Inside the eSIM Ecosystem: How Operators, Enablers, and New Digital Players Are Rewriting Mobile Connectivity

For decades, the little plastic card in your phone—the Subscriber Identity Module, or SIM—was the unassailable gatekeeper of your mobile life. It was a physical token of your loyalty to a single carrier. But the rise of the eSIM (embedded SIM) has shattered that model, transforming the mobile connectivity landscape from a rigid hierarchy into a fluid, multi-layered ecosystem.

The eSIM is not just a digital replacement for a plastic card; it is a fundamental shift in how we buy, manage, and use mobile service. It allows users to switch carriers and download new service profiles over-the-air, instantly. This simple technological leap has created a complex and fascinating new market, one where the traditional giants of telecom are now jostling for position with nimble tech companies, travel startups, and a new breed of digital middleman.

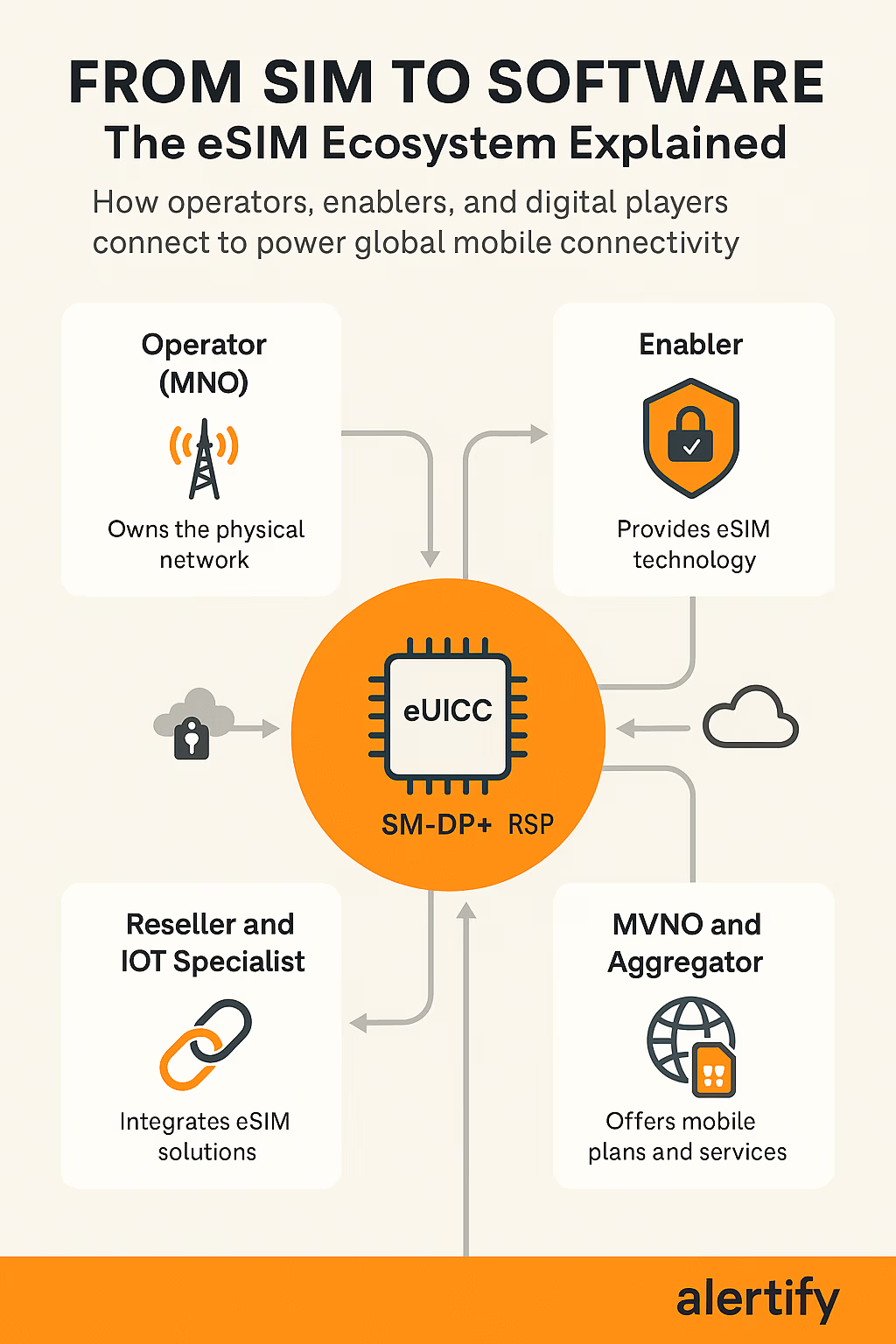

To truly understand where mobile connectivity is headed, you need to know who the players are in this new ecosystem. It’s a cast of characters that includes the old guard, the technological backbone, and the market disruptors.

The Old Guard: Mobile Network Operators (MNOs)

At the top of the food chain—or perhaps the bottom, as the foundational layer—are the Mobile Network Operators (MNOs), often simply called Operators.

These are the giants like AT&T, Deutsche Telekom, Vodafone, and NTT. They are the ones who own the physical infrastructure: the cell towers, the radio spectrum licenses, and the core network equipment. They are the landlords of the mobile world.

In the eSIM era, the MNO’s role is dual: they are the ultimate service provider, and they are also a key beneficiary of the new technology. For MNOs, eSIM means a significant reduction in logistical costs. No more manufacturing, shipping, and distributing physical SIM cards. It streamlines customer acquisition, especially for secondary devices like smartwatches and tablets, which can be activated instantly upon purchase.

However, the eSIM also introduces a challenge: it makes it easier for customers to leave. The friction of physically swapping a SIM card is gone. This forces MNOs to compete fiercely on price and quality of service, especially against the new wave of digital competitors who are leveraging the MNOs’ own networks.

The Quiet Architects: The Enablers

If MNOs are the landlords, the enablers are the architects and engineers who built the digital plumbing. These are the technology companies that provide the secure software and platforms necessary for the eSIM to function. Their role is critical, yet often invisible to the end-user.

The core technology they provide is Remote SIM Provisioning (RSP). This is the mechanism that allows a new service profile to be securely downloaded onto the embedded chip in your device. For consumer eSIMs, this process uses the Subscription Manager Data Preparation (SM-DP+) server, which creates, stores, and securely delivers the encrypted profiles directly to the device. The Subscription Manager Secure Routing (SM-SR) component applies only to the older M2M (machine-to-machine) eSIM standard used mainly in IoT deployments.

The major players in this space are often security and semiconductor specialists. They include giants like Thales (which acquired Gemalto, a pioneer in the space, and provides the complete eUICC and platform solution), Giesecke+Devrient (G+D), and IDEMIA, which remains one of the world’s most influential secure identity and embedded SIM technology providers, especially in large-scale MNO deployments and national infrastructure projects.You’ll also find Kigen (a spin-out from ARM with a strong IoT eSIM focus), which is best known for providing eUICC hardware and platform solutions for M2M and IoT deployments, rather than consumer eSIM services, while the secure silicon itself is typically supplied by semiconductor leaders like Infineon and STMicroelectronics. Crucially, the silicon itself is often provided by semiconductor powerhouses like Infineon and STMicroelectronics. These companies are the backbone of the entire system, ensuring that the digital transfer of your identity is secure and compliant with the standards set by the GSMA. Without them, the entire ecosystem collapses into chaos.

The Aggressive Middlemen: MVNOs and Aggregators

This is where the real disruption is happening. The eSIM has been a massive boon for two specific types of players who don’t own a single cell tower: Mobile Virtual Network Operators (MVNOs) and Aggregators.

MVNOs: The Digital-First Carriers

MVNOs, like Mint Mobile or Google Fi, have always leased network capacity from MNOs. But the eSIM is a game-changer for their business model:

The most visible and aggressive digital eSIM brands in the travel space—such as Airalo and Holafly—operate on top of MVNO and aggregator platforms to deliver local and regional data plans worldwide. These companies leverage the eSIM to offer local data plans in dozens of countries, bypassing the exorbitant roaming fees traditionally charged by MNOs. They have effectively turned the entire world into a single, seamless marketplace for temporary connectivity.

Aggregators: The Connectivity Supermarkets

Aggregators (or eSIM marketplaces) take the MVNO model a step further. They don’t just sell their own plans; they act as a single point of sale for plans from multiple different MNOs and MVNOs globally. They consolidate the offerings, negotiate bulk rates, and present them in a user-friendly app, essentially becoming the “supermarket” of global connectivity.

While companies like Airalo and Holafly are the most visible, acting as both MVNOs and aggregators, the pure-play aggregation model is also gaining traction. Other key players include GigSky and Truphone, which offer platforms that consolidate plans from hundreds of carriers globally. Their core function is to simplify choice and act as a single, trusted “supermarket” for global connectivity, creating a new, highly competitive layer between the network owner and the customer, driving down prices and increasing transparency.

Finally, the Resellers and IoT specialists are the ones integrating this new connectivity into specific business models.

Resellers are channel partners—think travel agents, corporate mobility managers, or device retailers—who sell eSIM plans as a value-added service. Because the product is digital, they can integrate the sale of connectivity directly into their existing platforms, creating new revenue streams with minimal overhead.

In the Internet of Things (IoT) space, companies like Kigen are enabling enterprises to manage vast fleets of connected devices (from smart meters to logistics trackers) globally. The eSIM’s ability to switch profiles over-the-air is essential here, allowing a manufacturer to deploy a single device globally and activate the best local network after deployment, a capability that was a logistical nightmare with physical SIMs.

|

Player Type

|

Core Function

|

eSIM Impact

|

Key Examples

|

|---|---|---|---|

|

Operator (MNO)

|

Owns the physical network and spectrum.

|

Reduces logistics costs; faces increased customer churn risk.

|

AT&T, Vodafone, Deutsche Telekom

|

|

Enabler

|

Provides the secure technology (RSP, SM-DP+, eUICC) to manage profiles.

|

The technological backbone, ensuring security and compliance.

|

Thales, G+D, Kigen, Infineon, STMicroelectronics

|

|

MVNO

|

Leases network capacity and sells service under its own brand.

|

Enables instant, digital-first onboarding and low-cost models.

|

Mint Mobile, Airalo, Holafly

|

|

Aggregator

|

Consolidates plans from multiple MNOs/MVNOs into one marketplace.

|

Simplifies choice for consumers, especially travelers; drives price competition.

|

Airalo, Holafly, GigSky, Truphone

|

|

Reseller

|

Sells connectivity as a value-add through existing channels.

|

Creates new, low-overhead revenue streams for partners.

|

Travel Agencies, IoT Integrators

|

The Conclusion: The Unstoppable Tide of Digital Identity

The eSIM ecosystem is not just a new market; it is a proxy war for the future of digital identity and control.

To understand its significance, we must compare it to similar market disruptions. The rise of the eSIM Aggregator is analogous to the emergence of Online Travel Agencies (OTAs) like Expedia or Booking.com in the airline industry. Airlines (MNOs) still own the planes and the routes, but OTAs (Aggregators) captured the customer relationship by simplifying search, comparison, and purchase. They became the gateway, forcing airlines to offer their best deals through the new channel.

Similarly, the eSIM has shifted the power dynamic away from the network owner (MNO) and toward the customer-facing digital intermediary (MVNO/Aggregator).

The key trend is the unbundling of the network from the service.

In the old world, your SIM card was a contract with a network. In the eSIM world, your device is a smart wallet for connectivity profiles. The MNOs will continue to be essential, but their role is trending toward becoming wholesale data providers, while the MVNOs and Aggregators will own the customer experience, branding, and pricing.

This trend is unstoppable. With major device manufacturers like Apple and Samsung fully embracing eSIM, the market is projected to grow from billions of dollars today to well over $6 billion by 2030, with a compound annual growth rate (CAGR) of over 20%.

The future of mobile connectivity is less about who owns the towers and more about who owns the software and the customer relationship. The MVNOs and Aggregators, armed with the digital advantage of eSIM, are winning the front-end battle. MNOs must now accelerate their digital transformation and embrace their role as flexible, wholesale network providers, or risk being relegated to the role of a silent utility in the new digital ecosystem.