Apple Expands Satellite Messaging Capabilities

The Non-Terrestrial Network (NTN) market is entering a new phase of mass adoption. iOS 18 and Android 15 are set to release satellite messaging as a core feature, enabling millions of devices worldwide to tap into satellite connectivity. Behind these advancements is an increasingly growing network of Apple ground relay centers that plug into terrestrial connectivity networks. Apple Satellite Messaging

This ABI Insight explores the advancements of the Direct-to-Cellular (D2C) and NTN markets and the implications of Apple’s growing networking capabilities on the global stage.

Satellite Messaging for IoS 18 and Android 15: A Tale of Two Approaches

Earlier this year, Google unveiled a preview of Android 15 Beta 2, introducing a new two-way satellite messaging feature. The Operating System (OS)-level integration of the feature revealed that the functionality would only be made available from eligible telco networks and regions, namely T-Mobile and Sprint in the United States for the time being. In this way, Google’s approach to Direct-to-Cellular (D2C) services relies on partnerships with telecommunications providers like T-Mobile and satellite services from companies such as SpaceX’s Starlink to facilitate connectivity.

More recently, at the Worldwide Developers Conference (WWDC), Apple unveiled a slew of new features for iOS, including expanded satellite messaging capabilities. With the new software update, iPhone 14 and 15 models can send and receive messages via satellite not only to emergency services but also to friends and family. Apple does this with a new custom protocol that ensures messages are end-to-end encrypted and employs special algorithms to minimize the size of message packets. While iMessage and Short Messaging Services (SMS) will be supported, Rich Communication Services (RCS) has not yet been optimized for satellite but is expected in future updates.

Apple Is Evolving Into a Global CSP-NTN Will Be at the Center

One of the more understated takeaways from the expanded functionality of the new iOS satellite services has been the buildout of Apple’s relay centers, which facilitate communications between emergency services, and now Communications Service Providers (CSPs).

While iMessage already travels over Apple servers and 11 Apple data centers linked to CSP infrastructure, the added functionality of Apple relay centers to enable greater networking capabilities is a new development for the company. While the exact locations and capabilities of these centers are not disclosed, these centers are akin to the International Emergency Response Coordination Center (IERCC) purchased by Garmin back in 2020 for Satellite SOS functionality and are staffed 24-7 by specially trained staff to coordinate with localized emergency services. With these new satellite connectivity software features, Apple has quietly added the capability to route a potentially considerable volume of iMessage and SMS user data traffic, which would typically be beyond the scope of such facilities. In this way, Apple is showing that its growing communications infrastructure will be the intermediary to connect its Globalstar-enabled services with local core networks, a key to enabling Non-Terrestrial Network (NTN) standard services.

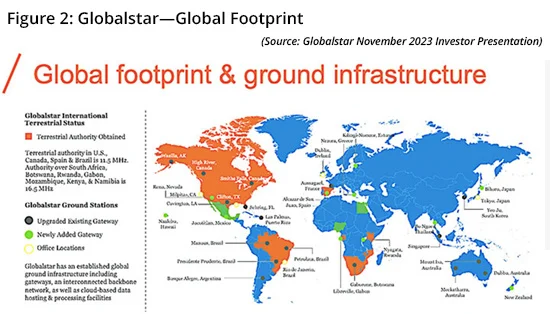

While these services are free for 2 years, Apple is anticipated to charge for these services in the future, likely bundled as part of a subscription, such as Apple One. There is also ongoing debate in the satellite community on whether the NTN opportunity will provide a significant Return on Investment (ROI) from deploying new D2C systems and building the business nation by nation, from the ground up. Even Apple’s satellite partner, Globalstar, has been actively getting terrestrial authorization for the use of its satellite spectrum (in 11 nations, so far), indicating its uncertainty on a satellite-only play. Despite the general mood of caution from the satellite industry, discussions with chipset and handset vendors, alongside Apple, Google, and SpaceX’s open determination to drive this market forward signal a strong conviction from adjacent markets in this mantra: by building the network, the users will come. Apple Satellite Messaging

Seek a Balanced Approach: Invest in Market Research and Validation

Seek a Balanced Approach: Invest in Market Research and Validation

Spearheading industry innovation and transformation is not an easy path. It can be riddled with uncertainty and a lack of real tangible evidence or certainty that a major investment will come to fruition. Indeed, while new Silicon Valley superstars such as LinkedIn, Facebook, Airbnb, and Uber have been successful in building valuable networks first, which then drove growth and monetary gain, it is often a riskier strategy for physical networks to employ. However, there are success stories, such as Amazon Web Services (AWS) development after Amazon discovered it had significant excess and underutilized computing capacity.

In this way, Apple, Google, and SpaceX’s conviction in building this NTN market is a boon for stakeholders, as they take on the risks of building out a new ecosystem while unlocking the benefits of greater synergies for the wider industry. Despite this, the NTN market is still growing past being a “PowerPoint technology” into a tangible opportunity, which requires a concerted unified industry effort, like with the Mobile Satellite Services Association (MSSA). To maximize the potential of the evolving NTN market, incumbent operators should adopt a more balanced strategy.

This approach should seamlessly integrate infrastructure development with comprehensive market research and proactive demand stimulation efforts, which, according to ABI Research’s latest Satellite Communications: Direct-to-Cellular & NTN Deployments & Subscriptions Market Data Overview: 2Q 2024, could enable stakeholders to potentially tap into a US$17 billion opportunity by 2032.

Seek a Balanced Approach: Invest in Market Research and Validation

Seek a Balanced Approach: Invest in Market Research and Validation