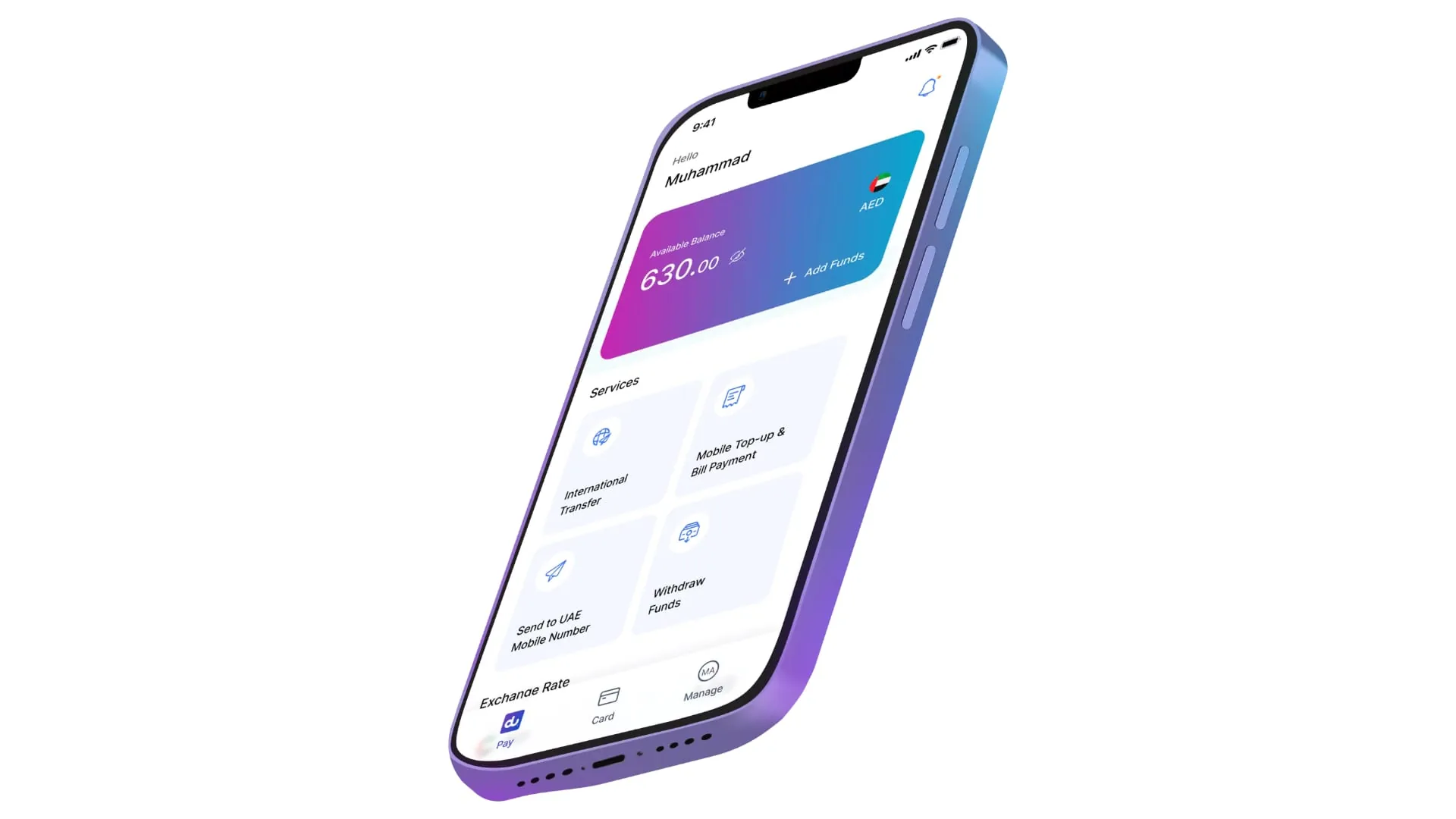

Du launches Du Pay – transformative fintech solutions for UAE residents

du, from Emirates Integrated Telecommunications Company (EITC), announced the launch of du Pay, marking a significant milestone in the UAE‘s transition toward a cashless economy and aligning seamlessly with the national agenda for digitalization. The innovative digital financial solution is poised to play a pivotal role in enhancing financial inclusion, accessibility, and security.

Licensed by the Central Bank of the UAE, du Pay is on a mission to simplify digital financial services for everyone, everywhere in the UAE. du Pay offers a diverse suite of digital financial services and payment services, from international money transfers and peer-to-peer (P2P) Transfers to mobile top-ups and bill payments. Additionally, it supports salary deposits through an IBAN, serving as a versatile account for users. With features available in six languages – Arabic, English, Hindi, Bangla, Malayalam, and Tamil, du Pay ensures inclusion for its varied user base.

Fahad Al Hassawi, CEO at du said: “du Pay underlines the company’s commitment to leveraging technology for financial empowerment, contributing to the directives of the UAE’s leadership towards a fully digitalized and inclusive financial ecosystem. Our vision with du Pay is to challenge the status quo and redefine the future of digital financial services. This is an essential step forward in realizing the vision of a digital UAE, enabled by seamless transactions for all residents in a truly inclusive, secure, and convenient financial ecosystem. By drawing on the strengths of our partnerships and our innovative approach, we aim to make significant contributions to the UAE’s journey towards becoming a global leader in the digital economy.”

du Pay unveils an array of service offerings

With an impressive $39.7 billion in outward international money transfer volumes from the UAE, du Pay is positioned to tap into this extensive market by providing services that prioritize simplicity and a customer-centric experience. Capitalizing on du’s robust infrastructure and market reputation, du Pay leverages du’s assets and expertise to deliver a superior platform that is not only convenient and cost-effective but also tailored to meet the evolving needs of customers. This move is aligned with market projections, which anticipate substantive growth in the digital payment sector, expecting it to reach $3.3 trillion in payment services by 2031.

Nicolas Levi, CEO of du Pay said: “In the UAE, we believe there’s a big opportunity for digital money services to grow. This pushes companies like ours to focus on new ideas and better ways to help the diverse population of the UAE with their digital financial services needs including international money transfers. We’re leading the way in making payments simpler, faster and secure than ever before. Our app is designed to include everyone, supporting multiple languages. What sets us apart is we are leveraging on du’s strong customer-centric focus, infrastructure and telco benefits that we can offer to customers to make our value proposition even stronger. Thanks also to our strategic alliances, we are set to take a significant role in the financial landscape of the UAE.”

du Pay introduces a broad spectrum of features designed to streamline and enrich the financial experience for users across the UAE:

· International Money Transfers: Users can send money to over 200 countries at competitive rates.

· Peer-to-Peer (P2P) Transfers: The platform enables users to transfer funds to any mobile number in the UAE with ease.

· Unique IBAN: Allowing users to receive funds, including salaries, notably for domestic workers, directly within du Pay app.

· Convenient Fund Additions: Adding funds is made easy via debit cards, bank accounts, or an extensive payment machine network across the UAE.

· Cardless Cash Withdrawals: ensures customers can withdraw cash without the need for physical cards from selected ATM in the UAE.

· Billing and Mobile Recharge: The app simplifies bill payments and mobile recharges.

· Payment Card: Facilitates seamless online and offline transactions globally.

The mission driving du Pay is to simplify financial transactions through a secure and intuitive application. du Pay’s vision extends beyond today’s market, aspiring to eliminate constraints posed by language, network, or limitations to become the preeminent mobile payment platform in the UAE.