The UAE’s Wellness Economy Hits $40.8 Billion — And It’s Growing Faster Than Anywhere Else in MENA

The United Arab Emirates isn’t just building skylines anymore; it’s building a wellness powerhouse. A new report from the Global Wellness Institute (GWI), published through its Geography of Wellness platform, puts a number on the country’s momentum: a $40.8 billion wellness economy, the fastest-growing in the Middle East and North Africa. And if you’ve been following the UAE’s strategic push into wellbeing, this won’t surprise you. UAE wellness economy

The report, released in partnership with Aldar, one of the UAE’s biggest real estate developers, traces explosive growth across wellness real estate, beauty and personal care, spa revenues, fitness, workplace wellbeing, and even public-health-driven initiatives. In short, wellness in the UAE isn’t a niche. It’s becoming a national operating system.

Where the UAE Leads the Region

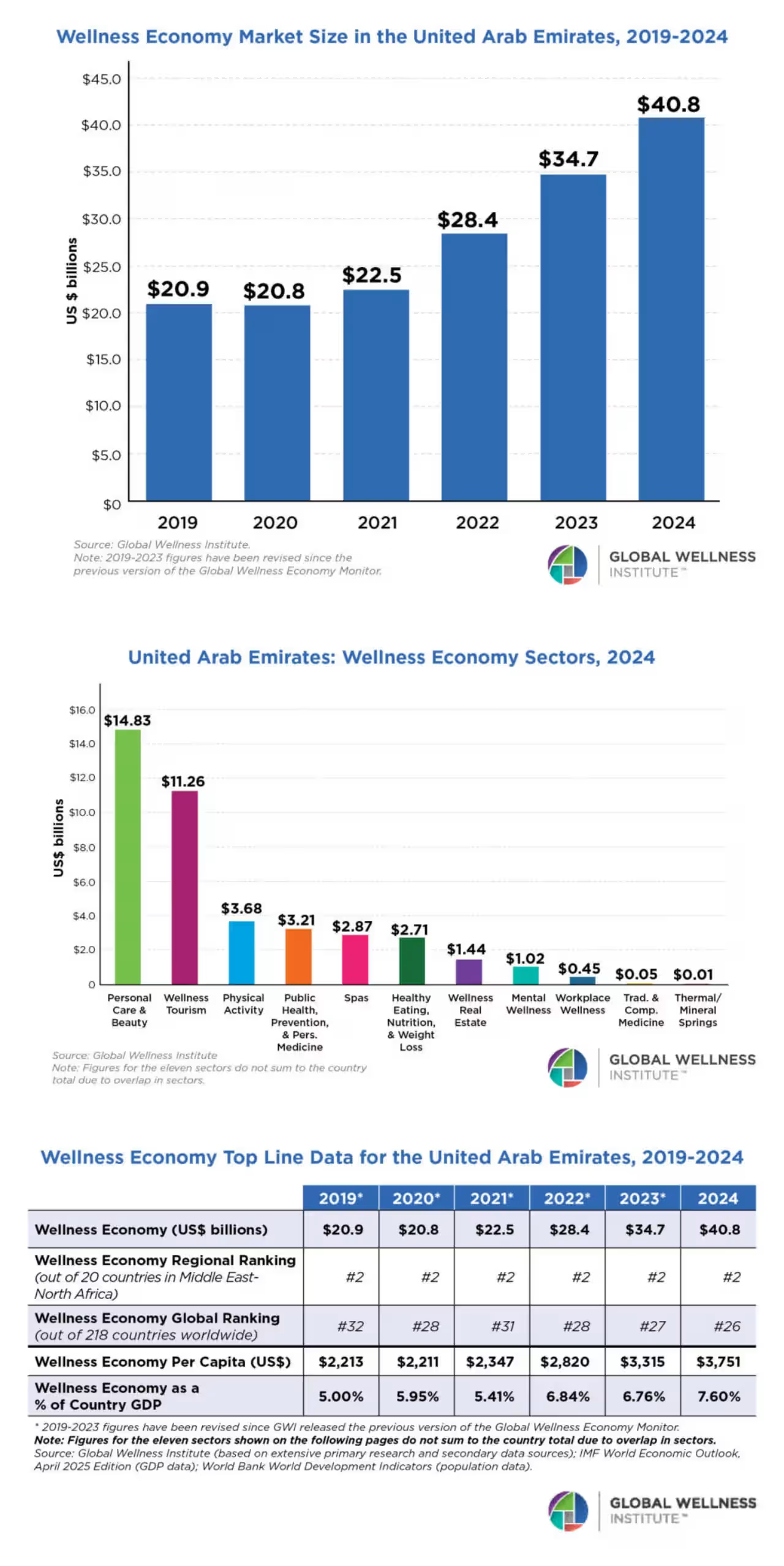

The UAE now ranks No. 1 in MENA in several categories—and by a wide margin. According to the latest GWI data, wellness real estate has reached $1.4 billion, personal care and beauty have climbed to $14.8 billion, spa revenues total $2.9 billion, and wellness tourism hit $11.3 billion. For context, most countries in the region are still in the early stages of institutionalizing wellness as a formal economic pillar. The UAE, meanwhile, is mapping it to long-term government strategies. Both the National Strategy for Wellbeing 2031 and the UAE Tourism Strategy 2031 position wellbeing—and wellness tourism specifically — as drivers of economic diversification. The message is clear: wellness isn’t an add-on. It’s part of the UAE’s growth blueprint.

Big Developments Reshaping How People Live

Susie Ellis, Chair and CEO of GWI, said the country’s rise is a direct result of coordinated policy and private-sector innovation. And the numbers back it up. From 2019 to 2024, the UAE’s wellness real estate sector grew 22.8%, fueled by large-scale projects such as SHA Emirates, the region’s new flagship for integrated medical wellness, and Aldar’s Fahid Island, Abu Dhabi’s first comprehensive coastal wellness destination.

These developments aren’t just luxurious. They’re designed around nature access, community-oriented layouts, and built-in wellness programming—things that global buyers increasingly expect from “healthy living environments.” It’s part of a broader trend GWI has been tracking globally: wellness real estate is becoming one of the fastest-expanding segments of the wellness economy, with high demand in markets like the US, Australia, and Singapore. But the UAE’s growth rate outpaces them all.

Wellness Tourism Becomes a Power Engine

Wellness tourism has always been a quiet strength in the UAE, thanks to its hotel ecosystem and spa culture. But now it’s a central economic lever. GWI reports that the UAE’s wellness tourism value reached $11.3 billion, growing at a remarkable 23.5% compound annual growth rate — a huge figure for a country of under 10 million people.

This growth aligns with the shift toward more diversified tourism offerings: advanced medical wellness, longevity retreats, desert and coastal wellness experiences and hotel brands explicitly designing wellbeing-first guest journeys. With the UAE Tourism Strategy 2031 aiming to grow to 40 million hotel guests annually, wellness is clearly being used as a differentiator in an increasingly competitive travel landscape.

Wellness Built Into Community Life

Jonathan Emery, CEO of Aldar Development, said something that perfectly captures the UAE’s direction:

“The UAE is leading a global transformation in how communities are designed to actively shape better, healthier lives.”

In practice, this looks like walkable neighborhoods, layouts designed around social connection, abundant green spaces and amenities that make healthy choices the default.

This design logic mirrors wellness-driven districts emerging in cities like Singapore’s Tengah Forest Town or Copenhagen’s Superkilen neighborhood. But the UAE is applying it at a speed and scale few markets can match.

Tradition Meets High-Tech Wellness

Tradition Meets High-Tech Wellness

One of the report’s most interesting insights is how the UAE blends its wellness heritage with cutting-edge tech. You’ll find Bedouin plant remedies in modern spa menus, traditional hammam rituals side-by-side with AI-powered diagnostics, and diets rooted in local produce complementing biometric tracking and longevity programs. This mix is becoming a signature of the Emirates’ wellness experience—appealing both to travellers seeking authentic cultural practices and bio-hackers chasing performance optimisation.

Sustainability Becomes Part of the Wellness Story

The UAE’s sustainability ambitions are also feeding into its wellness narrative. Many spas, resorts, and wellness real-estate developments now integrate solar energy, water-saving infrastructure, zero-waste strategies, and organic or local skincare. These align with wider national initiatives such as UAE Net Zero 2050, framing wellness not only as personal wellbeing but environmental wellbeing too—a theme also growing in markets like Costa Rica and New Zealand, where wellness, sustainability, and tourism intersect.

What This Means for Travelers, Investors, and the Region

With desert retreats, high-tech longevity hubs, coastal sanctuaries, and medical-wellness centers emerging simultaneously, the UAE is positioning itself as the MENA region’s wellness capital — and increasingly as a global contender. Countries like Saudi Arabia and Qatar are investing heavily in wellness tourism, but none yet match the UAE’s cross-sector coordination across real estate, tourism, healthcare, and lifestyle services.

Globally, the UAE’s growth rate now puts it in the same acceleration category as China, Mexico, and the US — all identified by GWI as major future wellness hubs. What differentiates the UAE is how deeply wellness is embedded into everyday living, not just into resorts or retreats.

Conclusion about UAE wellness economy

If the global wellness economy is now a $5.6 trillion sector, then the UAE has made an intentional decision to lead from the front. What’s striking is how coordinated its approach is compared with other rising wellness markets. Singapore and Switzerland offer tight integration between public health and lifestyle design, but the UAE is applying similar principles at hyper-speed. Countries like Saudi Arabia and Qatar are catching up fast, especially with projects like NEOM and new medical-wellness zones, but the UAE’s combination of policy, real estate strategy, and private-sector innovation gives it a head start.

For travellers, this means more choice and more types of wellness outcomes—from cultural rituals to precision-health optimization. For investors, it signals a region where wellness is becoming a structural pillar of national development, not a trend. For the rest of the MENA region, it raises the bar. And for the global wellness industry, the UAE’s rise offers a preview of how wellness-first living might look in the coming decade.

Tradition Meets High-Tech Wellness

Tradition Meets High-Tech Wellness