Google drops market share on direct hotel bookings

Just like many things in life, the landscape of tourism is continually changing. In recent months, we have seen the impact of the Digital Markets Act (DMA) on hotel bookings, particularly within the European Union. In this article, we’ll delve into how this regulatory framework has influenced direct bookings for hotels.

We’ll analyze relevant data, market reactions, and what it all means for the hospitality industry as a whole.

Understanding the DMA and Its Significance

The Digital Markets Act, designed to foster competition in the digital sector, has brought about significant changes. This law affects digital platforms that operate as “gatekeepers” to market access, consequently influencing hotel reservations and how consumers engage with them.

Purpose of the DMA

- To promote fair competition in the digital sector.

- To protect consumers and businesses.

- To limit the power of large platforms like Google.

By observing how the DMA has transformed market dynamics, it’s crucial to understand the context of these changes and how they translate into tangible numbers.

Data Analysis: The Methodology that Guides Us

To gain a clearer picture of how the DMA is affecting hotel bookings, we conducted an in-depth analysis that includes:

- More than 3,000 properties worldwide.

- Utilization of Google Analytics 4 to reflect current trends.

- Expansion of the analysis period from four to eight months before and after the implementation of the DMA.

Importance of Direct Bookings

Direct bookings are the lifeblood of a hotel, and understanding how the DMA is affecting this flow can mean the difference between success and failure for many properties. Let’s explore the most relevant figures.

Measurable Impact of the DMA on Hotels

Notable Losses in Direct Bookings

The situation is alarming for many hotels within the EU. According to our latest findings:

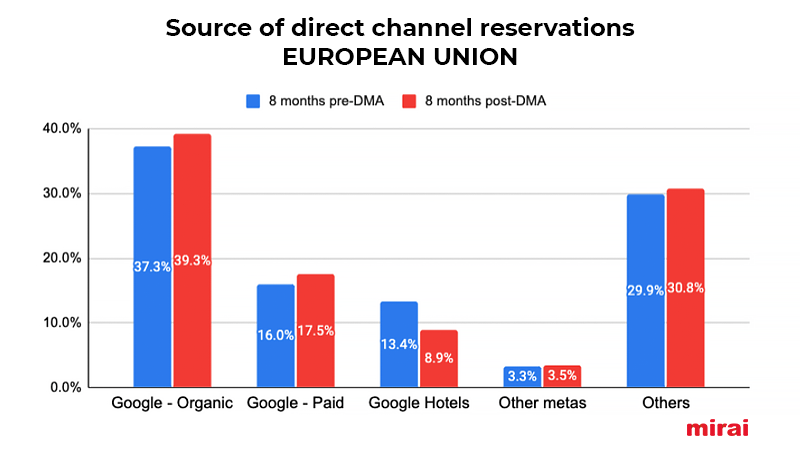

- Decrease of 4.5% in Google Hotels’ share.

- The overall market share of Google, which includes Ads, Hotels, and organic search, has decreased by a net of 1.5%.

Types of Traffic and Their Reassignment

Despite the losses, there are positive aspects. Hotels have managed to capture back 82% of the lost share, which includes:

- 3.5% through other Google placements (primarily through paid ads).

- 2% through organic search.

Is this a silver lining? Yes, but there is still a long road ahead.

A Deeper Analysis: Comparisons Outside Europe

According to the data, Google Hotels’ share of direct hotel bookings has fallen sharply from 13.4% to 8.9% within the EU as a result of the DMA, a 4.5 percentage points decrease.

The study, which spanned eight months and more than 3,000 hotels, showed that while overall Google has only lost 1% of the market share of hotel direct bookings, it has gained share in both organic and paid, possibly increasing distribution costs for hoteliers.

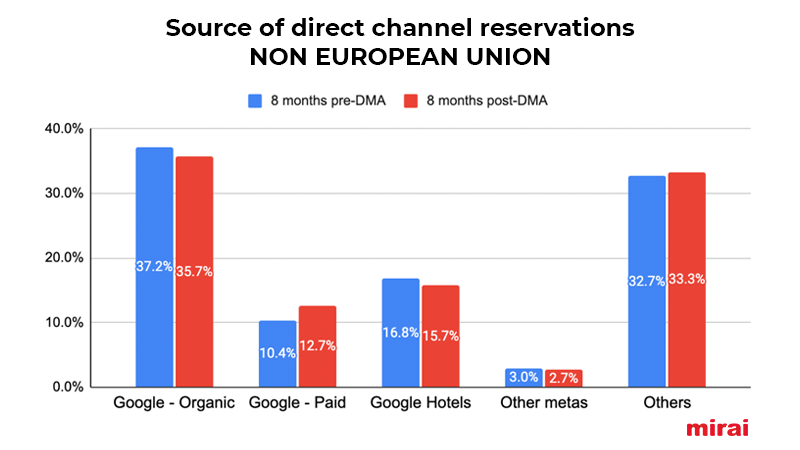

While the impact in Europe has been drastic, other markets tell a different story. Let’s analyze this further.

Growth of Paid Traffic in Non-European Markets

In other parts of the world, we’ve observed a significant increase in paid traffic, reaching 12.7% of total bookings generated. This indicates that opportunities remain for hotels to stand out, but it also warns of rising acquisition costs.

Organic Search and Its Negative Effect

In contrast to paid traffic, organic traffic has shown signs of weakness:

- Decrease in market share.

- Overall reduction of -0.29% across the Google ecosystem.

The Outcome of Visibility Reassignment

So, what does all this mean for hotels in terms of visibility and bookings? It’s more important than ever for hotels to maximize their presence on key platforms.

Presence on Google: An Indispensable Requirement

Since Google remains the primary portal where consumers initiate their searches, it is vital for hotels to optimize:

- Their direct rates.

- Their SEO content.

- Their visibility through paid ads.

The Rise of OTAs and Increased Distribution Costs

Online Travel Agencies (OTAs) are regaining visibility within Google’s ecosystem, meaning hotels are becoming increasingly reliant on these channels, raising their distribution costs.

Future Trends: What Lies Ahead?

As the DMA continues to evolve, regulations may adapt. But is there a conclusion in sight? It might be too early to say, but it is important to watch these trends.

Changes in Booking.com Practices

Recently, Booking.com has started implementing significant changes to its business practices:

- Removal of the parity clause in EU markets.

- DMA compliance is scheduled for November 2024.

Conclusions: The New Era of Hotel Tourism

The DMA is impacting how consumers interact with hotels. Although hotels have recaptured some bookings, the landscape remains challenging. As OTAs gain traction, hotels will need to adapt or risk falling behind.

In summary, the DMA has posed a series of challenges, but it has also opened the door to new strategies and ways to attract customers.