Looking to Maximize Your Investments? Try VectorVest’s 30-Day Trial for Just $0.99!

Investing in the stock market can be a daunting task, especially with the constant ebb and flow of market dynamics. But what if there was a way to simplify the process, make informed decisions, and consistently achieve profitable results? Stock market analysis tool

That’s where VectorVest comes in. This comprehensive guide will walk you through everything you need to know about how VectorVest can help you protect and grow your portfolio with minimal time investment.

What is VectorVest?

VectorVest is a powerful investment software that analyzes over 18,000 stocks daily, providing users with clear buy, sell, or hold ratings based on a sophisticated mathematical model. Whether you’re a seasoned trader or a novice investor, VectorVest’s tools are designed to simplify your decision-making process and enhance your investment returns.

The Origin of VectorVest

Founded by Dr. Bart DiLiddo, VectorVest was developed to help investors make sense of complex stock market data. The system distills thousands of data points into a simple, easy-to-understand rating system that provides clear guidance on when to buy, hold, or sell a stock. Stock market analysis tool

Why Choose VectorVest?

Investing in the stock market often involves a lot of guesswork and gut feelings. With VectorVest, you can eliminate the uncertainty. The software uses a combination of fundamental and technical analysis to provide accurate assessments of stock value, safety, and timing—what they call the VST™ rating.

Key Benefits of Using VectorVest

- Accurate Buy/Sell Signals: VectorVest’s mathematical models give you precise buy, sell, or hold signals for each stock.

- Comprehensive Stock Analysis: Analyze any stock in seconds using proprietary indicators.

- Market Timing Indicators: Know exactly when to enter or exit the market with the advanced market timing gauge. Stock market analysis tool

- Automated Portfolio Management: Manage and grow your portfolio efficiently with automated backtesting and portfolio management tools.

- Educational Resources: Access free courses and investment coaching to enhance your trading skills.

The Power of VST™ Ratings

At the core of VectorVest’s system is the VST™ rating—a metric that evaluates stocks based on three factors:

- Value: Is the stock undervalued or overvalued?

- Safety: How safe is the investment?

- Timing: Is now the right time to buy or sell?

These ratings make it easy for investors to make informed decisions quickly.

How VectorVest Simplifies Stock Analysis

Investors often spend countless hours researching stocks, trying to make sense of complex financial data. VectorVest simplifies this process by providing a clear and concise analysis of each stock, allowing you to make decisions in seconds. Stock market analysis tool

Fundamental and Technical Analysis Combined

VectorVest doesn’t rely solely on one type of analysis. Instead, it combines fundamental analysis (evaluating a company’s financial health) with technical analysis (analyzing price movements) to give you a well-rounded view of a stock’s potential.

Why This Matters

By combining both types of analysis, VectorVest ensures that you’re not just buying a stock because it looks good on paper. You’re buying it because it’s the right time to do so based on its market performance.

Market Timing: The Secret to Success

One of the most challenging aspects of investing is knowing when to buy or sell. Market timing can make or break your investment strategy. VectorVest’s market timing indicators remove the guesswork, giving you clear signals on when to act.

Real-World Examples

- March 20, 2000 – Sell Recommendation: VectorVest advised exiting the market before the Dotcom bubble burst, helping investors avoid significant losses.

- March 25, 2020 – Buy Recommendation: After the market downturn caused by the coronavirus pandemic, VectorVest signaled a buy, positioning investors for substantial gains during the recovery.

Who Can Benefit from VectorVest?

VectorVest is designed to cater to a wide range of investors, from novices to seasoned professionals.

Novice Investors

If you’re new to investing, VectorVest’s simple ratings and educational resources will help you get started without feeling overwhelmed. Stock market analysis tool

Seasoned Traders

Experienced investors will appreciate the depth of data and advanced tools that allow for sophisticated portfolio management and strategy testing.

Long-Term Investors

For those focused on long-term growth, VectorVest’s emphasis on safety and value ensures that you’re investing in stocks with strong fundamentals.

Day Traders and Short-Term Investors

Short-term traders can take advantage of VectorVest’s timing indicators to exploit market volatility and achieve extraordinary returns.

The VectorVest Engine™: How It Works

The VectorVest Engine™ is the powerhouse behind the software’s ability to analyze thousands of stocks every day. This engine uses a combination of algorithms and data points to assign a buy, sell, or hold rating to each stock.

Breaking Down the VST™ Rating

Each stock is evaluated based on its Value, Safety, and Timing. These three factors are combined into a single VST™ rating that ranges from 0 to 2, with 1 being the average. A rating above 1 is favorable, indicating a stock is likely to perform well.

Example: How to Use VST™ Ratings

Let’s say you’re considering buying a stock. You check its VST™ rating:

- Value: 1.2 (Above average, indicating it’s undervalued)

- Safety: 0.9 (Slightly below average, indicating moderate risk)

- Timing: 1.5 (Well-timed for purchase)

Based on this analysis, the stock is undervalued and well-timed, making it a strong candidate for purchase despite the slightly below-average safety.

Automate Your Investment Strategy

One of the most appealing aspects of VectorVest is its ability to automate your investment strategy. This feature is particularly useful for those who don’t have the time to monitor the market constantly.

Automated Backtesting

Backtesting allows you to test your investment strategies using historical data. This helps you understand how your strategy would have performed in the past, giving you confidence in its potential success.

Portfolio Management Tools

VectorVest’s portfolio management tools help you keep track of your investments, adjust your strategy as needed, and ensure that you’re always in the best possible position to achieve your financial goals.

Educational Resources to Enhance Your Skills Stock market analysis tool

Investing is a skill that requires continuous learning. VectorVest offers a variety of educational resources to help you improve your trading skills and stay ahead of the market.

Free Quick Start Course

For those just getting started, VectorVest offers a free quick-start course that covers the basics of investing and how to use the software effectively.

Investment Coaching

VectorVest also provides investment coaching, offering personalized advice and strategies to help you achieve your financial goals.

Advanced Courses and Webinars

For more experienced investors, VectorVest offers advanced courses and webinars that dive deeper into trading strategies, market analysis, and portfolio management.

Real-Time Alerts: Stay Ahead of the Market

In the fast-paced world of stock trading, timing is everything. VectorVest’s real-time alerts ensure that you’re always aware of significant market movements and can act quickly to capitalize on opportunities.

How Real-Time Alerts Work

Whenever a significant event occurs that could impact your investments, VectorVest sends you an alert. This could be a change in the market timing indicator, a new buy/sell signal, or an update on one of the stocks in your portfolio.

Why This Matters

These alerts give you the information you need to make quick, informed decisions, helping you stay ahead of the market and avoid potential losses.

Customer Success Stories

Many VectorVest users have achieved impressive results using the software. Here are just a few examples:

- Marc Spreed: “I’ve been using VectorVest for over 10 years and have averaged 30% annual returns.”

- Camella Turlington: “In just 12 months, I made over $110,000 trading SPX while only risking $20K at any one time.”

- Oliver Bianco: “With VectorVest, I’ve more than doubled my options account in under a year.”

What These Stories Show

These success stories highlight the potential of VectorVest to significantly enhance your investment returns, regardless of your experience level.

Pricing: Affordable Access to Powerful Tools

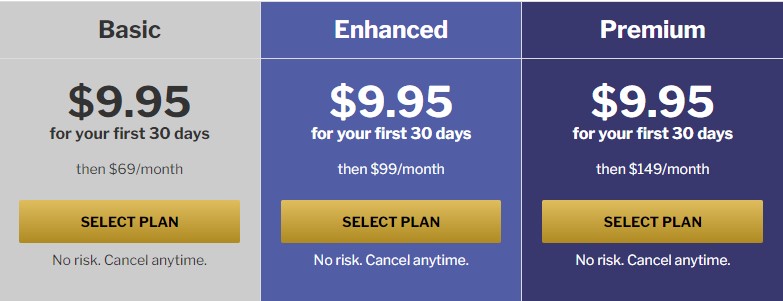

VectorVest offers a variety of pricing options to fit different budgets and needs. For those interested in trying the software, VectorVest provides a 30-day trial for just $9.95.

Subscription Plans Stock market analysis tool

After the trial period, users can choose from several subscription plans, each offering different levels of access to VectorVest’s tools and resources.

Is It Worth the Investment?

Given the potential for significant returns and the comprehensive tools and resources available, most users find that the cost of a VectorVest subscription is more than justified by the results they achieve.

Getting Started with VectorVest Stock Market Analysis Tool

Ready to take control of your investments and start making smarter, more profitable decisions? Getting started with VectorVest is simple.

Step 1: Sign Up for the Trial

Begin by signing up for the 30-day trial for $0.99. This gives you full access to all of VectorVest’s tools and resources for a limited time, allowing you to explore the software and see its benefits firsthand.

Step 2: Explore the Tools

Take some time to familiarize yourself with VectorVest’s features. Use the VST™ ratings to analyze stocks, set up your watchlists, and test your strategies with the backtesting tool.

Step 3: Implement Your Strategy

Once you’re comfortable with the software, start implementing your investment strategy. Use the market timing indicators to guide your decisions and adjust your portfolio as needed.