5G and possible tariff plans

5G technology will provide customers with innovative services based on ultra-high speed, low latency and massive connectivity. With speeds attained on 5G networks varying so much among operators globally, how much value for money are consumers getting for their 5G data? 5g prices

As a core driver of the Fourth Industrial Revolution, 5G will also help create many new business-to-business opportunities, said Lee Yong-Gyoo KT SVP. Mobile traffic is growing 40–50% per annum in some markets, and CSPs need to continue to invest to meet that capacity. Theoretically, 5G means increased network capacity in the region of ten times. In other words, 5G allows CSPs to provide more capacity at a lower cost, and that is the heart of the 5G business case.

On the pricing front, CSPs will offer very big data buckets or “true” unlimited mobile data plans (no throttling or data usage caps).

Many 5G early movers already have unlimited plans in the market, contributing to the growth in data buckets of at least 25GB (Figure below).

CSPs will still need to innovate around charging schemes with 5G, and that means ensuring upsell is built in. Some telcos are clearly prepping for this – offering “unlimited” plans with data caps (which continue to increase with 5G looming), and building in other differentiation points around content, the definition of that content (SD vs. HD), and mobile hotspot usage. 5g prices

5G IS NOW A REALITY 5g prices

Every month, more operators are announcing commercial launches of their 5G services. Countries such as South Korea, the US, the UK, Finland, and Austria have taken big steps in bringing the 5G experience to their consumers. South Korea reached 1 million subscribers within 69 days of the 5G commercial launch, compared to 58 days for 4G in 2011. Other countries have launched multiple pilots and will start commercialization soon.

In parallel, a new set of consumer applications are emerging, fuelled by 5G and built on technologies such as augmented reality, virtual reality, artificial intelligence, and cloud gaming.

THE 5G ECOSYSTEM IS HEATING UP

We expect most 5G consumer use cases to go mainstream within two to three years of 5G’s launch, as operators finish deployment, 5G handsets hit the market, and new services achieve maturity. 5G use cases can be categorized based on their time-to-market and complexity in development/adoption. As anticipated, enhanced-mobile-broadband (eMBB) will be the first 5G commercial use case, followed by applications such as enhanced in-vehicle “infotainment”, real-time traffic alerts, real-time video streaming, and 3D gaming. In two years, we can expect to see use cases such as virtual-reality movies, games, learning, and wearables that require low latency and high throughput. In three to five years, use cases such as AR maps, VR shopping and virtual event experiences are expected to materialize.

The success of 5G in the near-term hinges on the successful adoption of the initial use cases. This requires a robust 5G rollout (to meet the speed and capacity needs of these new applications) and well-priced commercial offerings.

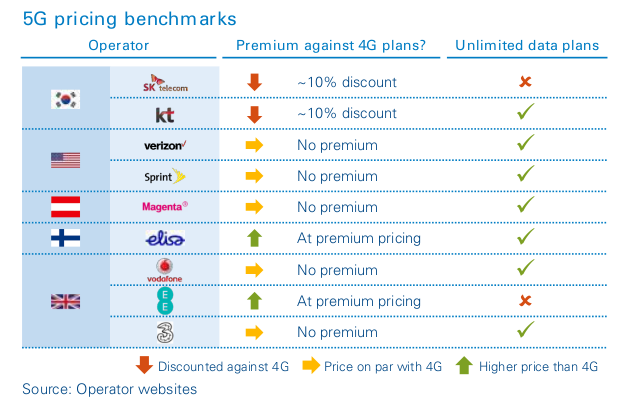

CURRENT 5G PRICING VARIES DRASTICALLY ACROSS OPERATORS 5g prices

Operators worldwide are experimenting with pricing and structuring of 5G tariff plans. Based on recently launched 5G tariff plans, we have observed various models across markets – while a few operators have slashed their price-per-gigabyte (PPGB) compared to 4G, others are charging a premium. However, most have set 5G pricing at similar levels to those of 4G.

The discounters and no-changers hope to make money from increased 5G data usage (instead of higher unit prices) and 5G applications adoption