Gambling Market Size in the UK to Grow by USD 2.83 billion

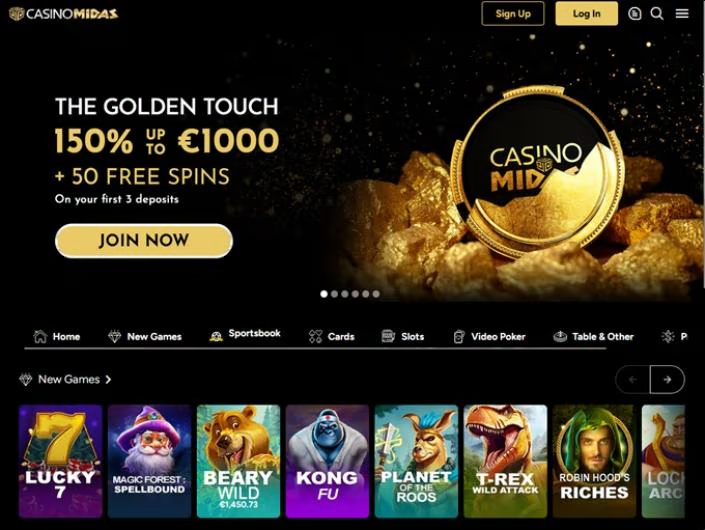

The growth of the online gambling market is notably driving the gambling market growth in UK, although factors such as increased exposure of children to online gambling may impede market growth. best online casino uk

What will the Gambling Market Size in the UK be During the Forecast Period?

Key Gambling Market Driver in UK best online casino uk

One of the key factors driving the UK gambling market growth is the growth of the online gambling market. The reason for the country’s dominance and realization of revenue from online platforms of gambling is primarily due to the limited restrictions laid on this platform. In countries such as China and India, the imposition of bans on online gambling has pushed the practice underground, creating multibillion-dollar black markets for wagers. Sands, MGM Resorts, and Wynn generate tens of billions in revenues from offline operations, including large casino operations focused on Nevada in the US and Macau in China. However, the UK dominates the global online gambling segment. Online gambling and its continued growth at the expense of conventional gambling operations will continue to drive the gambling market in the UK during the forecast period.

Key Gambling Market Trend in UK

The implementation of artificial intelligence (AI) in gambling is one of the key gambling market trends in the UK that is expected to impact the industry positively in the forecast period. AI is embodied by the presence of live dealers (or croupiers) that have the capacity to interact with players in real time while being underpinned by random number-generating algorithms. These dealers have helped replicate bricks-and-mortar gameplay in the virtual realm, creating an immersive and authentic gambling experience. In addition, advanced bots that are replacing customer service representatives can access and analyze knowledge about a customer’s specific playing habits. AI can also analyze the data to detect bad gambling habits before they can develop into a full-fledged gambling problem. Owing to its advantages, AI is expected to be increasingly adopted by vendors in the UK during the forecast years.

Key Gambling Market Challenge in UK

One of the key challenges to the UK gambling market growth is the increased exposure of children to online gambling. Currently, certain gambling websites use cartoon characters to attract children and encourage them to bet on games such as Top Cat, Peter Pan, Jungle Book, or Goldilocks. This not only impacts children negatively and creates problem gamblers but is also illegal. Thus, the UK government has been urged to curtail gambling ads that are inundated with messages that normalize betting among children and young people.

Campaigners are concerned about the presence of such ads during televised sports, while celebrities promote the games. In October 2017, the Gambling Commission, the Advertising Standards Authority, the Committee of Advertising Practice, and the Remote Gambling Association together sent a letter to online operators regarding ads with images that appeal to children aged below 18. Such factors may hamper the market growth in the coming years.

Market Segmentation best online casino uk

The gambling market in the UK is segmented by type (betting, lottery, and casino) and platform (offline and online). By platform, the offline segment will be the largest contributor to market growth during the forecast period. The brick-and-mortar forms of casinos in the UK are revolutionizing their offerings to sustain in the market, which will drive market growth during the forecast period.

Vendor Landscape best online casino uk

The gambling market in the UK is fragmented. Vendors are deploying growth strategies such as technological innovations to compete in the market. The market is highly competitive, with the presence of well-established online and offline vendors. The vendors compete on the basis of product portfolio, prize money, pricing, application availability, credibility, varieties, and payment options, along with increasing technological advances. They are also investing in planning, developing, designing, acquiring new players, and expanding existing facilities.

During the forecast period, the competition among vendors is expected to intensify. In addition, technological advances in terms of VR and AI will intensify the competition further among vendors. Moreover, vendors must be aware of emerging games and trends, licensing procedures and policies, and advances in technologies that could influence service lines to sustain in the competitive market. The gambling market in the UK is expected to witness rapid growth during the forecast period, with large vendors acquiring smaller online vendors.

Major Gambling Market Vendors in the UK:

- 888 Holdings Plc

- Ballys Corp.

- Bet365 Group Ltd.

- Betfred Group Ltd.

- Betsson AB

- Caesars Entertainment Inc.

- Camelot UK Lotteries Ltd.

- Casino Del Sol

- Delta Corp Ltd.

- Entain Plc

- Evolution AB

- Fantasy Springs Resort Casino

- Flutter Entertainment Plc

- Kindred Group Plc

- NetBet Enterprises Ltd.

- Rank Group Plc

- Scientific Games Corp.

- Simba Games

- Sky Betting and Gaming

- Station Casinos LLC