Carrier Billing: 1 in 5 Mobile Subscribers to Use Payment Channel Globally

Remember when we used to buy ringtones for our phones via SMS? Or donate to charities by texting a number? That was carrier billing in its early form. Now, this payment method is making a comeback, especially for Mobile Virtual Network Operators (MVNOs).

Let’s dive into why carrier billing is becoming so relevant and how it could reshape the future of mobile transactions.

What is Carrier Billing Anyway?

For those who are new to this, carrier billing is a straightforward way to make purchases by charging them directly to your mobile phone bill. This means no need for credit cards or bank accounts during checkout. It’s super convenient for digital stuff like apps, games, subscriptions, and even physical goods. Think of it as the easiest way to pay, especially when you’re on the go.

Why is Carrier Billing Making a comeback?

Mobile operators have seen their revenue from traditional services like calls and texts decline. With many now offering unlimited plans, the value of these core services has decreased. Premium SMS services, which used to bring in extra revenue, have also fallen out of favor. This decline has created an opportunity for carrier billing to step in and fill the gap. It’s a fresh way for mobile operators to earn more from each transaction.

The Difference Between Carrier Billing and Direct Carrier BilIing (DCB)

Okay, so there’s often some confusion between carrier bilIing and DCB. While they’re similar, there are some key differences. Carrier billing is the broader term, covering various uses like SMS-based payments and direct charges. DCB, on the other hand, is specifically for digital content and goods, charging them directly to your mobile bill.

How Does Carrier Billing Benefit Mobile Operators?

Well, there are a couple of perks. First off, operators get a cut from each transaction, which is a neat way to boost income. Secondly, it can help keep customers loyal. Since users already have a billing relationship with their mobile operator, adding purchases to their phone bill is just easier. Plus, it opens up opportunities in markets where traditional banking isn’t as common, like in parts of Africa and the Middle East.

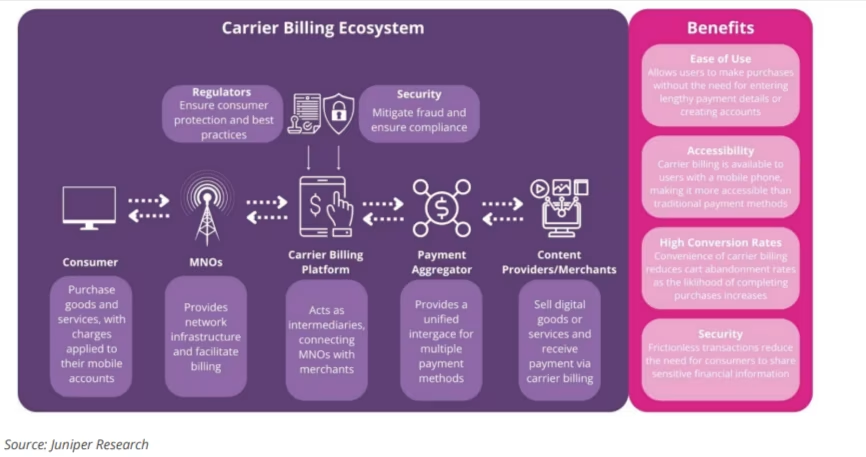

The Ecosystem of Carrier BilIing

Carrier bilIing involves various players, including mobile operators, billing platforms, regulators, and merchants. Everyone must work together to ensure everything runs smoothly and securely. This collaboration helps maintain the long-term viability of carrier billing as technology evolves and consumer expectations change.

Why is Carrier BilIing Set to Grow?

Why is Carrier BilIing Set to Grow?

A few factors are driving the growth of carrier biIling. More people are using smartphones and have access to the internet, which naturally increases demand for digital goods and services. Also, technology is improving, making mobile payment platforms more secure and easier to use. As we move further into a digital-first world, these trends will only accelerate the adoption of carrier billing.

Building Trust and Keeping Things Safe

Trust is a big deal when it comes to payments. People need to know their transactions are safe and their information is protected. That’s why having strong consumer protection regulations is crucial. Operators and merchants need to follow these rules to build confidence in carrier biIling. Transparency and reliability in how payments are processed are also essential for maintaining trust.

The Current Market and Future Trends

Different carrier billing methods cater to various needs. For example, SMS billing might still be useful for small, one-off payments, like voting in a contest. But Direct Carrier BilIing is likely to dominate, especially for digital content purchases. To ensure carrier billing continues to grow, several strategies are recommended. These include deepening relationships with existing clients, focusing on specific sectors, and partnering with major operators and regulators.

The different types of carrier billing mechanisms include:

• Mobile-terminated SMS Billing – customers are billed following receipt of a text from a merchant after opting in by sending an SMS code to the merchant.

• Mobile-originated SMS Billing – customers are billed after sending a premium SMS to a short code. This type of payment was popular when mobile payments first became mainstream. It is still used in some regions for voting in TV shows, donating to charities, and subscribing to premium services.

• Direct Carrier Billing – users are required to send or receive messages to make payments. Payments can be made through tablets and computers, as well as mobile phones. Billing a user directly in this way transforms the service into a money service, offering over and above the usual carrier service, and often requires the involvement of central banks in the market in which carriers operate. The introduction of additional layers of complexity due to regulation means that an MNO may not be able to offer carrier billing in all markets.

• WAP (Wireless Application Protocol) – also referred to as mobile airtime transfer, is a type of mobile payment made through a WAP-enabled mobile browser. Using WAP enables users to make one-click purchases directly from their mobile phone.

Mobile airtime transfer is used in markets that have distribution networks for P2P (Person-to-Person) payments, allowing users to pay by transferring airtime to another user. Specific markets include the US (Venmo), China (WeChat), India (Paytm), and Africa (Airtel Money).

Addressing the Issue of Fraud

Like any payment method, carrier billing has its risks. Fraudsters might try to create fake websites or apps to steal information. However, compared to traditional methods, DCB is relatively safer because it doesn’t require users to share sensitive payment details. While fraud is less common, operators must stay vigilant and upgrade their security to protect users and maintain trust.

Looking Ahead: The Future of Carrier Billing

The future of carrier bilIing looks promising. By 2029, global operator-billed revenue from carrier billing is projected to reach nearly $15 billion, up from $9.3 billion in 2024. This growth will be fueled by increased awareness and the introduction of standardized APIs, making it easier for operators to implement and scale carrier billing services. While challenges such as fraud exist, the ongoing collaboration among stakeholders and continuous innovation will help unlock the full potential of carrier billing, making it a key player in the digital economy.

In conclusion, carrier biIling is not just a throwback to the ringtone-buying days. It’s evolving into a robust and versatile payment solution, especially for MVNOs. As technology advances and consumer preferences shift, carrier billing is poised to play a significant role in how we transact in the digital world. With its convenience, security, and accessibility, it’s set to unlock new revenue streams and enhance the mobile experience for users everywhere.

Why is Carrier BilIing Set to Grow?

Why is Carrier BilIing Set to Grow?