Banks of 2030 will be in the ‘palm of your hand,’ says PwC

In a decade’s time, there may not be a single bank branch, but that doesn’t mean all your assets are going to managed by robots. “I think the bank’s going to be in the palm of your hand” in 10 years time, said Lucy Gazmararian, associate director, PwC Hong Kong, at CNBC’s East Tech West conference in the Nansha district of Guangzhou, China. bank of future

To be clear, the shift is firmly underway with many financial institutions long having offered online-only services. But younger generations have grown up with decentralized digital banking, and they’ll continue asking for new online services in lieu of traditional offline ones, Gazmararian believes. That means the shift toward all-digital banking may accelerate.

Even if there are branches, they won’t be “like today,” said Jun Lu, head of Lufax Technology Center, on the same panel at East Tech West.

What exactly they’ll look like is anyone’s guess, but machine learning and the technology beneath cryptocurrencies, including bitcoin, are revolutionizing everything from customer service to asset allocation. Even so, there will still need to be humans overseeing much of what financial institutions do for the foreseeable future, Lu said.

“Time’s too short, we’ll still have to wait to see” if robo-traders can take over completely,

Lu told CNBC’s Deirdre Bosa on Tuesday.

Big tech firms — Apple, Tencent and JD.com, among them — are another catalyst. They’re “racing” against traditional banks to create individual products for consumers to choose piecemeal. That’s what the future looks like, Gazmararian said. bank of future

1. Embracing Digital Transformation

The first pillar of the Bank of the Future is digital transformation. Traditional banking methods are being replaced by sophisticated digital platforms that facilitate customer engagement and streamline processes. Gone are the days of long queues and paper-based transactions. Customers now expect seamless access to their financial services across multiple devices, whether through mobile apps, web interfaces, or chatbots.

Artificial Intelligence and Automation

Artificial Intelligence (AI) plays a crucial role in enhancing customer experience. Through machine learning and predictive analytics, banks can offer personalized services tailored to individual needs. For instance, AI can analyze spending habits and suggest optimal saving plans or investment strategies.

Automation also minimizes human error and reduces operational costs. Routine tasks such as account openings, loan processing, and compliance reporting are increasingly managed by automated systems, allowing banking professionals to focus on higher-value activities and enhancing customer service.

2. Prioritizing Customer Experiences

At the heart of the Bank of the Future is an unwavering commitment to customer experience. Financial institutions are recognizing that, in a highly competitive market, offering outstanding service is key to attracting and retaining customers.

Personalization in Banking

Personalization goes beyond targeted marketing; it extends to the actual services offered. Banks are utilizing customer data to provide tailored products. For instance, personalized loan offers based on individual credit histories can lead to better customer satisfaction and loyalty.

User-Friendly Interfaces

To further enhance customer experience, banks are investing in user-friendly interfaces. An intuitive mobile banking app encourages users to engage with their finances regularly. Features such as budgeting tools, financial education resources, and real-time notifications on transactions foster not only engagement but also financial literacy, empowering customers to take charge of their financial well-being.

3. Sustainability and Ethical Banking

As global concerns about climate change and social justice intensify, the Bank of the Future is poised to integrate sustainability and ethical considerations into its core values. This shift is not only essential for compliance with evolving regulations but resonates with the growing number of consumers who prioritize ethical considerations in their financial choices.

Green Banking Initiatives

Financial institutions are adopting green banking practices, which include financing renewable energy projects, offering eco-friendly investment funds, and promoting sustainable business practices among their clients. Such initiatives not only contribute to environmental sustainability but also enhance the bank’s reputation among environmentally conscious consumers.

Socially Responsible Investments

The rise of socially responsible investing (SRI) and Environmental, Social, and Governance (ESG) criteria is changing how banks structure their investment portfolios. By focusing on investments that have positive social and environmental impacts, banks can attract a new segment of customers who prioritize ethical considerations in their investment strategies.

4. Enhanced Security and Privacy

As digital banking proliferates, so too does the need for robust security measures. The Bank of the Future must address growing concerns over cybersecurity and data privacy.

Blockchain Technology

One of the most promising advancements in secure banking is blockchain technology. By utilizing a decentralized ledger, banks can enhance transaction security and transparency. This technology minimizes the risk of fraud and ensures data integrity, providing customers with peace of mind regarding their financial information.

Advanced Authentication Methods

Additionally, banks are implementing multi-factor authentication and biometric identification methods, such as fingerprint scanning or facial recognition, to ensure that only authorized users can access their accounts. As cyber threats evolve, these measures will be critical in safeguarding customer assets and information.

5. Collaboration with Fintech Firms

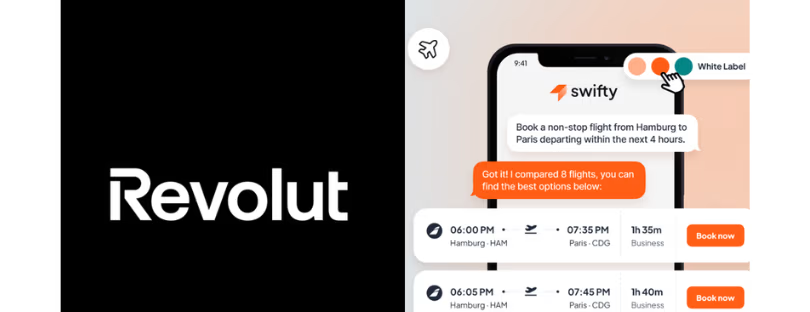

The future of banking is characterized by collaboration with fintech firms, which are known for their agility and innovative solutions. Traditional banks are increasingly partnering with these startups to offer enhanced services, leveraging the latest technologies without incurring the risks associated with in-house development.

Shared Resources and Expertise

These partnerships allow banks to tap into the expertise of fintech companies in areas such as mobile payments, peer-to-peer lending, and online financial advisory services. Furthermore, through shared resources, banks can quickly adopt new technologies, turning potential disruptions into opportunities for growth.

6. Financial Inclusion and Accessibility

A pivotal focus for the Bank of the Future is financial inclusion. With billions of individuals worldwide lacking access to traditional banking services, the industry is evolving to reach these underserved populations.

Mobile Banking Solutions

Mobile banking solutions are paving the way for financial inclusion. Smartphones are increasingly the primary devices for banking services in developing regions. Banks can use low-cost technologies and applications to provide essential services, facilitating access to savings accounts, loans, and remittances.

Microfinance and Tailored Products

In addition to mobile banking, the Bank of the Future is likely to expand offerings in microfinance—small, short-term loans tailored for individuals starting small businesses or needing assistance. By fostering financial literacy and responsible borrowing practices, banks can help uplift communities and drive economic development.

Conclusion

The Bank of the Future is a dynamic and responsive entity, shaped by technological advancements, a commitment to customer service, and ethical banking practices. As financial institutions navigate this transformative landscape, they must stay ahead of trends and continuously adapt to the ever-changing needs of consumers. By embracing digital innovation, prioritizing sustainability, and expanding access, banks can secure a competitive edge and ensure a brighter financial future for all.