Short-term rentals dominate NYE travel, despite rising prices across Europe

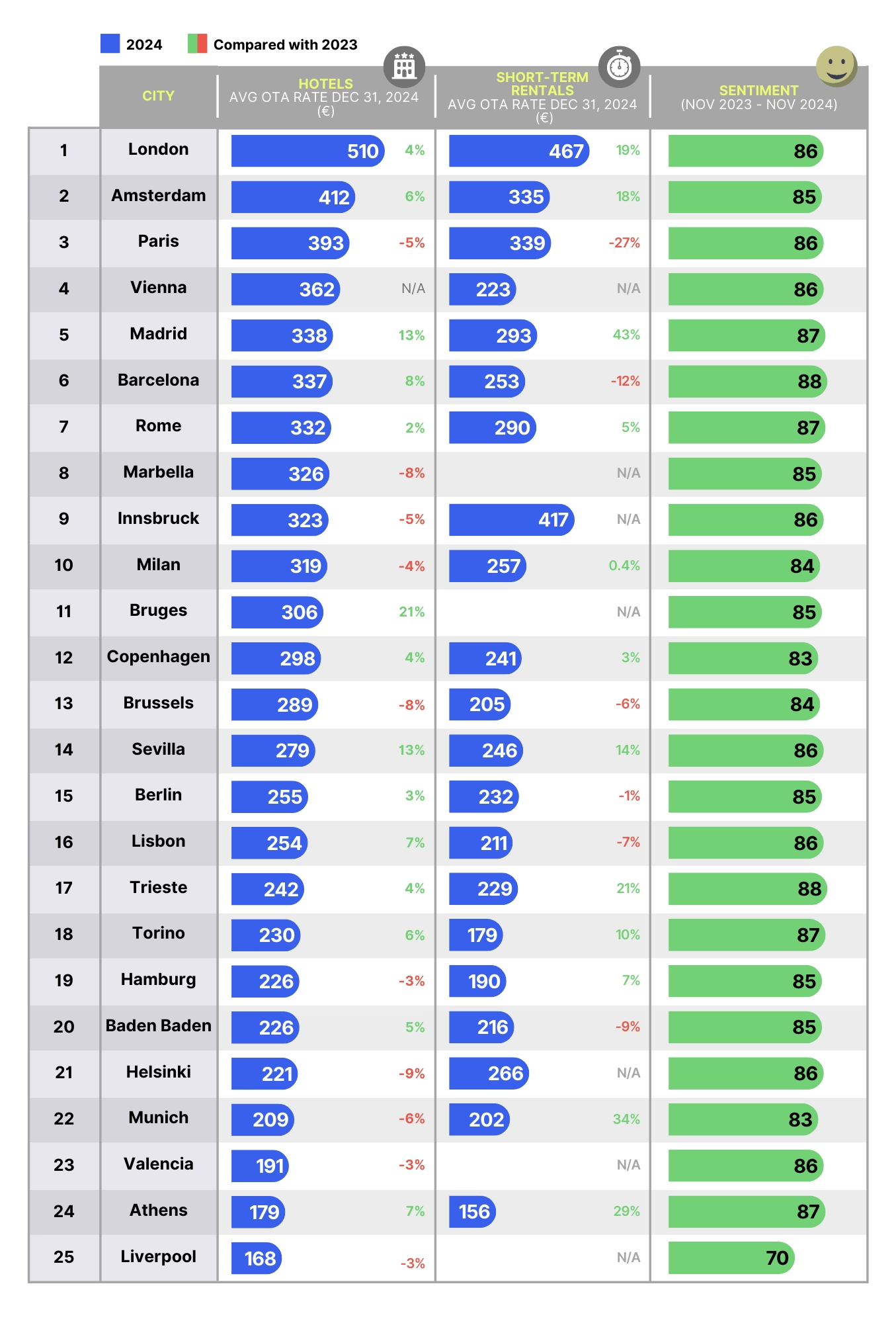

Almawave Group has analyzed New Year’s Eve 2024 accommodation trends, highlighting price shifts for hotels and short-term rentals across over 25 European capitals and destinations

Short-term rentals are properties rented out for a short duration, typically ranging from a few days to a few weeks. These can include apartments, houses, condos, and rooms in private homes.

Platforms like Airbnb, Vrbo, and Booking.com commonly list such properties. Short-term rentals are popular among travelers for their flexibility, affordability, and unique offerings, often providing a more home-like experience compared to traditional hotels.

Utilizing D/AI Destinations, their proprietary data analysis platform, the study compared rates published on major OTAs for December 31, 2024, with those of the previous year.

Short-term rentals outpace hotels

Apartments and private homes continue to dominate the holiday accommodation market, even during New Year’s celebrations. The sharp rise in short-term rental prices across most European cities compared to last year reflects their growing appeal among travelers seeking unique and flexible lodging options. However, this popularity comes at a cost.

Hotels across Europe have seen a modest average price increase of +2.71%, but short-term rentals have surged with a dramatic +7.86% increase, underscoring their demand.

While hotels generally command higher average prices, there are notable exceptions where short-term rentals rival or exceed hotel rates. In Innsbruck, for example, short-term rentals average €417, significantly surpassing the €323 average for hotels.

For travelers, the choice between a hotel and a private rental depends not only on budget but also on the type of experience they’re seeking. One thing is clear: the popularity of short-term rentals shows no signs of slowing down.

Luxury vs. Budget: Most and least expensive cities

When it comes to hotels, London secures its place as the most luxurious destination for New Year’s Eve, with average rates soaring to an eye-watering €510. In stark contrast, Liverpool stands out as the most affordable option, offering stays at just €168, making it an attractive choice for budget-conscious travelers seeking festive cheer without breaking the bank.

For short-term rentals, London continues to dominate the premium segment with average rates of €467, ideal for those aiming to immerse themselves in the city’s iconic celebrations. Meanwhile, Athens offers a budget-friendly alternative, with short-term rental prices averaging only €156, providing exceptional value for travelers looking to celebrate the new year in a vibrant and historic setting.

New Year’s Eve 2024 accommodation trends & price surges and drops

New Year’s Eve 2024 accommodation trends & price surges and drops

Bruges has seen a remarkable +21% surge in hotel prices, solidifying its position as a must-visit destination for New Year’s festivities. This growth reflects its rising popularity for festive tourism and its reputation for avoiding the pitfalls of over-tourism. On the short-term rental front, Madrid leads with an astonishing +43% price increase, driven by heightened demand and the proliferation of upscale rental options that cater to premium travelers.

Conversely, Paris has experienced a surprising -27% drop in short-term rental prices alongside a -5% decrease in hotel rates. This decline is attributed to an oversupply of properties and the impact of new regulatory measures reshaping the market. Helsinki also stands out with the steepest drop in hotel prices at -9%, offering travelers a more affordable yet chilly option for celebrating the New Year.

Mirko Lalli, CEO of The Data Appeal Company – Almawave Group, comments:

“The data highlights the shifting dynamics of traveler preferences and the critical role they play in shaping market strategies. For destinations, understanding pricing trends—such as the surge in short-term rentals or the rising appeal of alternative cities like Liverpool or Trieste—is key to staying competitive. By leveraging these insights, tourism professionals can fine-tune their pricing models, position their offerings more effectively, and ultimately maximize their appeal to both value-driven and premium travelers. It’s not just about following trends; it’s about anticipating them and using data to lead the way.”

New Year’s Eve 2024 accommodation trends & price surges and drops

New Year’s Eve 2024 accommodation trends & price surges and drops