What are 5G investment and revenue trends in Europe?

Mobile technologies and services now generate around 5% of GDP across Europe, a contribution that amounts to almost €1.1 trillion of economic value added. 5G, in particular, is expected to benefit most sectors of the European economy, adding around €164 billion of economic value by 2030.

However, achieving further growth beyond this will be challenging within the constraints of the current regulatory environment.

Consequently, Europe is at a crossroads in the development of crucial digital infrastructure, with key network performance and consumer adoption metrics showing that it is falling behind some of its global peers. This underlines the need for urgent action by the European Commission and other authorities to implement critical policy reforms to ensure that Europe’s digital economy

underpinned by strong, sustained network innovation—can re-establish a leadership position in the global tech race by 2030. The latest GSMA report has revealed 5G investment and revenue trends, 5G subscriber growth, and challenges in Europe during 2024-2030.

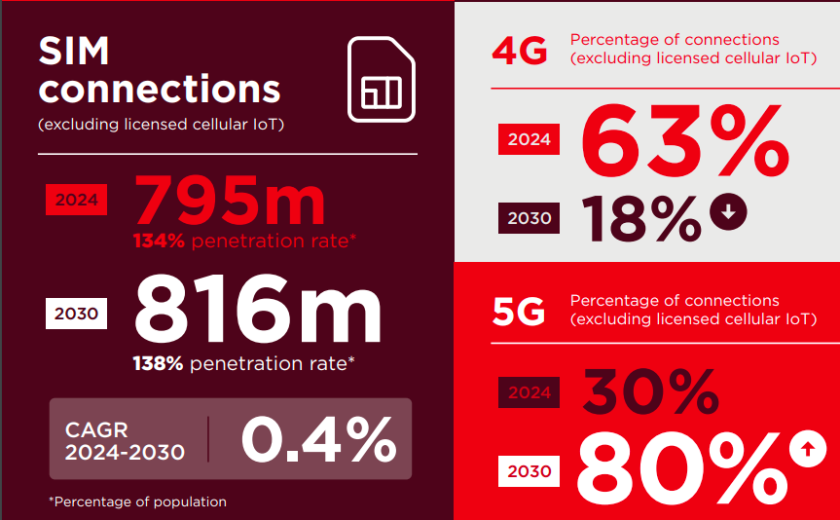

By the end of 2024, 5G represented 30 percent of mobile connections in Europe, totaling over 200 million, with adoption rates exceeding 40 percent in Denmark, Finland, Germany, Norway, Switzerland, and the UK.

While other regions like North America, East Asia, and GCC states have higher 5G adoption levels, Europe’s progression towards standalone 5G (SA) and 5G-Advanced remains slower due to investment challenges.

Europe accounted for 88 percent of mobile penetration in 2024, with 520 million users expected to grow to 527 million by 2030.

Mobile Internet

Mobile internet users in Europe numbered 471 million in 2024, projected to reach 494 million by 2030, while 5G penetration is anticipated to climb from 30 percent in 2024 to 80 percent in 2030.

Mobile data traffic in Europe grew from 3.8 GB per connection in 2019 to 15.3 GB in 2024, projected to reach nearly 50 GB per connection per month by 2030, driven by increased smartphone adoption and high-bandwidth applications like video streaming, GSMA said.

IoT

Cellular IoT connections are forecasted to grow from 322 million in 2024 to 545 million in 2030.

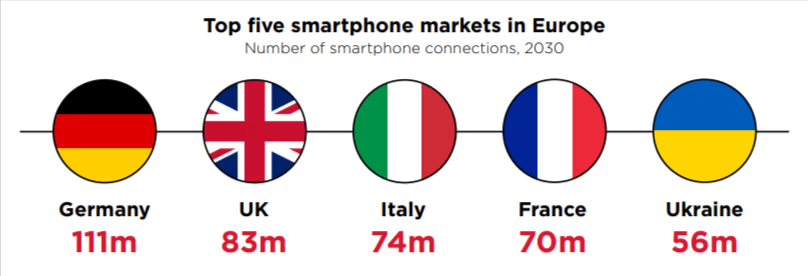

The top smartphone markets in Europe are Germany (111 million), the UK (83 million), Italy (74 million), France (70 million), and Ukraine (56 million).

Revenue

Revenue

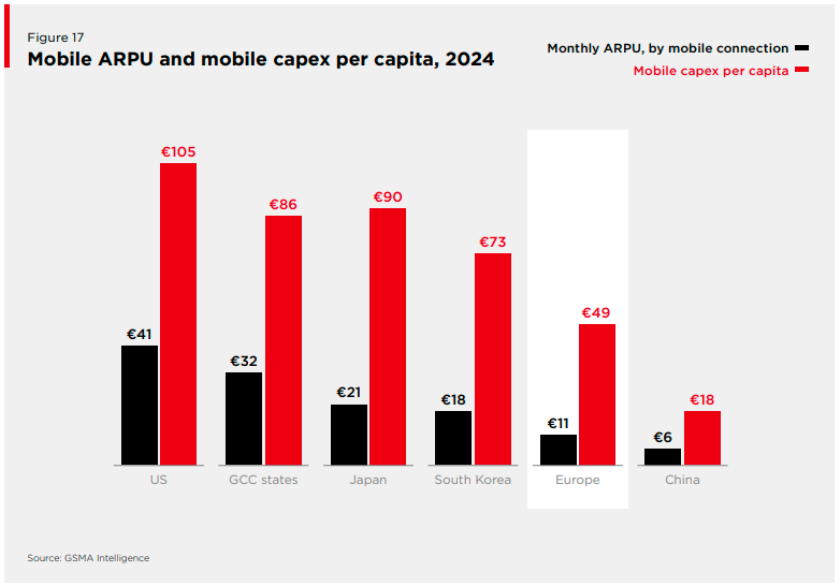

Despite significant 5G growth, mobile revenue in Europe remains low, driven by the slow monetization of advanced 5G use cases. Operator revenue is expected to rise from €163 billion in 2024 to €177 billion in 2030.

Capex

Cumulative capital expenditure or Capex of telecom operators in Europe will be €175 billion during 2024-2030. Mobile operators are increasingly focusing on 5G standalone networks to unlock new opportunities.

European mobile operators have invested over €160 billion in mobile capex over the past five years, much of which has been spent on 5G networks. Mobile capex/revenue in the region was 16 percent at the end of 2023, likely marking the peak of the 5G investment cycle. However, mobile Capex is still projected to surpass €25 billion in each year to 2030.

As legacy networks phase out, 2G and 3G accounted for less than 10 percent of mobile connections by 2024, with Europe witnessing 44 network sunsets by Q3 2024, about one-third of global sunsets. More than half of the planned network sunsets for 2025 are expected in Europe, enabling spectrum repurposing for 4G and 5G while enhancing energy efficiency.

Europe has played a leading role in the GSMA Open Gateway initiative, with 67 operator groups representing 75 percent of global mobile connections. In Europe, operators have prioritized API launches for fraud prevention and security, with use cases like SIM Swap and Number Verification APIs.

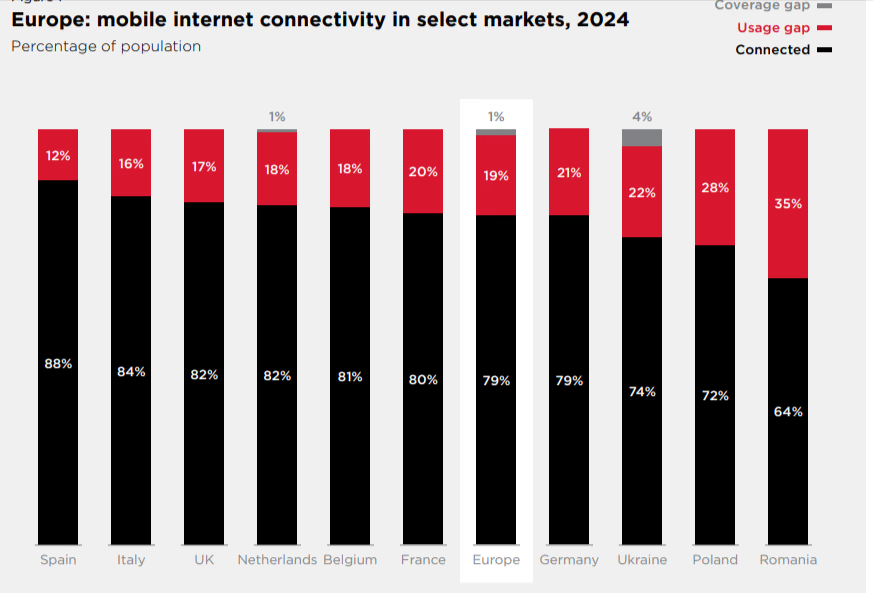

Almost 80% of Europe’s population subscribes to mobile internet services

By the end of 2024, 520 million people in Europe (88% of the population) subscribed to a mobile service. Mobile internet adoption is also widespread, reaching 79% of the population, which amounts to 471 million users. This represents an increase of more than 150 million people over the past decade. Growth during this period was largely driven by the expansion of mobile broadband

networks, with the coverage gap in Europe now at 1% of the population.

At 19%, the usage gap has also narrowed considerably over the past decade. However, significant differences persist among Europe’s 10 largest markets for mobile internet subscribers. In Ukraine, Poland, and Romania, less than three-quarters of the population have subscribed to mobile internet, compared to almost 90% in Spain.

5G adoption in Europe continues to lag behind other advanced regions

By the end of 2024, 5G accounted for 30% of mobile connections in Europe, equivalent to over 200 million connections. Countries such as Denmark, Finland, Germany, Norway, Switzerland, and the UK have seen the fastest uptake, with 5G adoption rates exceeding 40% in each of these markets.

However, regions such as North America, East Asia, and the Gulf Cooperation Council (GCC) states have higher levels of 5G adoption. With the first wave of 5G deployments based on Release 15 complete, many operators in these markets are shifting their attention to 5G standalone (SA) and 5G Advanced. The adoption of these technologies in Europe will progress more slowly unless the challenges that restrict investment capacity in the European mobile sector are resolved.

Final thoughts about 5G adoption in Europe

Europe stands at a crossroads. Strategic investments in advanced 5G technologies, satellite systems, and AI, coupled with policy reforms, are essential for the region to maintain its leadership in the global digital economy. Collaboration between governments, operators, and stakeholders will determine whether Europe can overcome its challenges and harness the full potential of mobile connectivity.

Revenue

Revenue