Global Wholesale Revenue to Double by 2028, Powered by eSIMs

The telecoms industry is undergoing a profound transformation as global connectivity demand surges. With international travel rebounding to pre-pandemic levels and technology advancing rapidly, including eSIM roaming 2025, both opportunities and challenges have emerged for mobile network operators (MNOs) and subscribers alike. A new study from Juniper Research has found that global revenue from wholesale roaming will grow from $9 billion in 2024 to $20 billion by 2028.

This article explores the current state and future of roaming, focusing on the interplay between traditional wholesale roaming, retail roaming, and emerging alternatives like travel eSIMs and SIMs.

Wholesale Roaming: A Pillar of International Connectivity

What Is Wholesale Roaming?

Wholesale roaming refers to agreements between a subscriber’s home network and a visited foreign network, enabling mobile users to access services like calls, texts, and data while abroad. These agreements are the backbone of international connectivity and drive substantial revenue for MNOs.

Growth Regions

Regions such as West Europe, fueled by initiatives like Roam Like at Home (RLAH), have seen significant adoption due to cost-free roaming.

A region set for substantial growth in inbound roaming connections is the Indian Subcontinent, with the region set to experience a 78.8% increase in inbound roaming connections between 2024 and 2029. This region has experienced significant technological advancements over the last couple of years, enhancing connectivity ranges and quality across the area. Therefore, the increased availability of high-quality connectivity creates a greater incentive for inbound travellers to utilise roaming provisions. Furthermore, this region is experiencing an increase in inbound tourism, which will naturally increase the number of inbound roamers.

Africa & Middle East is set to experience significant growth in wholesale roaming revenue; accounted for by efforts to digitalise and connect this region. Additionally, wholesale roaming prices are relatively high in this region, meaning that once these have settled the growth in wholesale roaming revenue will slow too.

Challenges

Despite its growth, wholesale roaming faces pressure from technological advancements, particularly the rise of travel eSIMs. To stay competitive, MNOs need to form partnerships with eSIM aggregators and innovate their offerings.

Travel eSIMs: The Disruptive Contender

The Appeal of Travel eSIMs

Countries with expensive roaming provisions tend to have higher rates of travel eSIM users due to them being a cost-effective alternative. Travel eSIMs provide greater opportunities for operators at the wholesale level as operators can establish partnerships with travel eSIM aggregators, which increases the number of roamers connecting to their network. Therefore, this will drive operator wholesale roaming revenue growth and increase opportunities too.

To capitalize on the growth in travel eSIM adoption, mobile operators must ensure that they are establishing partnerships with eSIM aggregators. Furthermore, mobile operators must also develop their own travel eSIM product offerings to encourage

users to remain with their network while traveling internationally.

The rising penetration of IoT devices creates greater opportunities for travel eSIM usage, as travel eSIMs provide a cost-effective alternative to traditional roaming charges for these devices. This is particularly applicable for use cases where there are large volumes of IoT and connected devices, as ensuring that they have consistent connectivity comes at a lower price than roaming. This, coupled with the easy implementation of travel eSIMs makes them an attractive offering to these use cases.

Opportunities for MNOs

Opportunities for MNOs

By partnering with eSIM aggregators and developing their own travel eSIM solutions, MNOs can capture a share of the growing market. Travel eSIMs also open doors to IoT applications, where cost-effective and scalable connectivity solutions are essential.

Regional Variations

In regions with affordable roaming plans, like Europe under RLAH, eSIM adoption remains limited. However, aggressive pricing and bundled offerings tailored to traveler needs could drive adoption in these areas.

Retail Roaming: A Market in Flux

Post-Pandemic Recovery

Retail roaming, where subscribers connect to foreign networks while retaining their home network relationship, has rebounded alongside international travel. The COVID-19 pandemic impacted retail roaming significantly, with mobile subscribers unable to travel internationally and thus impacting MNOs’ roaming revenue. However, international travel has now recovered and so too has roaming spend, with mobile subscribers increasingly taking consumer devices with cellular capabilities abroad and using them to roam.

Additionally, high levels of outbound tourism in Western Europe and North America contribute greatly to the high rates of retail roaming revenue in these regions. These must be key focus areas for the monetization of retail roaming amongst mobile

operators and mobile roaming vendors, due to the high levels of outbound roaming from these regions.

Regions like North America and West Europe dominate this space due to high outbound tourism and affluent travelers.

Threat from Alternatives – Travel SIMs and Travel eSIMs

On the retail roaming level, the greatest threat to MNO revenue from roaming is the emergence of travel SIMs and travel eSIMs. These technologies bypass traditional roaming by allowing the mobile subscriber to connect directly to a local network while abroad, without having to utilise the services of their home MNO. This contributes to the number of ‘silent roamers’, due to these subscribers not utilising their MNO’s roaming services.

Travel SIMs and travel eSIMs, along with innovations in eSIM roaming 2025, are typically more cost-effective than expensive roaming services due to the SIM connecting directly to the local network in the visited country. This does, however, mean that the mobile subscriber does not utilise its own MNO’s roaming services, therefore impacting MNOs’ retail roaming revenue.

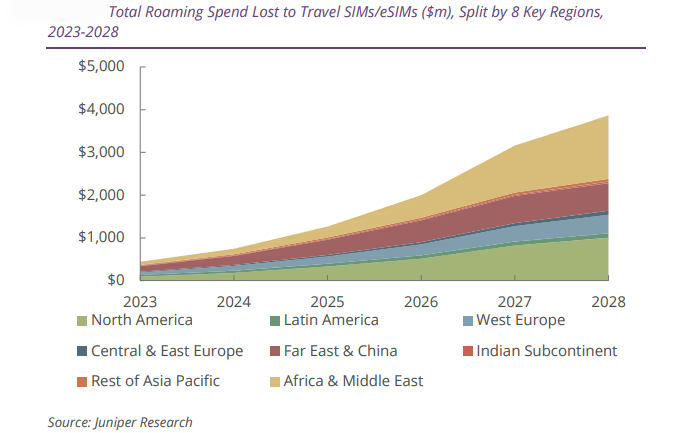

Juniper Research forecasts that the revenue loss to travel SIMs/eSIMs will increase by 777% between 2023 and 2028, which indicates the scale of the threat to traditional roaming practices. This highlights the importance of mobile operators adopting travel eSIM services and eSIM roaming 2025 strategies to capitalise on the revenue potential of travel eSIMs, meaning that instead of losing revenue, it is simply diverted to another stream.

Travel SIMs

Travel SIMs are physical SIM cards that allow the mobile subscriber to connect to a local network in the country they are visiting. This allows the mobile subscriber to bypass expensive roaming fees. With a travel SIM, mobile subscribers have to swap the physical SIM card within their mobile devices to be able to utilise the connection to the local network.

These travel SIMs do provide a financial benefit to mobile subscribers, however, the practicalities of switching to a travel SIM can be less attractive. Carrying and swapping between multiple SIM cards can be an unattractive proposition for travellers, while also posing the risk of losing them.

Additionally, when investing in a travel SIM, mobile subscribers have to either go to a reseller or wait for them to arrive in the post, meaning that there can be delays in being able to access them.

Furthermore, when utilising a travel SIM, the mobile subscriber will be given a different contact number, which may be seen as a hassle to some users. Therefore, there are limitations to the adoption of travel SIMs, however, with the significantly lower price, they remain a viable option to mobile subscribers while travelling internationally.

Travel eSIMs

Travel eSIMs solve many of the limitations of travel SIMs; most notably distribution channels, while also offering the same benefits of being able to connect to local networks. eSIMs are digital SIMs that provide the services of your mobile plan with your operator without the need of a physical SIM card. eSIMs require mobile device compatibility, as they rely on an inbuilt software chip in the mobile device. Therefore, travel eSIMs are reliant on mobile devices that are eSIM-compatible.

To capitalize on the growing demand for travel eSIMs and eSIM roaming 2025, the technology must be included in existing travel bundles, such as package holidays and holiday extras. This will include tailoring travel eSIM offers to the destination country and length of holiday. This not only alerts travellers to the option of travel eSIMs but ensures that they can be purchased to suit the customer’s needs.

Travel eSIM uptake will be low in countries with well-established, cost-effective roaming services available. This is particularly evident in Europe, where the RLAH initiative is widely adopted. Therefore, this leaves little requirement for mobile subscribers to seek alternatives to their home MNO’s roaming services as it is typically included in their mobile subscription, thus limiting travel eSIM adoption. To see any adoption of travel eSIMs and eSIM roaming in 2025 in this region, the packages will need to be priced more aggressively to appeal to mobile subscribers.

5G Roaming: Unlocking New Possibilities

5G technology is reshaping the roaming landscape. Features like network slicing and real-time monitoring enhance the user experience and open new revenue streams for MNOs. Applications in IoT and connected devices, which demand high-speed, low-latency connectivity, will be major drivers of 5G roaming adoption.

Looking Ahead: Strategies for Success

For MNOs

- Embrace eSIM Technology: Develop and market travel eSIM solutions to counteract revenue losses from traditional roaming.

- Invest in 5G: Facilitate 5G roaming through advanced agreements and technologies like network slicing.

- Target Growth Regions: Focus on regions with increasing outbound tourism and inbound connectivity needs.

For Subscribers

- Evaluate Alternatives: Compare travel eSIMs and SIMs for cost-effective options tailored to your destination.

- Adopt 5G: Leverage the enhanced capabilities of 5G networks for a superior roaming experience.

Conclusion

The connectivity landscape in 2025 is both promising and complex. While traditional roaming remains a cornerstone of global telecoms, the rise of travel eSIMs and SIMs signals a shift toward more flexible and cost-effective options. For MNOs, embracing these innovations is essential to sustaining growth and meeting evolving consumer expectations.

- AIRALO

-

eSIM for

Europe

39 countries

-

1 GB – 7 days – €4.27

3 GB – 30 days – €11.09

10 GB – 30 days – €31.57

- AIRHUB

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – €2.99

3 GB – 30 days – €5.12

10 GB – 30 days – €11-09

- aloSIM

-

eSIM for

Europe

32 countries

-

1 GB – 7 days – €5.00

3 GB – 30 days – €13.00

10 GB – 30 days- €36.00

- GigSky

-

eSIM for

Europe

36 countries

-

1 GB – 7 days – €6.99

3 GB – 15 days – €11.19

10 GB – 30 days – €27.99

- iRoamly

-

eSIM for

Europe

39 countries

-

1 GB – 7 day – €6.83

3 GB – 15 days – €10.24

10 GB – 30 days – €18.77

- Maya Mobile

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – –

5 GB – 15 days – €5.99

10 GB – 30 days- €13.99

- NOMAD

-

eSIM for

Europe

36 countries

-

1 GB – 7 days – €4.71

3 GB – 15 days – €10.27

10 GB – 30 days – €15.41

- UBIGI

-

eSIM for

Europe

29 countries

-

500 MB – 1 day – €2.00

3 GB – 30 days – €8.00

10 GB – 30 days – €19.00

- VOIA

-

eSIM for

Europe

34 countries

-

1 GB – 7 days – €2.69

3 GB – 15 days – €5.05

10 GB – 30 days- €11.70

Opportunities for MNOs

Opportunities for MNOs