Overpaying for currency exchanges?

Navigating the volatile landscape of foreign currency can be a daunting task for businesses. Fluctuations in exchange rates can impact everything from supplier payments to employee wages, leaving businesses feeling vulnerable. Currency Management

However, with the strategic use of Limit and Stop Orders, businesses can regain control, avoid transaction fees, and ensure they never overpay for future exchanges. Here’s how.

The Power of Limit and Stop Orders Currency Management

Limit and Stop Orders allow businesses to set their own price for buying and selling currencies. These orders can be executed automatically at any time, allowing businesses to focus on their finances without constantly monitoring global markets. The best part? There are no hidden fees, just competitive rates that businesses can set themselves.

Setting Your Price for Currency Exchange

With Limit and Stop Orders, businesses can automatically buy and sell foreign currencies and cryptocurrencies at their ideal rates, fee-free (for paid plans). These orders can be placed directly from a business account, both on the web and mobile platforms.

Protecting Your Capital Against Market Volatility

Limit and Stop Orders offer a shield against the uncertainties of tomorrow. They allow businesses to stick to their budget and protect their capital, regardless of how fast prices move. Businesses can place orders in over 25 currencies with no restrictions, and up to $100k per exchange in seven cryptocurrencies. Orders can be canceled at any time.

Managing Trades Without Constant Market Monitoring

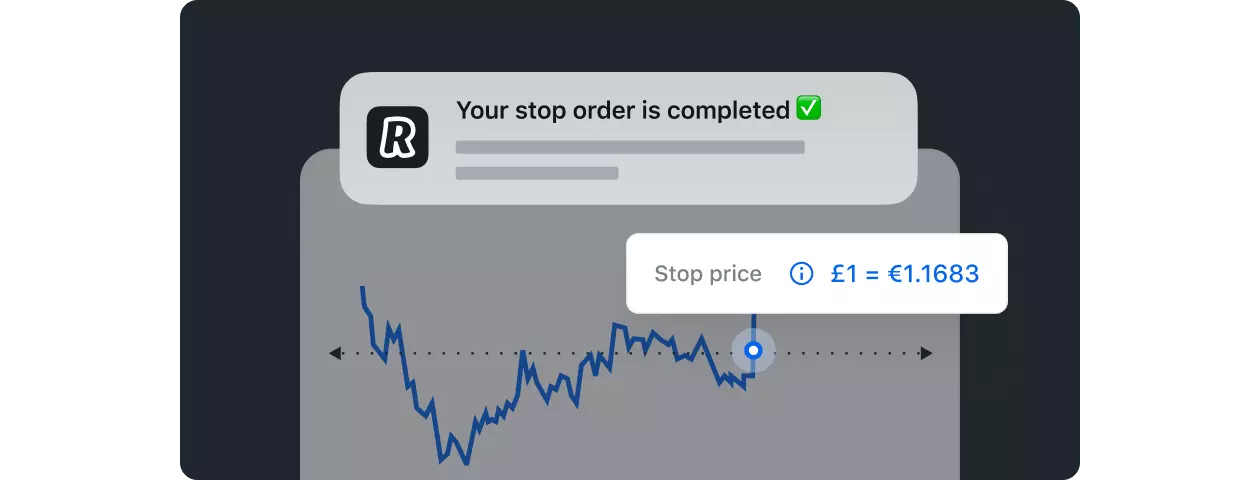

Limit and Stop Orders are perfect for businesses that want to manage their trades without becoming day traders. These orders allow businesses to ignore minute-to-minute market movements. Instead, when the chosen currencies hit the set price, they automatically exchange, and the funds land in the account immediately.

How to Limit and Stop Orders Work

Limit orders are ideal when you need to buy a currency, but your margins are tight, and you’re willing to wait for prices to change. For instance, if GBP/USD is £1 = $1.21, but you anticipate this might move in your favor, you can place a limit order for £1 = $1.09. This order will automatically execute at this price, or better.

Stop orders, on the other hand, are useful when you need to buy a currency, and the price is moving higher – becoming less favorable to you. To ‘stop’ the price from getting away from you as it rises, you can place a stop order at £1 = $1.21 to buy when this price hits and keeps rising. Your final price might be different, depending on the market.

Placing an Order: A Simple Process Currency Management

Placing an order is a straightforward process. Simply go to any currency account on the Home screen, select ‘Exchange’, choose an order type at the top-right of the screen, confirm your limit or stop price, review your order, and then submit it. You can view all your orders from the Home screen under Favourites (★ icon) > Orders.

Upgrading for Access to Limit and Stop Orders

Upgrading your account will give you access to Limit and Stop Orders, along with a suite of tools designed to save time, cut costs, and boost productivity. Remember to check whether Revolut Business is available in your country on their help center.