From Travel Hack to Telecom Standard: GSMA’s 2025 Findings on eSIM

The plastic SIM card has been the foundation of mobile connectivity for over three decades. But 2025 is shaping up to be the year its successor, the embedded SIM (eSIM), takes center stage. After years of slow progress, momentum is now building rapidly. eSIM adoption 2025

In 2024, operators and technology vendors announced a wave of initiatives to accelerate eSIM and iSIM development, covering new specifications, products, and services. Once limited to premium devices and specialized enterprise use cases, eSIM is now entering the mainstream. According to GSMA Intelligence’s Global Mobile Trends 2025, adoption is accelerating across consumer markets, travel, IoT, and enterprise connectivity — marking an inflection point in the global telecom landscape.

eSIM and the Consumer Market: From Curiosity to Commitment

Rising Awareness — But Education Needed

Over the last two years, commercialization of eSIM has gained traction across devices, services, and digital-first brands. The launch of Apple’s eSIM-only iPhones in 2022 acted as a catalyst, pushing operators to scale deployments worldwide.

Yet, adoption outside the US remains modest. Most operators still do little to promote eSIM, leaving consumers to discover it elsewhere — in fact, just 8% of eSIM-aware users learned about it from their operator.

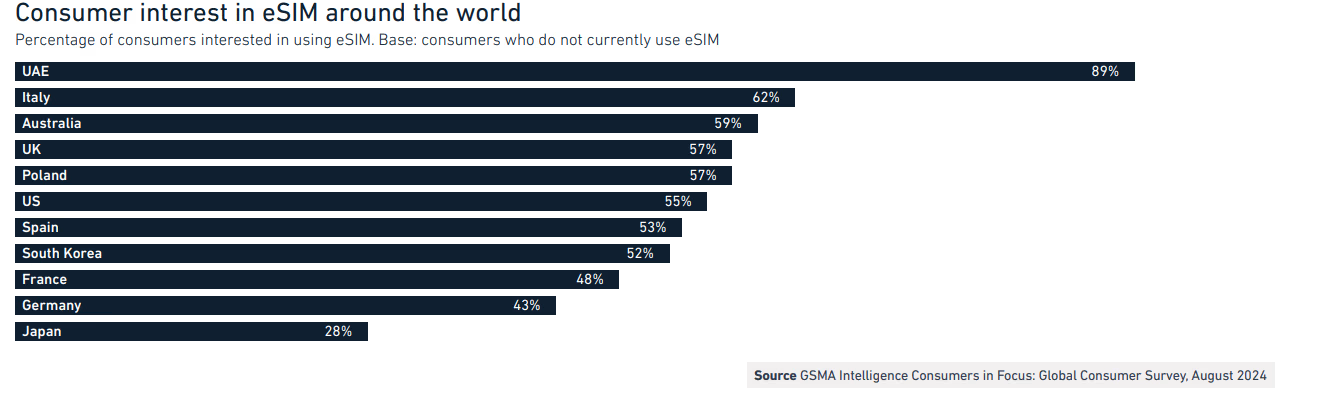

Surveys across 11 countries show:

- 54% of non-users are interested in adopting eSIM.

- 31% are not interested, and 14% remain unsure.

- Key barriers: satisfaction with traditional SIMs, unclear benefits (13%), and lack of understanding (11%).

This underlines the urgent need for better customer education from operators and OEMs.

Adoption Patterns

- 51% of eSIM-aware consumers now use it.

- Of these, 51% purchased a travel eSIM in the past year, and 28% turned to global providers like Airalo, Holafly, or eSIM.me.

- The US leads adoption, thanks to Apple’s bold move to eliminate the SIM tray.

Forecast to 2030

By the end of the decade, 6.9 billion smartphones (76% of all connections) are expected to use eSIM. Growth will depend on affordable devices entering mid- and low-tier markets, alongside stronger consumer education.

Although eSIM has become standard in flagship smartphones, its presence in the broader device market remains limited. To accelerate adoption beyond premium users, manufacturers need to expand support to mid-range and entry-level phones, which are especially important in developing markets. Geographically, more than half of the world’s countries now offer eSIM services for smartphones, but gaps remain. China stands out as a major holdout, while many African markets are only beginning to roll out services. Looking ahead, the next wave of eSIM launches will come from developing countries in Africa and Asia, where affordable devices and wider network support will be critical for mass adoption.

Travel eSIM: The Breakthrough Use Case

Travel eSIM: The Breakthrough Use Case

Roaming costs remain a top frustration for travelers. eSIM has emerged as the simplest solution, and it’s driving adoption worldwide:

- More than half of eSIM users purchased a travel eSIM in 2024, making it the leading use case.

- Operators see eSIM as a chance to monetize inbound roaming, creating new revenue streams outside of traditional wholesale agreements.

- Travel eSIM often acts as a gateway technology: once consumers experience seamless activation abroad, they’re more likely to adopt eSIM domestically.

This makes travel eSIM providers not only disruptors but also educators, introducing millions to the technology.

Enterprise and IoT: Unlocking the Largest Growth Potential

While consumer adoption is critical, IoT and enterprise applications represent eSIM’s most significant long-term growth engine.

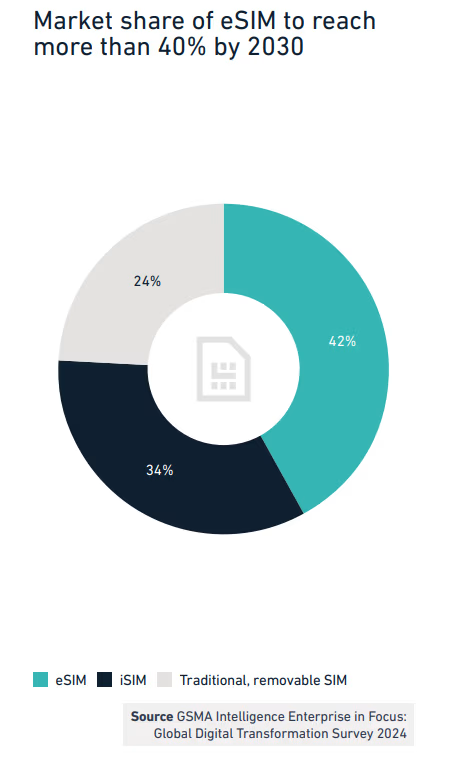

- By 2030, there will be 6 billion IoT cellular connections, with over 40% powered by eSIM.

- Automotive leads today, but growth is expanding into logistics, healthcare, utilities, and smart cities.

5 Key Growth Drivers

- Enhanced GSMA eSIM specifications (SGP.32, SGP.33) for IoT.

- Deployment of 5G RedCap and satellite-cellular integration.

- Expanding availability of eSIM-enabled IoT devices.

- Growing adoption of private wireless networks.

- Sustainability benefits, with eSIM reducing billions of plastic SIM cards.

Enterprise Challenges

Enterprises cite cost, security, and integration with existing systems as top challenges. Still, both operators and enterprises agree: security and scalability are the biggest benefits of eSIM.

Industry Innovation: Expanding the eSIM and iSIM Ecosystem

2024–2025 has seen a surge of innovation to simplify and expand eSIM adoption:

- Thales + Google: standardized eSIM activation across Android devices.

- Ericsson + Microsoft + Thales: trials of secure enterprise provisioning.

- Vodafone + Kigen: iSIM deployments for simplified IoT connectivity.

- eSIM Go + Vodafone: “MVNO-in-a-box” for digital brands.

- TIM + Intel: testing eSIM laptops for seamless cellular access.

- Vantiva + e&: launching eSIM-enabled 5G FWA gateways in the UAE.

These developments highlight eSIM’s evolution from a connectivity feature to a platform for digital services and innovation.

Operators: From Passive to Proactive

Operators: From Passive to Proactive

For years, many operators quietly launched eSIM without marketing it. But the tide is turning:

- Data from US carriers shows no evidence that eSIM increases churn, alleviating long-held fears.

- Operators are beginning to actively market eSIM, particularly through digital-first sub-brands aimed at younger, tech-savvy consumers.

- Travel eSIM remains the anchor, but domestic adoption is set to rise as operators create digital-first propositions around eSIM.

Mobile operators are increasingly launching eSIM services but not talking much about eSIM to customers. Raising consumer awareness of eSIM while explaining and promoting its benefits is key to driving eSIM adoption.

Mobile operators will likely start talking more about eSIM to customers in 2025, especially in the context of digital-first or digital-only consumer propositions that target digital-native and tech-savvy customers, and for the onboarding of new customers. Travel

eSIM will continue to gain traction.

Why 2025 Is the Inflection Point

Several converging forces make 2025 a turning point for eSIM adoption:

- Mainstream availability in flagship devices, now expanding into wearables, tablets, and laptops.

- Growing enterprise and IoT adoption, supported by new standards and technologies.

- Travel eSIM as a global growth engine, helping to bridge consumer education gaps.

- Operator engagement is shifting from passive rollout to active promotion.

By 2030, eSIM is expected to dominate smartphones, enterprise solutions, and billions of IoT devices — making it the backbone of global connectivity.

Conclusion: eSIM in Context — A Standard, Not Just a Feature

2025 is the year eSIM transitions from niche technology to a global standard. For consumers, it offers convenience and flexibility. For enterprises, it unlocks scalability and security across IoT. For operators, it presents new revenue models and reduced logistics costs.

The message is clear: the future of mobile is embedded.

What makes this moment striking is how closely it mirrors past inflection points in mobile. When 4G LTE launched a decade ago, adoption lagged until affordable devices, global spectrum alignment, and compelling use cases converged. Similarly, 5G uptake only accelerated once operators stopped treating it as a premium add-on and began embedding it into mainstream consumer and enterprise packages (Ericsson Mobility Report, 2024). eSIM is now at that same tipping point: moving from an optional feature to an invisible enabler of digital-first connectivity. eSIM adoption 2025

Comparisons also extend beyond telecom. Just as cloud computing reshaped enterprise IT from hardware-bound to service-driven, eSIM is turning connectivity from a physical asset (a piece of plastic) into a scalable, software-defined resource. This transition is supported not only by telecom incumbents but also by digital-first players like Airalo, Holafly, and Truphone, whose global travel eSIM models are accelerating consumer awareness in ways operators have not yet fully matched.

GSMA’s Global Mobile Trends 2025 forecasts 6.9 billion eSIM smartphone connections by 2030, accounting for 76% of the market. Independent analyses from Juniper Research and Counterpoint echo the same trajectory, with both firms projecting that IoT and enterprise deployments will outpace consumer adoption by the late 2020s, largely because eSIM simplifies provisioning across borders and reduces operational overhead.

At the same time, challenges remain. China’s reluctance to adopt eSIM mirrors its cautious stance on certain Western standards, while Africa’s late but growing embrace reflects the continent’s dependence on low-cost device availability. This uneven geography means that while eSIM is becoming the global standard, the timeline will not be uniform.

Still, the trajectory is unmistakable. In the same way that removable SIM cards once enabled the rise of global mobility in the 1990s, eSIM is now poised to power the next wave of borderless, software-driven, and sustainable connectivity. The industry no longer debates if eSIM will dominate, but how quickly.

Travel eSIM: The Breakthrough Use Case

Travel eSIM: The Breakthrough Use Case