Global Smartphone Shipments Slip in Q2 as Vendors Shift Strategy Amid Tariffs

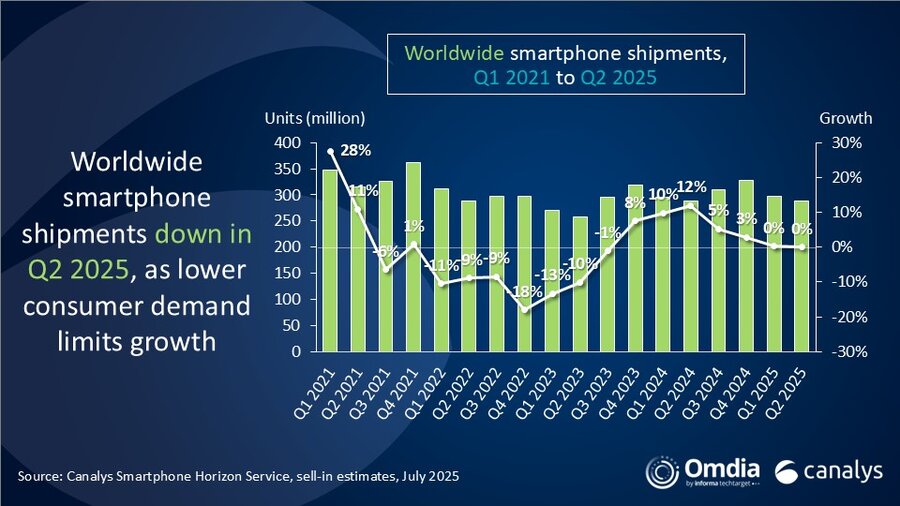

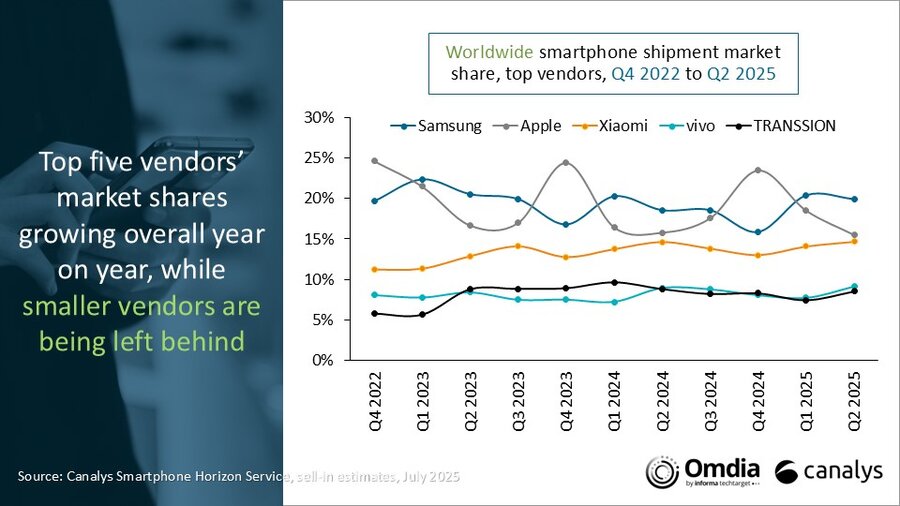

According to the latest research from Canalys (now part of Omdia), global smartphone shipments fell marginally to 288.9 million units in Q2 2025, as modest consumer demand limited market growth. Samsung was the largest vendor in Q2, shipping 57.5 million smartphones, up 7% year on year. Its performance was largely driven by its mass market-focused Galaxy A series.

Apple finished second on the vendor ranking table, with iPhone shipments down 2% at 44.8 million units. Apple’s performance showed strong resilience amid fierce competition in China and an inventory correction in the US as it adjusted to the rapidly changing tariffs. Xiaomi defended third place, shipping 42.4 million units, backed by robust growth in Latin America and Africa. In fourth, vivo grew 2%, shipping 26.4 million units, backed by strong growth in India, while TRANSSION came fifth, down 3% to 24.6 million units.

“Q2 marked a key turning point for Samsung. It was the first quarter since Q4 2021 in which it recorded the strongest growth among the top five,”

said Aaron West, Senior Analyst at Omdia. “Samsung has refocused its strategy on ‘smart volume,’ aiming to profitably scale its mass market Galaxy A series while continuing to grow its premium models. In particular, the entry-level A0x and A1x lines were key drivers in Q2, backed by the newly introduced Galaxy A06 5G, which helped Samsung gain traction in emerging markets. The S25 series maintained steady performance, even though any major uptake in demand from the new Galaxy S25 Edge failed to materialize. Additionally, Samsung’s performance in Q2 was boosted by frontloading of inventory into the US amid tariff concerns, with its shipments there increasing by a remarkable 38% year on year.”

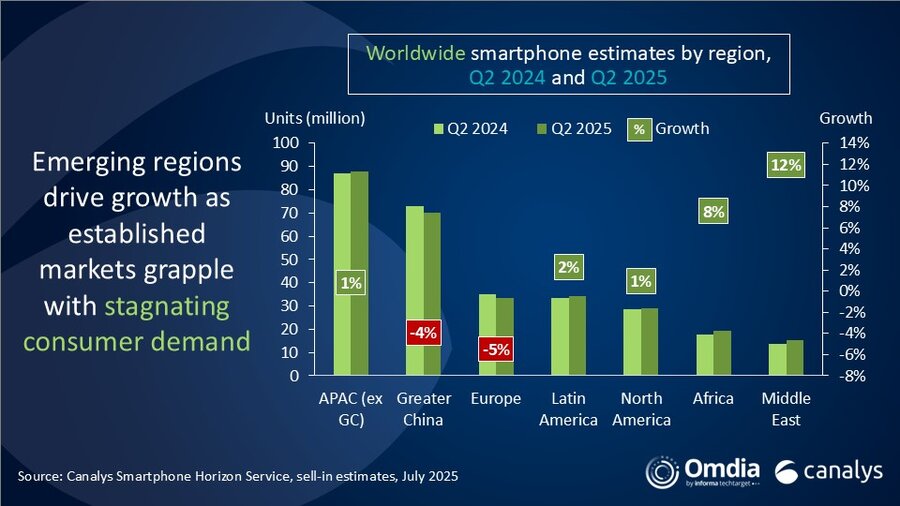

“While most vendors maintained stable overall performance in Q2, their success often hinged on strong momentum in specific regions to balance softer demand elsewhere,” said Manish Pravinkumar, Principal Analyst at Canalys (now part of Omdia). “The Middle East and Africa stood out as growth engines, each showing robust progress in Q2 2025. Across Africa, strategic government policies, increased vendor competition and a clear shift from feature phones to smartphones, supported by innovative financing models, are accelerating digital adoption. Meanwhile, in the Middle East, rising demand for premium devices was fueled by the growing popularity of ‘Buy Now, Pay Later’ options, a successful Eid Al-Adha sales period and coordinated efforts by vendors and retailers to drive sell-through ahead of a busy H2 launch calendar.”

Another key highlight in Q2 came from outside the top five from Nothing, which grew 177% year on year, surpassing 1.0 million quarterly shipments for the very first time. Nothing’s route to becoming the strongest-growing vendor worldwide was predominantly driven by its successful investments in India.

“With a flattish outlook for the full year, vendors are prioritizing profitability with short-term tactical gains and long-term strategic investments,” said Sheng Win Chow, Senior Analyst at Canalys (now part of Omdia). “Stringent cost control and optimized enterprise resource planning are priorities for all the major vendors, as past high ambitions have to be adjusted to 2025’s reality. Many vendors are betting on a hectic launch season in Q3, focusing on topics such as AI, foldables and slimness, to reboot demand ahead of the holiday shopping season toward the end of the year. But vendors need to remain cautious in how they approach the market as consumer sentiment remains modest. Also, downward market corrections post inventory build-ups in the US and the fading effect of China’s subsidy scheme will contribute negatively. It will be vital for vendors to work closely with their channel partners to find opportunities and balance inventory levels, which will be key to avoiding any errors that can hamper ambitions for 2026.”

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2025 |

Q2 2025 |

Q2 2024 |

Q2 2024 |

Annual |

|

Samsung |

57.5 |

20% |

53.5 |

19% |

7% |

|

Apple |

44.8 |

16% |

45.6 |

16% |

-2% |

|

Xiaomi |

42.4 |

15% |

42.3 |

15% |

0% |

|

vivo |

26.4 |

9% |

25.9 |

9% |

2% |

|

TRANSSION |

24.6 |

9% |

25.5 |

9% |

-3% |

|

Others |

93.3 |

32% |

96.2 |

33% |

-3% |

|

Total |

288.9 |

100% |

288.9 |

100% |

0% |

|

|

|

|

|||

|

Note: Xiaomi includes sub-brands Redmi and POCO. TRANSSION includes sub-brands Infinix, iTel and TECNO. Percentages may not add up to 100% due to rounding. |

|||||

Conclusion:

The marginal decline in global smartphone shipments during Q2 2025 reflects a broader industry trend: stabilization, not stagnation, following years of post-pandemic volatility. Samsung’s ability to pivot toward profitable volume through its Galaxy A-series—especially in price-sensitive markets like Latin America, India, and Sub-Saharan Africa—demonstrates how legacy brands can still maneuver with agility. In contrast, Apple’s slight dip, while not alarming, signals growing exposure to geopolitical risks (like US tariffs and China’s local brand loyalty) that it hasn’t fully countered despite its strong brand ecosystem.

Compared to peers in the broader consumer tech space—such as Huawei, which continues to gain local traction in China (Counterpoint Research, June 2025), or realme, which is aggressively targeting price/performance segments in Southeast Asia—the top five vendors are choosing divergent strategies. Xiaomi’s stability suggests a plateauing in its aggressive expansion play, while TRANSSION’s dip may reflect growing competitive pressure from newcomers like Nothing, whose triple-digit growth this quarter signals that challenger brands with clean design and transparent pricing are resonating, especially with younger users in India and Europe.

Looking ahead, sources like IDC and Gartner predict that AI integration, regionalized strategies, and flexible financing models (e.g., “Buy Now, Pay Later”) will shape H2 2025 and beyond. The real winners will be those who balance innovation with local execution and channel discipline. Samsung’s inventory management, Apple’s premium loyalty, and the rise of region-specific players like Nothing and Lava (India) underscore that scale alone is no longer the only differentiator in a fragmented global market.

About the Smartphone Horizon service

The worldwide Smartphone Horizon service from Canalys (now part of Omdia) provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

About Canalys

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct focus on distribution channels. For over 25 years, it has provided market analysis and custom solutions to technology vendors worldwide. The firm’s research spans emerging, enterprise, mobile, and smart technologies, always emphasizing the importance of understanding distribution networks.

Canalys delivers insightful reports, data, and forecasts that help clients shape forward-looking strategies. It also fosters community engagement and feedback through initiatives like the Canalys Forums and the Candefero online community.