5G in Europe: What Went Wrong — And Who Got It Right

While Europe has long positioned itself as a leader in digital innovation, the latest data on 5G performance suggests a fragmented and underwhelming reality. 5g in europe

According to Ookla’s Q2 2025 analysis, the continent’s 5G deployment remains alarmingly inconsistent, with dramatic gaps between the most and least connected nations—raising questions about Europe’s ability to meet its Digital Decade targets.

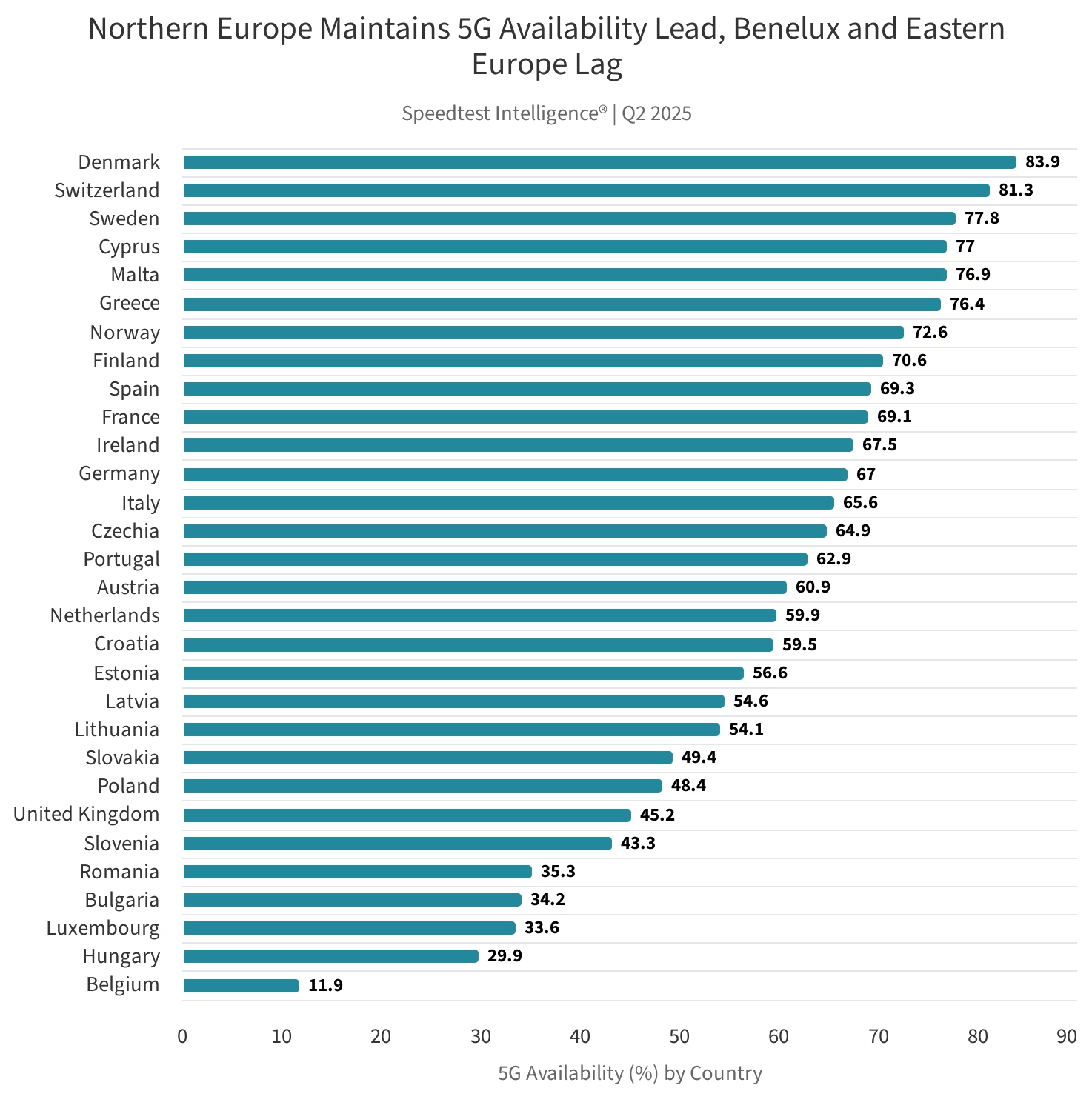

Northern and Southern Europe Take the Lead

In a surprising twist, it is not the continent’s largest economies that are setting the pace. Instead, smaller nations with proactive policies are out in front. Denmark topped the charts with 83.9% 5G availability, followed closely by Sweden (77.8%) and Greece (76.4%). These figures reflect a combination of smart spectrum licensing, shared infrastructure strategies, and government-backed incentives for rural coverage.

For instance, Sweden’s operators Telia and Telenor continue to benefit from long-standing network-sharing agreements. Similarly, Spain’s use of EU recovery funds to extend coverage in underserved areas is beginning to pay dividends. In Switzerland—outside the EU but often a benchmark for telecom performance—availability reached an impressive 81.3%.

For instance, Sweden’s operators Telia and Telenor continue to benefit from long-standing network-sharing agreements. Similarly, Spain’s use of EU recovery funds to extend coverage in underserved areas is beginning to pay dividends. In Switzerland—outside the EU but often a benchmark for telecom performance—availability reached an impressive 81.3%.

Central and Western Europe Lag Behind

Conversely, countries like Belgium (11.9%), Hungary (29.9%), and even the United Kingdom (45.2%) are falling behind. In these markets, rollout has been hampered by regulatory bottlenecks, fragmented infrastructure, and, in the UK’s case, the added burden of post-Brexit policy shifts such as the Telecom Security Act, which forced the removal of Huawei equipment and disrupted deployment timelines.

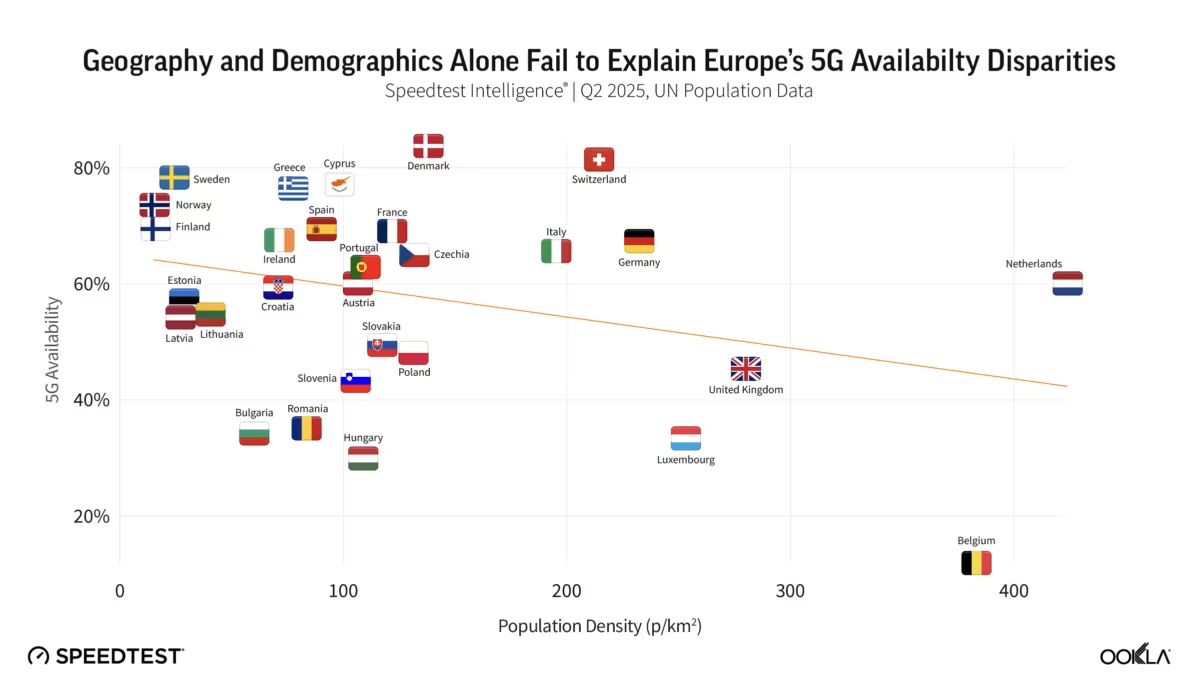

What’s most striking is that this disparity has little to do with geography or population density. Instead, the key differentiator is policy. Countries that embraced shared infrastructure models and clear spectrum roadmaps have raced ahead. Others, burdened by high licensing costs and slow permitting, are stuck in neutral.

5G Standalone: Europe’s Weakest Link

5G Standalone: Europe’s Weakest Link

Even in countries with strong basic 5G coverage, the transition to 5G Standalone (SA)—which enables ultra-low latency, advanced IoT applications, and network slicing—is progressing at a crawl. Spain leads the continent in SA adoption, but even there, only 8% of 5G-capable devices were connected to SA networks in Q2. The EU average? Just 1.3%.

Compare that to the United States, where more than 20% of users have access to SA, or China, where nearly 80% of 5G users are already on next-gen architecture. This delay is largely due to cautious investment from European operators, many of whom are still trying to recoup the costs of their initial 5G rollouts.

Ambitious Goals, Limited Progress

The EU’s Digital Decade strategy aims for 100% 5G coverage in populated areas by 2030, but at the current pace, this goal looks increasingly unrealistic. Despite coordinated spectrum allocation efforts and regulatory guidelines from Brussels, member states have taken widely different paths—leading to a patchwork of results rather than a unified front.

Moreover, the lack of clear business models around 5G SA further weakens incentives for operators to accelerate upgrades. Until telcos can translate ultra-fast speeds into tangible revenue, investment in core network modernization will remain limited.

The Road Ahead 5g in europe

The Ookla report serves as a wake-up call: Europe’s 5G future depends less on technical limitations and more on political will and regulatory cohesion. A pan-European push toward shared infrastructure, rural coverage incentives, and affordable licensing could help narrow the digital divide. Without it, the continent risks falling further behind global competitors—both in connectivity and innovation.

5G Standalone: Europe’s Weakest Link

5G Standalone: Europe’s Weakest Link