash will exclude those most at-risk in society.

Product design was noted as an area of potential discrimination for such groups – in particular, the elderly. “There are all sorts of technologies that have biases against people who are older,” said Jonathan Williams, Technical Payments Specialist, Payment Systems Regulator. “One example is that biometric fingerprint scanners don’t tend to work as well with people who are over the age of 70 because, in some cases, their skin tends to be drier and therefore has less ridge definition. So, they don’t get quite as good a read if they’re trying to use fingerprints.”

But is it possible that, by 2030, digital currencies could be built to be inclusive for all? Some workshop attendees believed that Central Bank Digital Currencies (CBDCs) could be an antidote to the exclusive implications that come with the decline of cash. However, education is needed if this is to become a reality. 30% of respondents said they don’t like the idea of the state tracking their digital currency and 27% don’t understand how CBDCs would affect them.

The survey of 2,037 consumers from across the UK was conducted on behalf of card and payments services provider Marqeta. payments chip implant