Revolut Launches Standalone Investment App with 4,000+ Instruments, Aims to Rival Robinhood & Etoro

Revolut, Europe’s most valuable fintech, is stepping up its game in the retail investor market by launching a standalone app based on its wealth management offering. revolut invest

This new move places Revolut in direct competition with heavyweights like Robinhood and Etoro.

What Does the Revolut Invest App Offer?

The Revolut Invest app will provide users access to over 4,000 financial instruments, including US and European stocks, bonds, commodities, and exchange-traded funds (ETFs).

According to the London-based company, the new app will charge a flat fee for equity and bond investments, with rates of either 0.25% or €1, keeping the fees competitive for users looking to diversify their portfolios.

Why Launch a Standalone App?

Revolut already offers retail trading within its main banking app, but this standalone investment platform is aimed at attracting new customers who have yet to try the company’s other financial services.

The move is designed to widen Revolut’s user base in the investment space while offering a more focused and robust investment experience.

Premium Features with Trading Pro

For those looking to level up their trading, Revolut Invest will also offer “Trading Pro,” a premium subscription plan. This will include perks such as discounted commission fees, higher order limits, and advanced analytics, making it an appealing choice for serious retail investors.

Initial Rollout and Expansion Plans

The app is currently in its pilot phase, available in Greece, Denmark, and the Czech Republic. Revolut has plans to expand the service across other countries within the European Economic Area (EEA) later this year.

Rolandas Juteika, head of Wealth and Trading (EEA), said:

“With our Revolut Invest App we want to disrupt the world of traditional investing platforms who expose traders to high foreign exchange rates, ask for minimum deposits and charge them different fees like inactivity fee.

“We are fixing this. We let our customers forget distractions and focus solely on investing by saving their time and putting all investments related tools in one single and easy to use place – Revolut Invest App.”

Looking ahead, Revolut aims to launch the app in even more markets, with approvals already secured in major financial hubs like the UK, US, Singapore, and Australia.

A Step Toward Becoming a Super App

This latest product launch aligns with Revolut’s larger goal of evolving into a “super app” — one that offers a wide range of financial services, from payments and trading to banking and lending. By positioning itself as a one-stop-shop for personal finance, Revolut aims to compete not only with retail investment platforms like Robinhood and Etoro, but also with traditional banks that provide a broad spectrum of financial services.

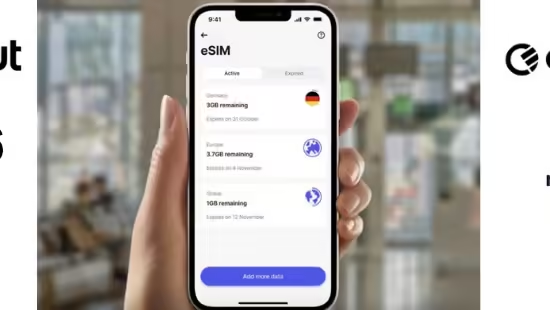

Revolut’s other financial services include banking, lending, insurance, crypto and a mobile eSIM service.

A Record-Breaking Year for Revolut

A Record-Breaking Year for Revolut

Revolut’s aggressive expansion comes on the heels of a record-breaking year. In 2023, the fintech giant booked a pretax profit of £438m, driven by higher interest rates and the addition of nearly 12 million new retail customers. With a growing global presence, the company expects its user base to exceed 50 million by the end of this year.

Securing a UK Banking Licence

Revolut’s challenge to British high street banks took a major step forward earlier this summer when it secured a UK banking licence, albeit with temporary restrictions. This licence allows Revolut to hold deposits and expand lending services in its home market, where it already boasts over 9 million customers.

Looking to the Future revolut invest

Revolut’s successful expansion into the retail investing space, coupled with its ongoing efforts to become a super app, solidifies its position as a serious contender in the global fintech scene. As it rolls out the Revolut Invest app across more markets, its competition with platforms like Robinhood, Etoro, and Freetrade will only intensify.

Summary revolut invest

Revolut is launching a standalone investment app to challenge major retail trading platforms like Robinhood and Etoro. With access to over 4,000 financial instruments and a premium subscription offering, the new app aims to attract new users and strengthen Revolut’s position in the financial world. As part of its broader strategy to become a super app, Revolut is expanding its offerings and challenging traditional banks.