Airline-Integrated eSIM Data Plans: The Future of Seamless Travel Connectivity

Imagine this: you board your flight, settle into your seat, and by the time the seatbelt sign turns off, your phone is already connected to a local network at your destination—without ever swapping a SIM card or queuing at the airport kiosk. Welcome to the future of travel—powered by airline integrated eSIM data plans.

By 2025, we’re heading toward a major shift in how travelers stay connected. Airlines aren’t just flying people from point A to B anymore—they’re becoming full-on travel tech providers. And integrating eSIM (embedded SIM) data plans into airline tickets or ancillary services is one of the smartest plays they can make.

Let’s unpack what this means, why it’s happening, and how it could reshape both passenger experiences and airline revenue models.

What’s the Big Deal with eSIMs?

Before we dive into the airline side of things, let’s get clear on what eSIMs actually are. Unlike traditional SIM cards, which are physical and need to be inserted into your device, eSIMs are built into your phone or device and can be activated digitally.

That means no more hunting for local SIM cards abroad. No more swapping tiny chips. Just instant data connectivity, often at better prices than roaming with your home provider.

Now imagine this tech, seamlessly built into your flight booking.

Airlines: From Seat Sellers to Connectivity Providers

Over the past decade, airlines have evolved far beyond just selling tickets. Ancillary revenues—from baggage fees and seat upgrades to inflight Wi-Fi—have become a major part of their business model.

So, where does eSIM come in?

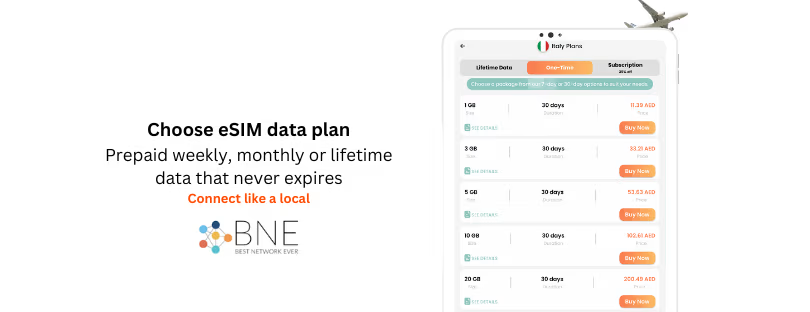

eSIM data plans are now becoming a natural extension of what airlines already offer. Many are already selling Wi-Fi onboard. The next step? Offering mobile data plans you can use inflight and once you land—all bundled within your ticket or sold as an easy add-on.

Here’s how this might look by 2025:

- When booking your flight, you’ll see an option like “Add travel data for €5”—just like adding extra luggage or choosing your seat.

- At check-in, the airline sends a QR code or profile installation link to your email or app. One tap, and your eSIM activates.

- Your device automatically connects when you land. No stress. No roaming shocks.

Seamless Inflight & On-Arrival Connectivity

One of the biggest pain points for travelers is the gap in connectivity between flying and arriving. You might have inflight Wi-Fi, but once you land, you’re scrambling to get online, find your Uber, or message your hotel. airline integrated eSIM data plans

Airline-integrated eSIMs can eliminate that friction completely.

Here’s a scenario that could soon be standard:

- You’re flying with Lufthansa from Frankfurt to Tokyo.

- As part of your booking, you select an eSIM data plan that covers Japan (or maybe a regional Asia plan).

- Onboard, you enjoy complimentary in-flight messaging. Once you land, your eSIM automatically kicks in on the local Japanese network.

- You’re instantly online—no SIM swap, no airport kiosk, no waiting.

For frequent flyers, business travelers, or even casual tourists, this kind of experience isn’t just convenient—it’s game-changing.

New Revenue Stream, Better Passenger Loyalty

Let’s not forget the business side of this.

Airlines are under constant pressure to diversify revenue and enhance customer loyalty. Selling eSIM data is a relatively low-cost, high-margin service that ticks both boxes:

- Airlines partner with eSIM providers or integrate APIs from companies like Airalo, Airhub, or Bnesim.

- They get a cut of the data plan revenue, without managing the tech infrastructure themselves.

- Passengers enjoy cheaper, simpler connectivity. Win-win.

And for airlines, the value goes beyond direct revenue. Offering seamless connectivity builds brand loyalty. If travelers know that flying with a certain airline means always being connected, they’re more likely to book again.

Strategic Partnerships Are Already Brewing

We’re already seeing the first moves.

- Some airlines are testing partnerships with eSIM providers. They’re piloting offers where travelers can purchase a travel data pack directly from the airline app or in-flight portal.

- Others are embedding eSIM onboarding into their mobile check-in flow, especially for premium or frequent flyer customers.

- Budget airlines are eyeing this as a new ancillary revenue stream, particularly for younger, more tech-savvy travelers.

Several airlines are already embracing eSIM technology to enhance passenger connectivity. Alaska Airlines became the first in North America to offer eSIM services through a partnership with CELITECH, enabling travelers to stay connected without roaming. KLM has teamed up with Kolet to provide seamless eSIM solutions for passengers, while eSIM Go has partnered with the Lufthansa Group, including SWISS, to integrate travel eSIM options directly into their digital platforms—making it easier for travelers to connect inflight and upon arrival.

And it’s not just the airlines—airports, travel apps, and even hotels are exploring eSIM integrations. But airlines have the most leverage: they control the ticketing flow, the in-flight experience, and the post-flight journey.

What This Means for Travelers

If you travel even once a year, this shift will affect you.

You’ll no longer need to:

- Research the best SIM card for each country

- Pay absurd international roaming rates

- Waste time at airport kiosks

- Worry about staying offline when it matters most

Instead, you’ll be able to:

- Add a travel data pack to your flight like ordering extra legroom

- Use the same plan from takeoff to touchdown

- Be connected from the moment you land

And if you’re a digital nomad or business traveler? This could be the final nail in the coffin for physical SIM cards.

Challenges to Watch

Of course, there are still some hurdles to sort out:

- Device compatibility: While most modern smartphones support eSIM, not all do—especially budget models.

- Coverage quality: Not all eSIM providers offer great speeds or support in every region. Airlines will need to vet their partners carefully.

- Pricing transparency: Travelers will expect fair, competitive rates, not another overpriced upsell.

But with the right tech partnerships and customer-first mindset, these issues are manageable.

Final Boarding Call: The Future Is eSIM

By 2025, the idea of not having data the moment you land may feel downright prehistoric.

As airlines look for smarter ways to serve their passengers and make money beyond the ticket, eSIM data plans will play a key role. It’s not just about selling connectivity—it’s about owning the end-to-end digital travel experience.

If airlines get this right, they won’t just be flying us around the world—they’ll be keeping us connected every step of the way.

So next time you book a flight, don’t be surprised if your boarding pass comes with a side of mobile data. airline integrated eSIM data plans