Why outdated airport payments are frustrating travelers and costing airlines

Picture this: You’re at the airport, juggling your passport, boarding pass, and luggage. You decide to upgrade your seat or pay for extra baggage, only to be told to walk across the terminal to complete the payments. Frustrating, right? Unfortunately, this scenario is still far too common for travelers worldwide.

Airports are no longer just transit points; they are becoming retailing hotspots where airlines have the opportunity to offer seamless, personalized services. But the payment experience has a long way to go. Travelers want predictability, convenience, and security when making payments at the airport, and airlines are scrambling to keep up.

This article dives into the challenges and future of airport payments, based on a comprehensive study by Outpayce involving 4,500 travelers and industry experts. If you’ve ever felt annoyed at a payment experience in an airport, you’re not alone. And change is coming.

The Current Payment Experience: A Hassle for Travelers airport payments

The airport is already a high-stress environment. Travelers worry about security checks, flight delays, and finding their gates. Adding an inefficient payment process to the mix only makes things worse.

Common Pain Points for Travelers:

- Being Sent to Another Location to Pay

Imagine standing in line at check-in, only to be told you need to walk across the terminal to pay for extra baggage. According to the study, 54% of travelers have experienced this inconvenience at least once in the past two years, with 23% facing it multiple times. This unnecessary step disrupts the travel experience and causes frustration. - Limited Payment Options

Many airport check-in counters and service desks still don’t accept digital wallets like Google Pay or Apple Pay. Shockingly, 57% of surveyed travelers reported being asked to swipe their card on outdated magstripe readers, which are considered insecure in many parts of the world. Card payments remain the most preferred method, but travelers also want flexibility to use digital wallets and alternative payment methods. - Balancing Convenience and Security

Security is a top concern for travelers. Many prefer contactless transactions because they feel safer than swiping a card. Yet, outdated systems at airports force travelers to use older methods, increasing concerns about fraud and data security. 37% of travelers ranked data security as their top priority when making airport payments.

Airlines’ Perspective: Revenue Loss and Operational Challenges

While travelers struggle with outdated payment systems, airlines are facing their own set of problems. Airports should be major revenue generators for airlines, yet payment inefficiencies are leading to revenue leakage and operational headaches.

Major Challenges for Airlines:

- Revenue Leakage

Airlines frequently miss out on revenue simply because they can’t accept payments efficiently. For example, if a traveler reaches the gate with excess baggage, there may be no easy way to charge them. The study found that 56% of travelers had an airline waive a fee because payment wasn’t possible at the time. That’s a huge amount of lost revenue. - Manual Payment Reconciliation

Many airlines still rely on manual reconciliation of payments made at the airport. One airline executive noted that it takes an hour and a half per flight just to match payments to purchases, which is a massive drain on resources. - Lack of a Unified Payment System

Airlines operate in multiple countries, each with different banking systems and regulations. Many carriers juggle multiple local acquiring relationships, making payments complex and inconsistent across different airports.

The Future of Airport Payments: A Retailing Revolution

So, what’s next? Airlines are evolving into modern retailers, and payments are at the heart of this transformation. The goal is to turn airports into seamless retailing environments where travelers can make purchases quickly and effortlessly.

Key Trends Shaping the Future of Airport Payments:

- Mobile and Contactless Payments

The days of swiping cards are numbered. Airlines are integrating digital wallets, QR codes, and one-click payments into their systems, allowing travelers to pay for upgrades, baggage, and services using their smartphones. The study found that 45% of travelers would be more likely to buy additional services if they could use their preferred payment method. - Invisible and One-Click Payments

Imagine booking a seat upgrade at the check-in counter, and instead of handing over a card, the payment is automatically deducted from your stored payment method—like an Uber ride. This kind of frictionless payment experience is expected to become the norm. - More Payment Touchpoints Across the Airport

Instead of making travelers walk to a separate desk to pay, airlines are investing in roaming payment systems where staff with tablets can accept payments anywhere in the terminal. Additionally, self-service kiosks and payment links sent via SMS or email will give travelers even more flexibility. - Integration with Loyalty Programs

More travelers will be able to pay with air miles or a combination of cash and points. The study found that 53% of travelers would be more likely to buy additional services if they could pay with loyalty points. - Better Disruption Management

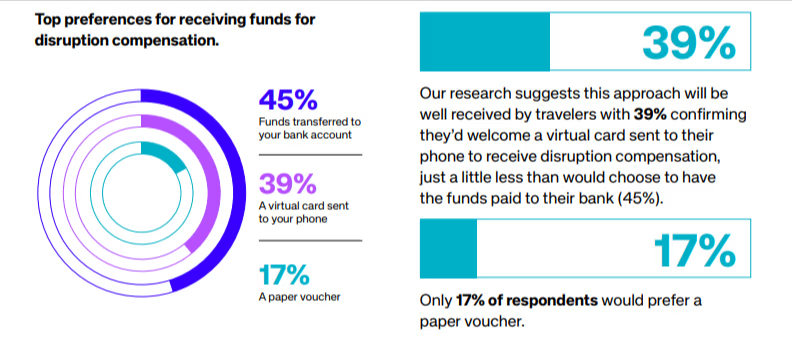

Missed flights and cancellations are an unavoidable part of air travel. Traditionally, airlines hand out paper vouchers for meal and hotel compensation. In the future, travelers will receive virtual compensation cards directly on their phones, which they can use anywhere.

A Real-World Example: How One Airline Increased Revenue

One North African airline recently implemented a modern payment system at check-in and saw a €300,000 increase in seat upgrade sales during the first weekend. By offering contactless payments and seamless integration with their system, they created a smoother experience that led to more sales.

Final Thoughts: A Win-Win for Travelers and Airlines

The transformation of airport payments isn’t just about making life easier for travelers—it’s also about unlocking new revenue streams for airlines. The future of airport payments is all about speed, security, and flexibility.

For travelers, this means no more running across terminals just to pay for extra baggage. For airlines, it means fewer missed sales and smoother operations. And as airports evolve into retailing hotspots, payments will become a key part of the travel experience rather than an afterthought.

So, the next time you’re at an airport, keep an eye out—you might just notice a shift toward smarter, more seamless payments.