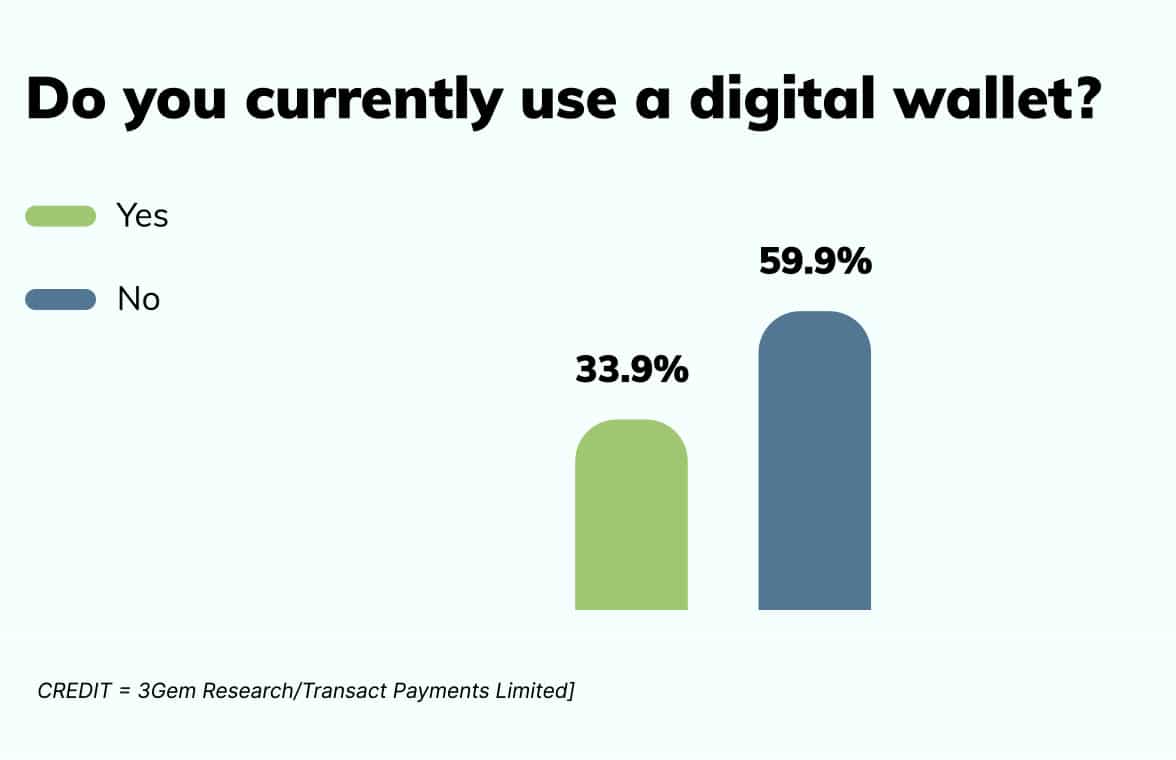

A digital wallet is now used by more than one third of UK users

Only 18% of consumers aged 54 to 65 in the UK have a digital wallet, compared to just 34% of consumers aged 18 to 34. However, this percentage increases to more than two-thirds among this age group, research reveals.

Of those respondents who make payments using a digital wallet, 46% use Apple Pay, 41% Paypal, 9% Google Pay and 3% Samsung Pay.

The UK Payments in Transition to Digital survey also found that more than a quarter of UK consumers no longer carry physical cash (26%), but that cash and physical card payments remain the most popular payment methods, with more than four in ten saying they appreciate being able to pay with cash or card (43%) and just under a quarter concerned that some people would struggle if physical cash were no longer available (22%).

In addition, it reveals that, although the total annual number of cash withdrawals from ATMs in the UK dropped below 7,000m in 2020 for the first time since 2000 and has fallen significantly from average annual totals of more than 12,000m between 2010-2016, 60% of respondents use an ATM at least a few times a month and that only 5% never withdraw cash from a machine.

“Despite attempts by so-called ‘alt pay’ providers to present cards as a legacy technology, cards are still the dominant non-cash payment method by some distance,” the researchers say.

“The advent of more powerful chips on payment cards and new biometric security arrangements — together with the popularity of contactless NFC transactions using cards — have breathed new life into the card as a payment method. As more powerful chip cards including biometric security come to market, we can expect to see multi-function cards that combine credit, debit, loyalty and buy-now, pay-later proliferate.”

“This is a significant development, since these more powerful cards can compete with the flexibility and multi-functionality of a digital wallet.”

The UK Payments in Transition to Digital survey was conducted with 1,000 adult consumers across the UK on behalf of Transact Payments in April.